Crypto exchanges are online platforms for buying, selling, and exchanging cryptocurrencies and fiat. They are needed to ensure the convenience and safety of all transactions with digital money. But if you only trade on one exchange, you are missing out on the benefits.

In this article, we will look at the many risks and limitations of trading with just one service and talk about how to trade to your full potential.

What do You Lose by Trading on Only one Exchange?

When trading on only one platform, there is always a risk of missing out on better prices on other exchanges. The difference is not so big but significant for large sums. To always get the best prices, you should create accounts on several proven exchanges and, using monitoring, choose the one with the most favorable exchange rate.

However, a favorable rate is not the only reason to use several platforms. By trading on only one exchange, you may encounter risks and restrictions. And having accounts on several platforms at once will help you get around them. So, what might happen?

Technical glitches

Any crypto exchange may encounter technical problems. For example, on January 7, 2023, the popular exchange Coinbase experienced a massive outage due to an error in its traffic routing system. Because of this, users lose access to the website and mobile application for several hours. Such incidents also happen with other major exchanges, like Binance or Bybit. When problems occur, a person trading on only one platform will not be able to make transactions, which can result in lost profits, for example, in case of sharp fluctuations in the exchange rate.

Hacker attacks

Storing funds on only one exchange is risky because hackers can gain access to all accounts and wallets. If you keep money in one place, the losses can be colossal. Distribution across different sites reduces risks. However, it’s even better to deposit funds on the platform only for trading and use software wallets (Metamask, Trust Wallet) or hardware wallets (Ledger, Trezor) for storage.

Risk of account blocking

The P2P platform may block your account by accident, due to a violation of rules, or after the restrictions for the regions. A good example is Binance: the exchange began to limit deposits and P2P trading involving the ruble and then tightened KYC. Users with accounts on other platforms were affected by the problem but already had options. Those who limited themselves to only one platform had to look for a solution to solve their problem.

Limited trading options

Different exchanges offer different trading pairs and conditions. For example, BNB and BUSD are available in the Binance P2P section. An alternative to the USDT stablecoin, USDC, is available on Bybit. Gate.io has DOGE. And on HTX, you can exchange fiat for TRX. There are also fees, available payment methods, and other factors that unify each P2P exchange. For example, HTX has no commissions for P2P trading, and Binance has the highest liquidity.

The situation is similar in the spot market or derivatives. All popular exchanges have some unique features. For example, Bybit has an AI trading feature called TradeGPT, which allows you to trade based on advice from artificial intelligence. If you have accounts on different exchanges, you can choose a platform for a specific task.

How to Become a PRO Trader

As we have found out, using only one crypto exchange has a lot of disadvantages. It comes with risks from technical failures to hacking or account blocking. To trade effectively, you need to use several platforms at once. So, what do you need to become a professional from an ordinary crypto trader?

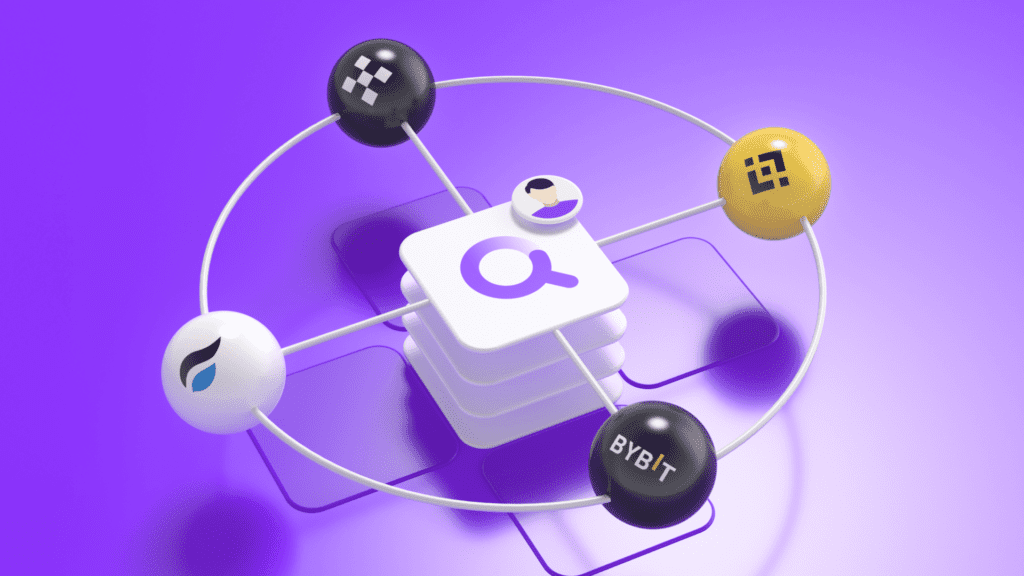

Step 1: Register accounts on different exchanges

The first and most significant step is to create accounts on at least 5-6 large and trusted exchanges. It will give you access to different trading pairs, liquidity, and instruments. For spot trading, an excellent solution would be:

For trading derivatives, you can consider Bybit. This exchange was created specifically for margin trading. The same exchanges are suitable for P2P trading, but you can add services for crypto-fiat exchanges: Bitpapa, Garantex, and HodlHodl.

You can get acquainted with the exchanges and get all the necessary information, including available coins, commission amounts, and much more, using our navigator.

Step 2: Сreate crypto wallet

Keeping all your funds on exchanges is dangerous. If your account is hacked or blocked, you may lose access to your money. Therefore, it is better to keep only working capital for trading on exchanges and transfer your crypto reserves to reliable wallets.

- Hardware – Ledger, Trezor, KeepKey. They provide maximum protection since private keys are stored in a secure device.

- Software – Metamask, TrustWallet, Exodus. Convenient to use, but less safe. The keys are stored in an application on your computer or phone.

It is better to have a combination of hardware and software wallets.

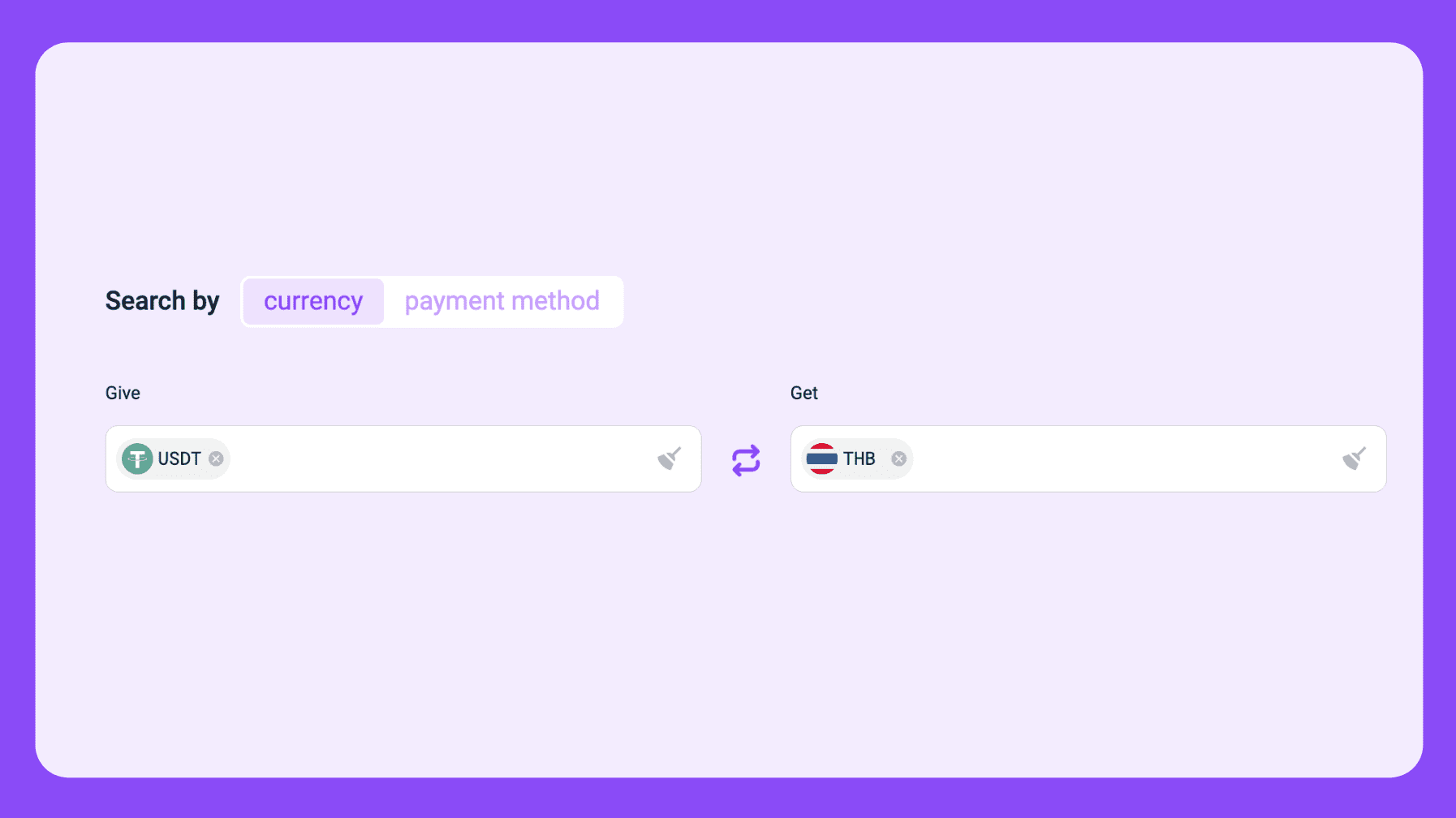

Step 3: Use Monetory to find an offer

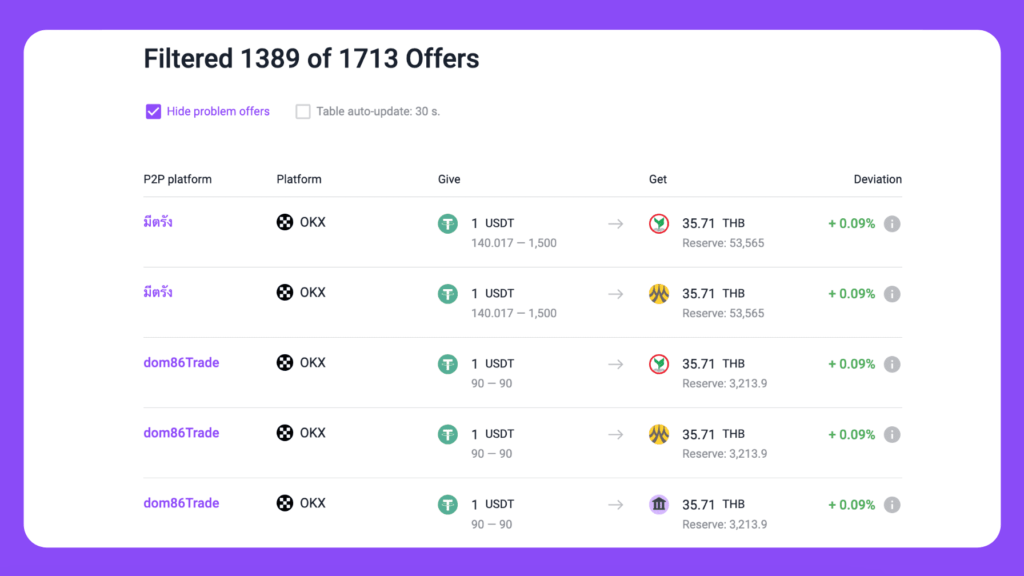

When you have all the necessary tools, it is time to look for the best prices or conditions. The solution is to use special aggregator services that collect and compare data from different sites in one interface. For example, Monetory allows you to find the most favorable rate for buying or selling the desired cryptocurrency among dozens of P2P exchanges and thousands of private exchangers. Let us look at an example: we want to sell USDT for THB at the most profit.

- Go to the main page

- In the Give field, select USDT, and in the Get – THB

Already at this stage, we received the most profitable rates on the market.

Now we can further filter them, for example:

- Choose payment methods convenient for us

- Set transaction limits

- Select P2P-exchanges or, for example, only private exchangers

- After all the steps above, we go to a suitable offer and make an exchange.

If you only register on one platform like Binance, there are a lot of risks. Crashes, hacks, and blockages may occur. Not to mention that prices may be better on other exchanges. Use all available tools for the most efficient and safe trading:

- Create accounts on different trusted exchanges

- Store coins in secure wallets

- Open accounts in popular banks and payment services

- Choose the best rate with Monetory

Happy trading!