Peer-to-peer (P2P) trading is a process where people directly exchange cryptocurrencies and fiat currencies with each other through a particular platform. For example, if Steve wants to buy Bitcoin with USD and Bill wants to sell it, they can find each other on a P2P platform and exchange. Steve transfers USD to Bill, and Bill transfers the cryptocurrency to Steve. The platform acts as a guarantor and helps them complete the deal safely. Some platforms charge a nominal fee for this service.

This article will explain all the P2P nuances in simple terms and even teach you how to profit from it.

How P2P Works

P2P platforms function like bulletin boards. Some users post their exchange offers, while others accept them. The difference with P2P trading is that people exchange funds directly. The platform itself does not participate but guarantees security. You can act as either a maker or a taker. Makers create their offers, while takers choose from existing ones. Makers can set their rates and select payment methods. However, being a taker allows you to make quicker transactions. As a taker, you choose the offer that suits you without waiting for someone to trade with you.

Once the buyer and seller confirm the operation, the offer is automatically closed. If either party disagrees, they can open a dispute, and the platform will mediate and resolve it.

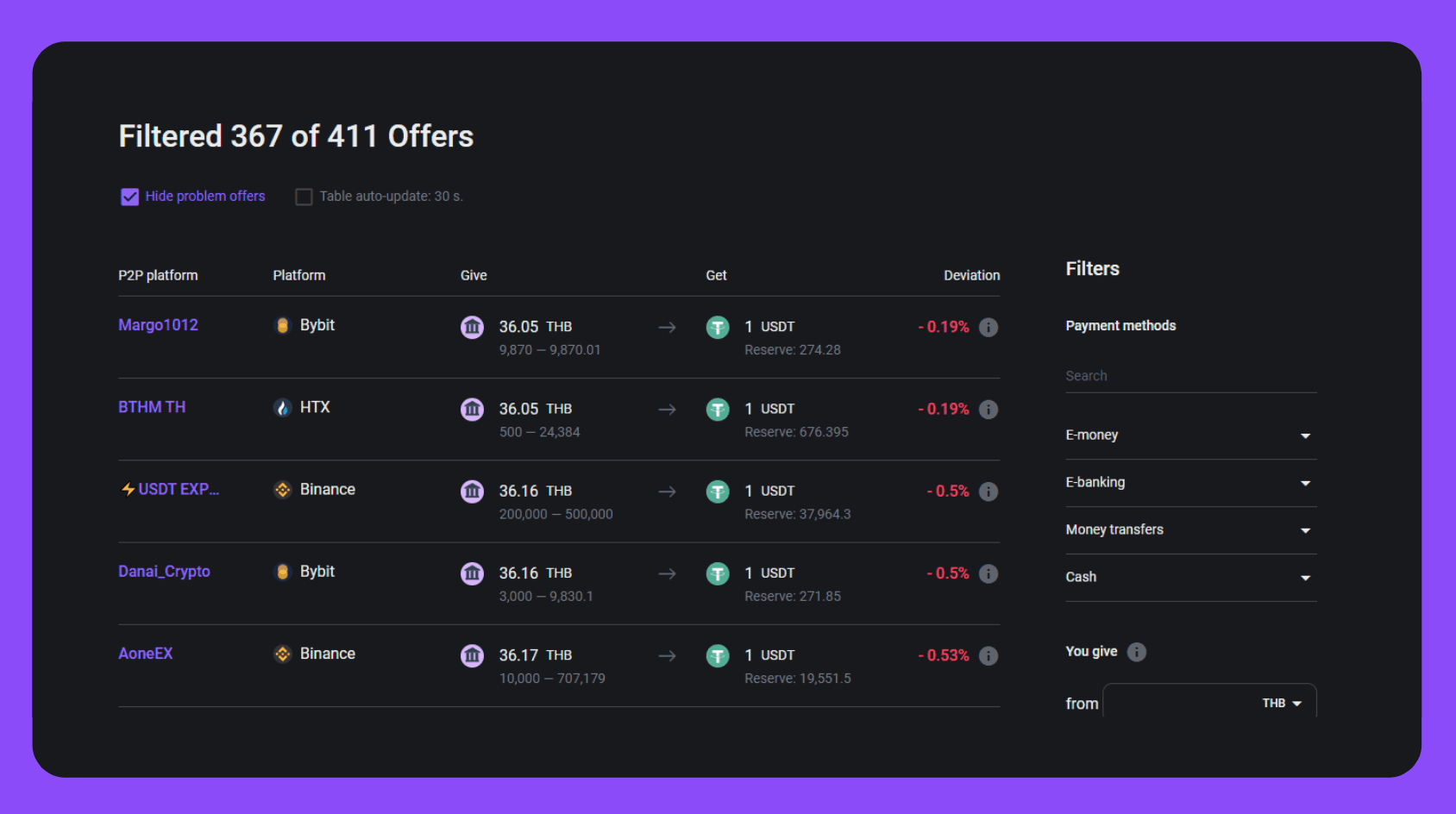

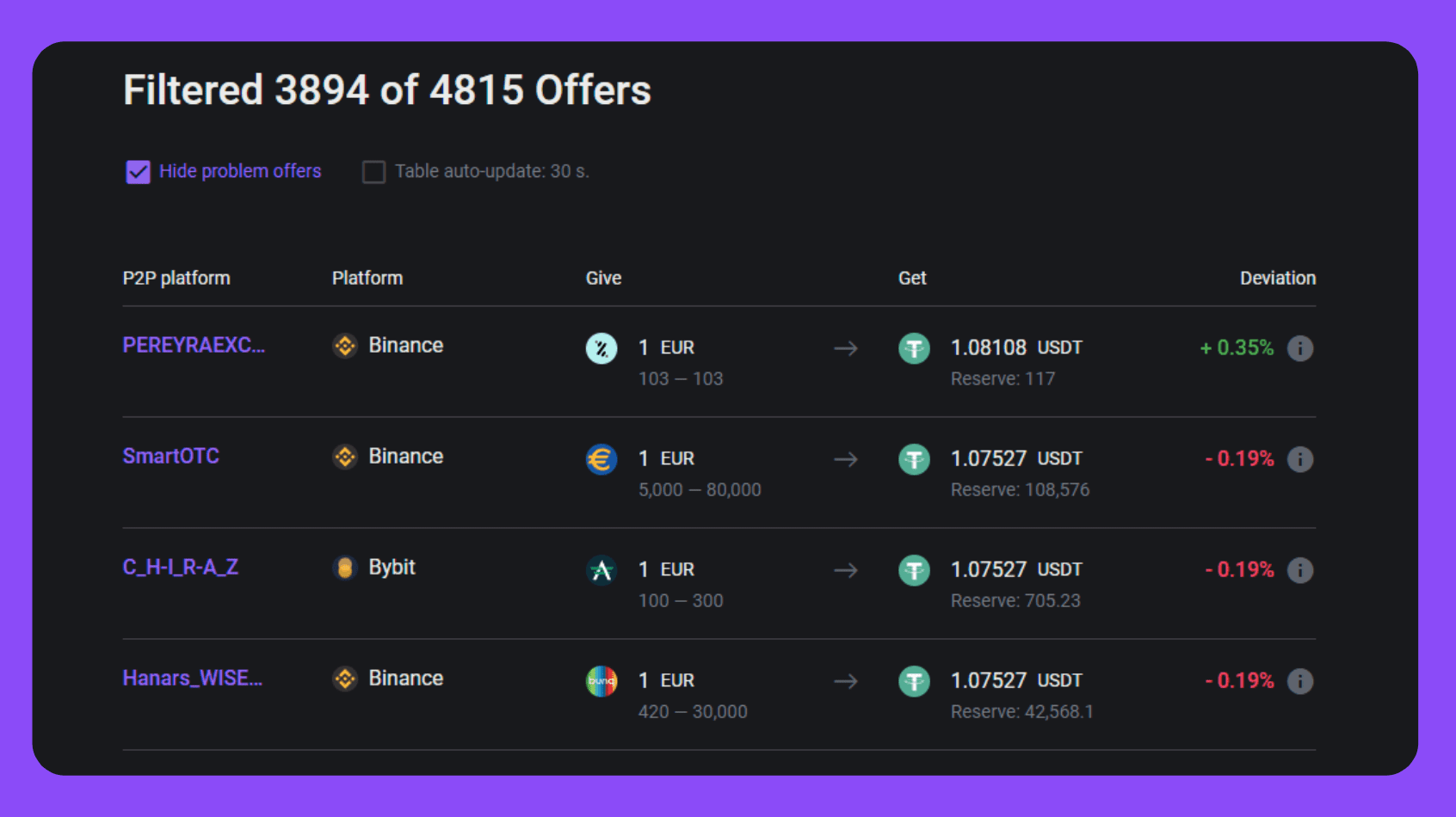

Rates can vary significantly across different P2P platforms

For example, at the time of writing this article, the most favorable rate for buying USDT with THB was on the Bybit platform, followed by HTX, with the popular Binance coming in last at a rate of 36.16. If you are looking for profit from P2P or want the best exchange rate, always compare offers across platforms.

In addition to major P2P platforms, there are also Local Exchangers. They post offers on their websites, apps, or Telegram bots. These are even simpler. You select what you want to buy and sell, and the exchange and confirmation happen. We covered the differences between Local Exchangers and P2P platforms in this article.

Why People Use P2P

Let us move from theory to practice. What tasks can you solve using P2P exchanges? Just about any mission, from buying cryptocurrency for investment purposes to paying suppliers in another country. Some people also choose cryptocurrency as an additional storage method.

Buy Cryptocurrency at Favorable Rates

You could deposit fiat currency on an exchange and buy USDT, Bitcoin, and other cryptocurrencies. However, direct deposits are subject to rather hefty fees. Therefore, it is more cost-effective to buy crypto through P2P since most platforms have low or even zero fees.

Send Money Abroad

Traditional methods like SWIFT or services like Wire often require time. It is faster and frequently more cost-effective to buy cryptocurrency on a P2P platform and sell it to the recipient in another country for their local currency, receiving cash or a bank transfer.

Exchange Currency in Another Country

If you are traveling and need to exchange money, P2P platforms can also help. You buy crypto on a P2P platform using your currency, then sell it for the local currency. It allows you to exchange directly, without intermediaries like banks or currency exchanges, saving on fees and getting better rates.

Send Cash

You can use cryptocurrency as a buffer if you need to send cash from one city to another. Buy crypto on a P2P platform or through Local Exchangers, then send it to another user in the destination city. They can then follow the same process in reverse. There is no need to travel or conduct multiple cash deposit/withdrawal operations.

Pay for Goods or Services

P2P platforms and cryptocurrency can facilitate purchasing goods or services from a supplier in another country. It streamlines international payments and avoids additional fees associated with traditional financial institutions.

P2P exchanges are faster and more cost-effective than other methods. Let us look at an example:

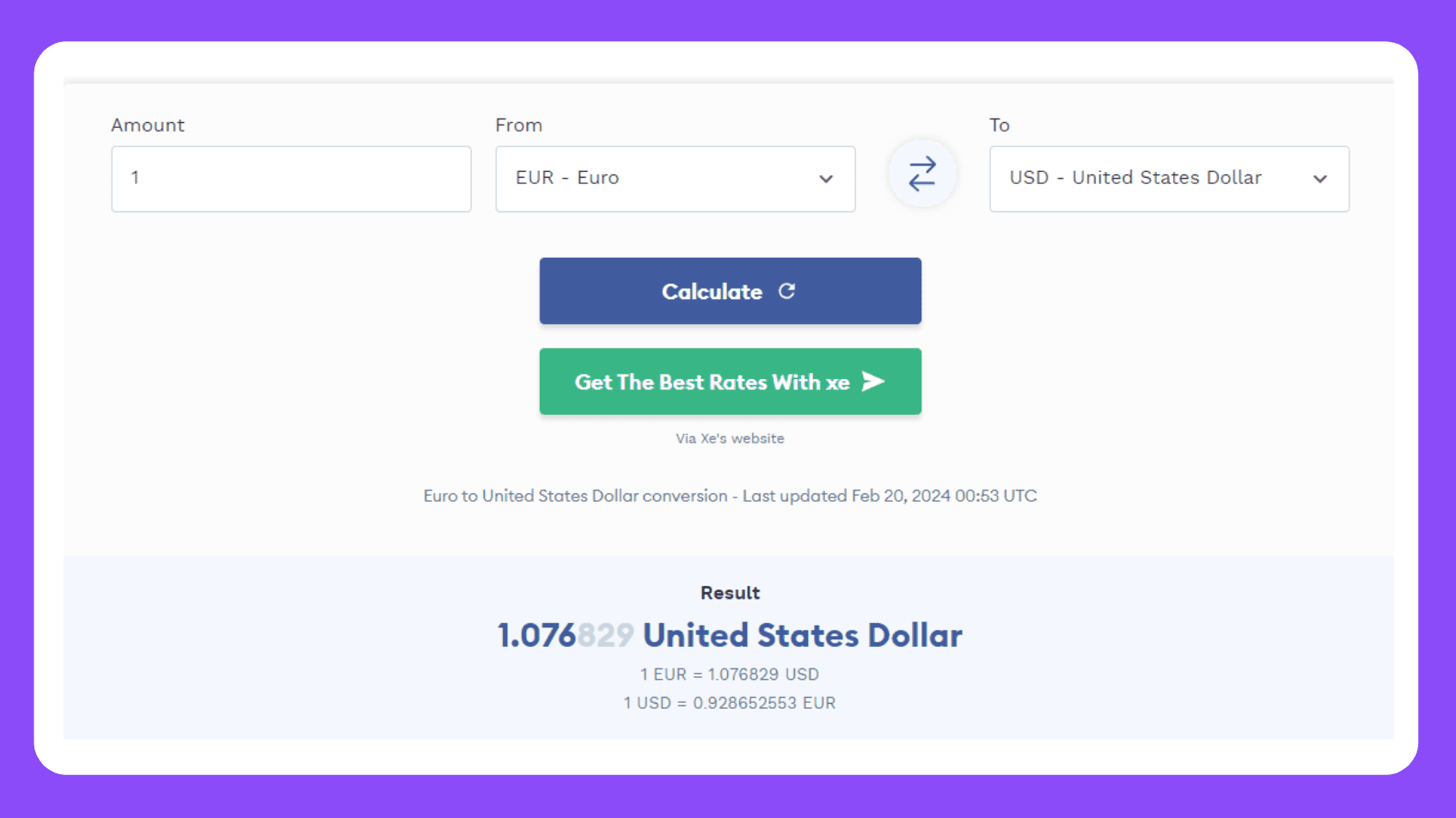

- On 19.01.2024, the EUR/USD exchange rate, according to Forbes, was 1.07

- In the P2P market, we can buy USDT, which typically trades slightly higher than the regular dollar, at a rate of 1 EUR = 1.08 USDT.

While the difference may seem insignificant at first glance, it becomes more noticeable when exchanging large sums of money.

Banks and currency exchanges make a profit from the spread between buy and sell rates. On P2P platforms, you can become that intermediary! Offer your exchange rate and earn from the spreads

How to Profit from P2P Trading

You may have already heard about P2P arbitrage. There are many trading platforms without shared liquidity or interconnectedness. It creates pricing discrepancies across platforms like Binance and HTX, for example. Traders profit from these spreads by buying low on one platform and selling high on another. For example, A trader buys cryptocurrency on HTX and sells it on Gate.io at a 0.3% higher price.

There are various P2P arbitrage strategies:

- Intra-exchange. All trades occur within a single platform. The trader buys an asset cheaper and sells it higher to other users or buys one asset, swaps it for another, and sells that.

- Inter-exchange. Profits come from price differences across platforms. Buy cheaper on one exchange, sell higher on another, pocketing the spread.

- International arbitrage. Profit comes from crypto-to-fiat price differentials across countries.

There are other strategies. The biggest impact comes from combining multiple approaches. Do not be afraid to experiment and test new tactics!

Here is a general step-by-step plan:

- Analyze prices across different P2P exchanges

- Compare exchange rates for different crypto/fiat pairs

- Look at rate differences for various payment methods

- Identify pricing gaps and mismatches

- Calculate each step, including fees/commissions

- Execute the loop — cycling funds back to the starting point while locking in profits

If you are a beginner, do not forget scam protection and safety precautions

Protecting Yourself in P2P Trading

To profit from P2P trading instead of losing money, you need to know the basic rules for protecting yourself against scammers. As in any arena involving large sums of money, there is no 100% foolproof way to avoid this problem. However, you can minimize the risks:

- Choose reputable, well-established platforms.

- Look at the percentage of successful trades.

- Check the counterparty’s registration date and verification status.

- Only accept and send payments using the details provided by your counterparty. It reduces the risk of interacting with dirty money and accounts.

- Conduct the trade and communicate solely within the P2P platform’s interface. Do not move to Telegram or other messengers.

- If you do encounter a scammer, immediately open a trade dispute and follow the exchange employee’s instructions.

Search for exchange platforms through Monetory — we only add verified resources and regularly check platforms and Local exchanges for fraudulent activity.

On spot markets, trades happen instantly. P2P involves manual person-to-person exchanges, so it takes more time. Do not worry! The process usually takes 10-15 minutes. But if you need maximum speed:

- Choose merchants: reliable and experienced counterparties with good reputations. They will confirm trades faster.

- Use instant payments like SEPA Instant.

- Separate card numbers with spaces. 1234 1234 1234 1234 instead of 1234123412341234. It is easier for your counterparty to enter.

- If your counterparty is AFK and not sending funds, try sending an SMS to the mobile number provided. People often miss notifications.

Avoiding Fund Freezes

Traders may face fund freezes on exchanges. To avoid this:

- Follow all platform rules.

- Confirm the origin of your funds if asked.

- If a freeze occurs, immediately contact support and provide evidence proving your case.

Types of P2P Platforms

All P2P platforms look like bulletin boards. It could be a separate section on an exchange that offers other trading tools or a dedicated website/app solely for P2P. We advise you to create accounts on multiple platforms. There are two types of them: custodial and non-custodial. Custodial requires depositing funds onto the platform, while non-custodial allows direct peer-to-peer transfers.

Custodial P2P Platforms

Platforms like Binance, Bybit, and HTX request you to deposit cryptocurrency. It is convenient for beginners because there is no need for your crypto wallet. But there are downsides:

- You do not control your funds while they are on the platform.

- You must trust the platform to keep your assets safe.

- KYC verification is required.

Non-Custodial P2P Platforms

Here you can trade directly from your crypto wallet. The platform just matches you with other participants. Advantages:

- You fully control your funds.

- There is no need to trust the platform with your assets.

- Identity verification is often not required.

Want high liquidity and convenience? Custodial solutions are your choice. If you value anonymity and decentralization more, go non-custodial. Use our navigator to compare

Use P2P to Extend Your Opportunities

P2P is the same as exchanging cash with acquaintances. You give them one currency, and they give you another. Except with P2P platforms, you can find such offers in different countries and choose favorable rates. The P2P platforms connect buyers and sellers in one interface.

Start with small amounts, choose reliable partners, follow security rules, and you will succeed. And use Monetory to compare rates!