The largest investment company, BlackRock, is confident that its application for a Bitcoin ETF will be approved by the beginning of 2024. This event will mark the turning point towards the mainstream adoption of cryptocurrencies by investors. It’s the perfect time to delve into the two main players in the crypto market — Bitcoin (BTC) and Ethereum (ETH).

Let’s discover their strengths and weaknesses and determine which coin holds more prospects shortly.

The History of Bitcoin and Ethereum

Mysterious Satoshi Nakamoto created Bitcoin in 2008. Nakamoto published a whitepaper presenting a decentralized payment system based on blockchain technology. This system would allow people to transfer money to each other without banks or other intermediaries. Nakamoto’s real identity is still unknown. There are many theories about who is hiding behind this nickname, but none of them have been confirmed so far.

The first genesis block in the Bitcoin blockchain appeared on January 3, 2009. Just a year and a half later, on May 22, 2010, programmer Laszlo Hanyecz bought two pizzas for 10,000 BTC!

In 2013, Ethereum emerged as a cryptocurrency platform that enables the transfer of digital currency and the creation of decentralized applications and smart contracts based on it. Russian-Canadian programmer Vitalik Buterin and his co-founders, including Charles Hoskinson and Gavin Wood, created it.

By 2014, the prototype of Ethereum was ready, and in 2015, the public network was launched. Over the years, Ethereum has evolved into the world’s largest platform for decentralized applications. Thousands of different services operate there, and millions of transactions have already been conducted.

Both projects are based on blockchain technology. Each block contains the hash (a unique digital fingerprint) of the previous block. It makes the blockchain immutable — it cannot be tampered with or alter the data in the chain.

The Operation Principle of Bitcoin and Ethereum

Both projects are based on blockchain technology. Each block contains the hash (a unique digital fingerprint) of the previous block. It makes the blockchain immutable — it cannot be tampered with or alter the data in the chain.

Blockchain is a distributed database that stores information about transactions in encrypted form. The data is recorded in blocks and linked together in a chain using cryptography

Bitcoin uses the Proof-of-Work algorithm to create new blocks. In this system, miners solve complex mathematical problems that require enormous computational power.

The first miner to find the solution confirms the new block and receives a reward of 6.25 BTC. However, in April 2024, the reward will be halved, and miners will receive only 3.125 BTC per block. This process is called halving, occurring approximately every four years, thus maintaining the planned emission of new coins.

An interesting fact! People have already mined over 93% of bitcoins. But the last one will only be mined by the year 2140.

Until September 2022, Ethereum also utilized PoW for transaction confirmation. However, due to significant energy costs, it transitioned to the Proof-of-Stake mechanism. In PoS, validators stake their ETH coins to gain the right to confirm blocks. This has reduced energy consumption by 99.95% compared to PoW!

Both cryptocurrencies employ proven cryptographic methods for recording data in the blockchain. However, the approaches differ significantly.

| Bitcoin (BTC) | Ethereum (ETH) | |

| Purpose | Used only for crypto payments. It doesn’t have any other functions. | A more flexible platform for creating new decentralized services. In Ethereum, you can create new currencies, applications, NFTs, and smart contracts directly on the blockchain. |

| Decentralization | Completely decentralized. Its network is not controlled by any company or government. | Less decentralized, with some parts of the network controlled by developers. |

| Emission | The number of bitcoins is limited to 21 million. They are becoming scarcer, making Bitcoin deflationary, like gold. | The number of coins is unlimited. It employs a so-called burn mechanism, where a portion of coins in a block is burned. However, the platform is still on the path to becoming deflationary tokenomics. |

| Transaction Speed | ~ 8 minutes per transaction | ~ 12 minutes per transaction |

| Transaction Fees | From $0,1 and above | $0,01 – $0,02 |

Thus, Bitcoin is primarily a payment cryptocurrency, while Ethereum is a platform for new dApps.

Technical Analysis of BTC and ETH

Disclaimer: The data is current as of the article’s writing.

| Bitcoin (BTC) | Ethereum (ETH) | |

| Price | ~ $37,000 | ~ $2,000 |

| Market Cap | ~ $730,000,000 | ~ $250,000,000 |

| ATH | ~ $69,000 | ~ $4,900 |

| Volume (24h) | ~ $23,000,000 | ~ $13,000,000 |

| Circulating supply | ~ 19,500,000 BTC | ~ 120,000,000 ETH |

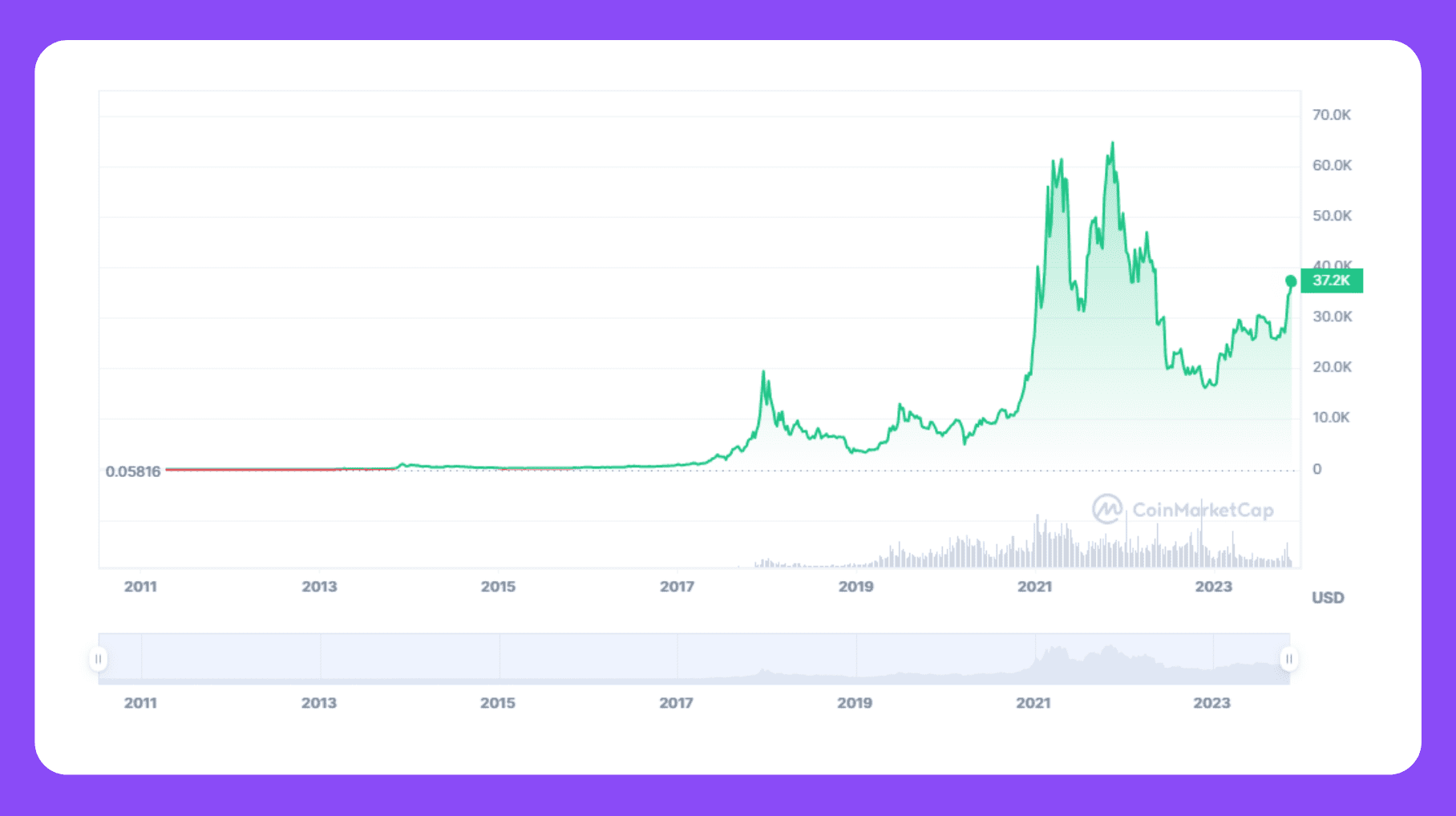

Despite high volatility, both assets show long-term growth. In terms of market share in the crypto market, Bitcoin holds about 40%, while Ethereum accounts for approximately 20%.

The growth pattern for ETH is similar. If we overlay the charts, we can conclude that Bitcoin sets the trend — almost all altcoins follow it.

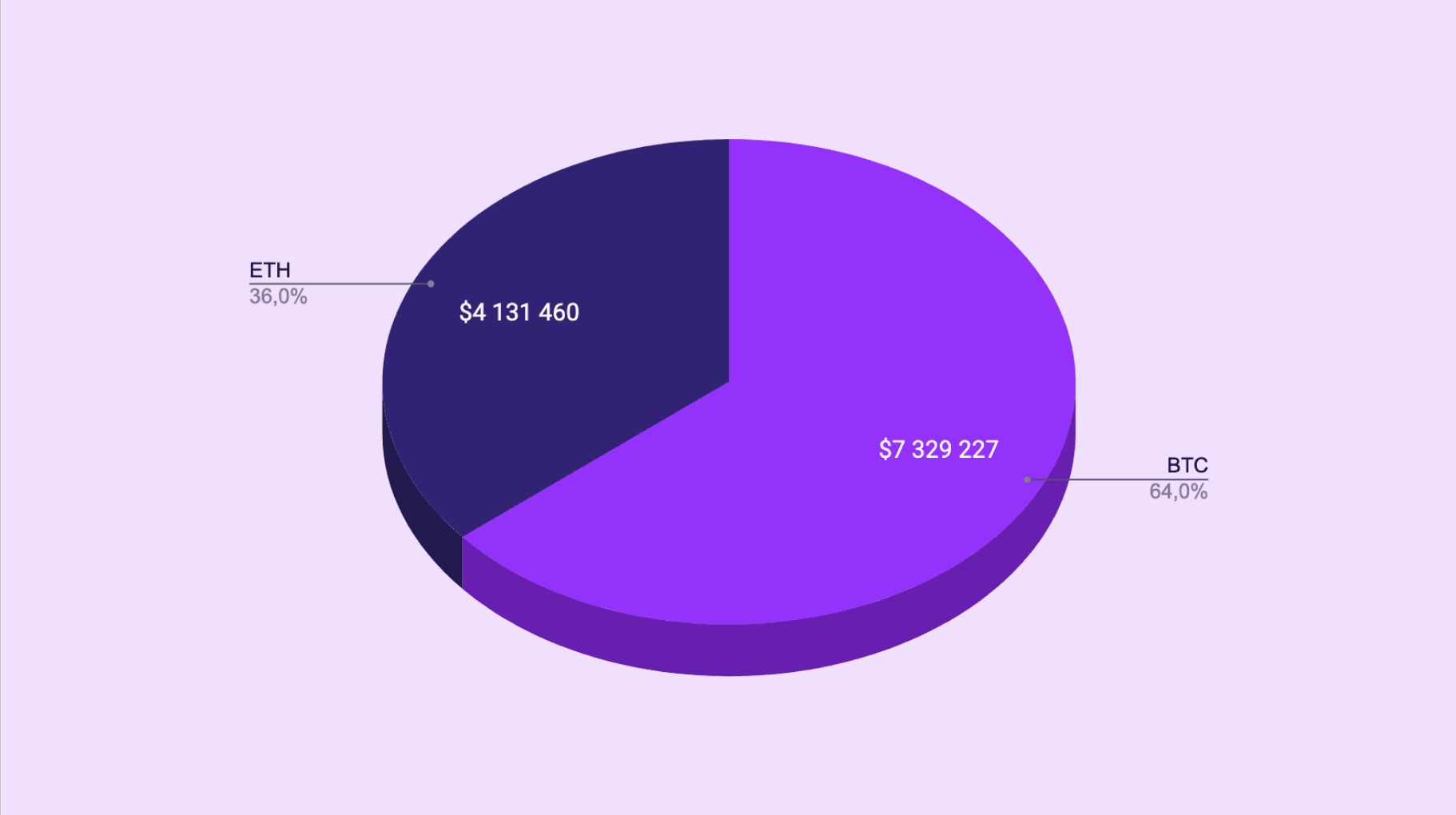

Looking at the cryptocurrency data on the P2P market, BTC is much more liquid. As of November 23, 2023, the order book volumes for “Buy” on four popular platforms — Binance, Bybit, HTX, and OKX — were 200 BTC and 2120 ETH. If we convert this to dollars, we’ll see the following picture:

- Despite the high volatility, both assets demonstrate long-term growth.

- BTC and ETH hold leading positions in terms of market capitalization among all cryptocurrencies, confirming their significance for the entire industry.

- Both projects have strong teams and active communities, ensuring further development and the implementation of innovations.

- BTC is positioned as digital gold, serving as a tool for value preservation. ETH serves as the foundation for decentralized applications and smart contracts.

Despite the high risks associated with cryptocurrencies, BTC and ETH remain the most reliable and promising assets. Their fundamental advantages and leading positions allow for forecasting further long-term growth.

Which Cryptocurrency to Choose for Investment?

While Bitcoin and Ethereum have their merits and drawbacks, for long-term investors, it is reasonable not to consider them direct competitors. Instead, they can complement each other in a balanced crypto portfolio.

Bitcoin is a more established asset with a limited supply. It is popular as a store of value, and there is a separate category of “Bitcoin maximalists” in the crypto community who do not recognize other cryptocurrencies. Ethereum, on the other hand, offers greater flexibility and potential for future growth through decentralized applications and smart contracts. Moreover, there should be an alternative for everything.

Most likely, both networks will thrive in the future, performing different tasks. Based on this, an investment distribution of 50/50 or 60/40 – with a slight bias towards Bitcoin – seems like an optimal solution.

So, instead of asking “Who will win?” it is worth considering, “How can these leading cryptocurrencies work together?”. Ultimately, the cryptocurrency ecosystem is only at the beginning of its journey. As crypto becomes more similar to the traditional market, there will be room for the success of both Bitcoin and Ethereum in their respective roles. Strong allegiance to one “camp” limits opportunities. Objectivity and adaptability will serve investors best in the long run.

It is important to remember the high risks of investing in cryptocurrencies. However, the fundamental advantages of Bitcoin and Ethereum allow for predicting an increase in their value over the next 5-10 years. If you want to buy them now, do it through the Monetory search. You will have the opportunity to compare prices across a wide range of P2P platforms and private exchangers and choose the best offer among them!