Right now, millions of people are playing clicker games on Telegram, earning their first cryptocurrency. They store it directly in the messenger’s wallet and spend it on real purchases from paying for hosting services to shopping at Shopify stores.

But let’s be honest: most people aren’t ready to deal with the complexities of cryptocurrencies or risk their money due to extreme price fluctuations. Cryptocurrencies will only become mainstream when they become as simple and reliable as regular money. This is precisely why the future belongs to stablecoins. These cryptocurrencies function like traditional money but are faster and more convenient.

In this article, you’ll learn why stablecoins might replace conventional payment methods and where you can use them instead of regular money now.

The Advantages of Stablecoins

What makes stablecoins so attractive? First and foremost, their price stability. While Bitcoin can rise or fall by 20% in a single day, stablecoins always hold a steady value. For example, USDT or USDC is worth exactly one dollar no more, no less. This stability is possible because each token is backed by a real dollar held as collateral by the issuing company.

There are also more complex types of stablecoins. DAI is also worth one dollar but operates differently. Instead of holding real dollars, smart contracts ensure each DAI is over-collateralized with another cryptocurrency. For example, you lock $150 worth of ETH to receive $100 worth of DAI. If ETH’s value falls, the system automatically adjusts positions to maintain DAI’s stability.

Stablecoins are not perfect and can occasionally lose their peg to the dollar. The most infamous case was the collapse of UST in 2022. However, such situations are rare for major stablecoins like USDT and USDC.

International Transactions

International money transfers are a headache. SWIFT? Fees nearing $100 and days of waiting. SEPA? It only works within Europe and isn’t always fast. Do you need to send money to Latin America or Southeast Asia? Prepare for a labyrinth of intermediaries and fees at every step.

With stablecoins, it’s much easier. You send USDT or USDC, and within minutes, it reaches the recipient, regardless of weekends, holidays, midnight, or rush hour. A transfer from Turkey to India? No problem. Thailand to Vietnam? Easy. All you need is the recipient’s wallet address, and the money arrives in minutes with a transaction fee of about $1. The recipient can then exchange the stablecoins for local currency via any crypto exchange or P2P platform.

That’s it! You just sent real money across the world in a few minutes for almost no cost.

Dollars are understood and accepted worldwide, and their exchange rates are known in every country. When you send USDT, both the sender and receiver know the value of the transaction. There are no exchange rate fluctuations during the transfer and no conversion issues. While the crypto world has many different coins, stablecoins are uniquely suited for international payments, combining the speed of cryptocurrencies with the stability and clarity of traditional money.

Better than Bank

Banks come with many restrictions. Do you want to transfer money on the weekend? Wait until Monday. Need to send a large amount? Be prepared to explain the source of funds, show contracts, and fill out numerous forms. Banks can also freeze your account “for verification” or reject transactions without clear explanations.

With stablecoins, you don’t need a bank. Transfers work 24/7, and no one questions why you’re sending money at 3 a.m. on a Sunday. There’s no endless checks or bureaucracy. You can send any amount you wish. All transactions are recorded on the blockchain, so you can always verify where your money is.

But the main benefit is full control over your funds. There are no unexpected account maintenance fees, no imposed transfer limits, and no account freezes “pending investigation.” Your stablecoins are always accessible to you and only to you. And if you need to check your transaction history, it’s transparently stored on the blockchain, impossible to alter or forge.

A New Level of Savings

Forget about bank deposits with 1% annual interest. Stablecoins offer far more attractive opportunities. You can earn 5–10% of annual interest on crypto exchanges or use DeFi protocols, where rates may be even higher.

And this isn’t some dubious investment. You’re simply holding digital dollars. Stablecoins neither increase nor decrease in value but maintain a consistent peg to the dollar. You can withdraw your funds anytime—no penalties for early withdrawal or lengthy waiting periods.

Of course, like any investment, there are risks. But the ability to earn a stable income in dollars while maintaining full control over your funds is something, that no traditional bank can offer.

On Monetory, you will find the best offers for buying and selling USDT, USDC, and other stablecoins. Choose a convenient payment method, set suitable limits, and find the best rates in just a few clicks.

Why Stablecoins Are the Future

“Cryptocurrencies today are where the internet was in its early days,” says Graham Cook, CEO of the Brava platform. He’s convinced that the future is not about Bitcoin or Ethereum but about stablecoins. Why? Because they can serve as the “mask” that hides the complexities of cryptocurrencies from ordinary users, offering a simple and intuitive way to make payments.

Think about how the internet evolved. Sending an email once required knowledge of specialized programs and an understanding of mail protocols. Today, we open an app and send a message without thinking about the underlying technology. The same is happening now with cryptocurrencies. We’re at the stage where complex technologies are becoming simple and user-friendly.

Already, we hardly use cash today. Instead, we use banking apps, tapping our phones at terminals, or scanning QR codes. Whether these apps use traditional money or stablecoins inside doesn’t matter; what matters is the convenience and speed of payments.

Stablecoins promise us:

- Instant international transfers without complex forms

- Simple payments worldwide without currency conversions

- Transparent, predictable costs in familiar dollars

- 24/7 payment capability, unrestricted by banking hours

Stablecoin in the Global Financial System

Stablecoins can solve real problems in transfers and payments. They’re faster and more convenient than traditional money. But why can’t we use them at a local store yet? The issue lies in regulation and the readiness of the financial system to adopt new technologies.

Regulators worldwide are searching for a balance: stablecoins can make the financial system more efficient, but user protection and risk prevention are also vital. Some countries are already taking steps:

- Japan has recognized stablecoins as legal payment tools and allowed banks to work with them.

- Singapore has created a regulatory sandbox to test stablecoins in real conditions.

- The U.S. is actively discussing federal legislation for stablecoin regulation.

- The European Union has included stablecoins in its new MiCA law, establishing clear usage rules.

The world of stablecoins has moved beyond crypto exchanges. This isn’t just another “technology of the future”—it’s a functional tool helping millions of people manage their money more effectively now. From instant international transfers to hosting payments, from investments to travel, stablecoins offer faster, simpler, and more cost-effective solutions.

Where Stablecoins Are Already Used

Hosting and VPN Services

Many people prefer hosting their projects on international servers. This is especially true for VPNs. Here you can meet some problems:

- A bank may block payments to foreign services.

- Conversion rates for dollar payments are often unfavorable.

- Some banks outright prohibit transfers to certain companies.

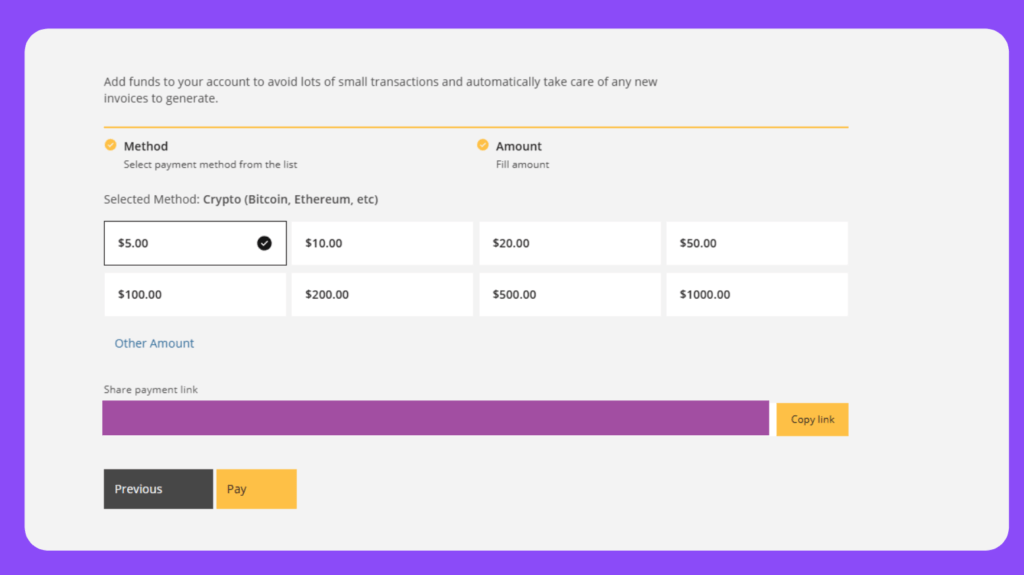

This is why hosting providers are adding stablecoin payment options. It solves all these problems. You just need to transfer USDT or USDC. Among major hosting providers that already accept stablecoins are:

- Namecheap: One of the largest domain registrars and hosting providers.

- Snel.com: A popular Dutch hosting service known for its high-speed performance.

- is*hosting: An Estonian company, one of the pioneers in working with stablecoins.

Take Estonian is*hosting, for example. It offers clients a wide range of payment methods from traditional bank cards and transfers to various electronic payment systems and USDT.

Marketplaces

Interesting changes are also happening in the world of online commerce. Remember when PayPal payments seemed novel? Today, the same story is unfolding with stablecoins.

Shopify, one of the largest platforms for creating online stores, now allows stablecoin payments. How does it work? It’s simple: store owners connect to Crypto.com Pay, enabling their customers to pay with USDT or other cryptocurrencies. Storeowners can choose the currency, keeping funds in stablecoins or automatically converting them into traditional money.

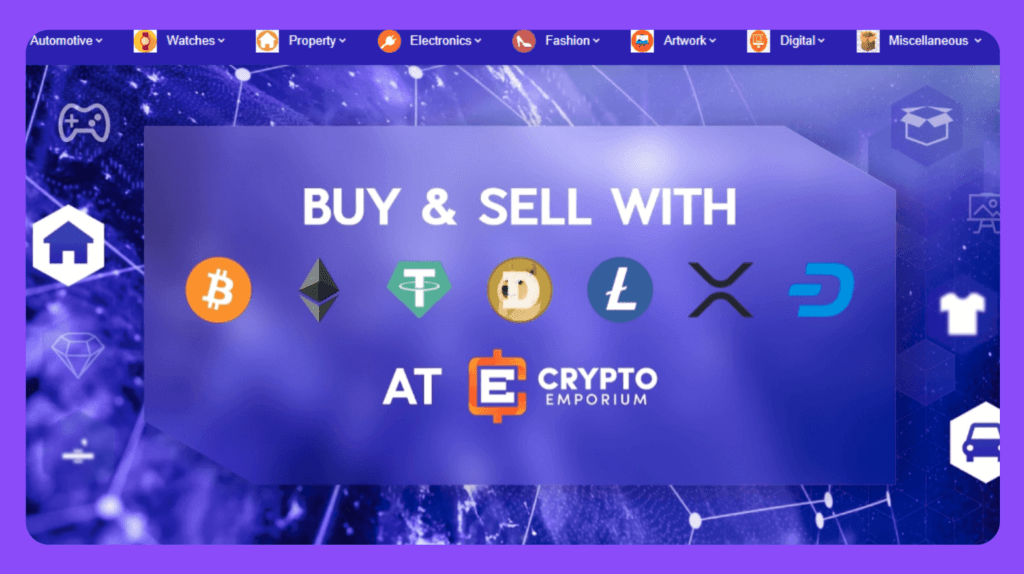

There are also fully crypto-based marketplaces emerging. For instance, Crypto Emporium (essentially an Amazon for stablecoins) allows users to buy anything from headphones to cars, with all payments made exclusively in cryptocurrency. No traditional payment methods—only digital money.

Gaming and Entertainment

Cryptocurrencies have already firmly established themselves in mobile games and various GameFi projects. On the other hand, major publishers remain cautious. For example, Steam has outright banned games with cryptocurrencies on its platform.

Interestingly, there are rumors that GTA VI may feature opportunities to earn and withdraw cryptocurrency.

Workarounds are already available. Bitpay lets users purchase games from major stores, including:

- PlayStation Store

- Xbox Store

- Nintendo eShop

But Bitpay isn’t just for games. The service covers over ten categories, from real estate and car purchases to restaurant payments. Some payments are made directly in crypto and some through special gift cards. It functions as a kind of digital exchange. You use cryptocurrency, and the platform doesn’t even realize it.

Travel Services

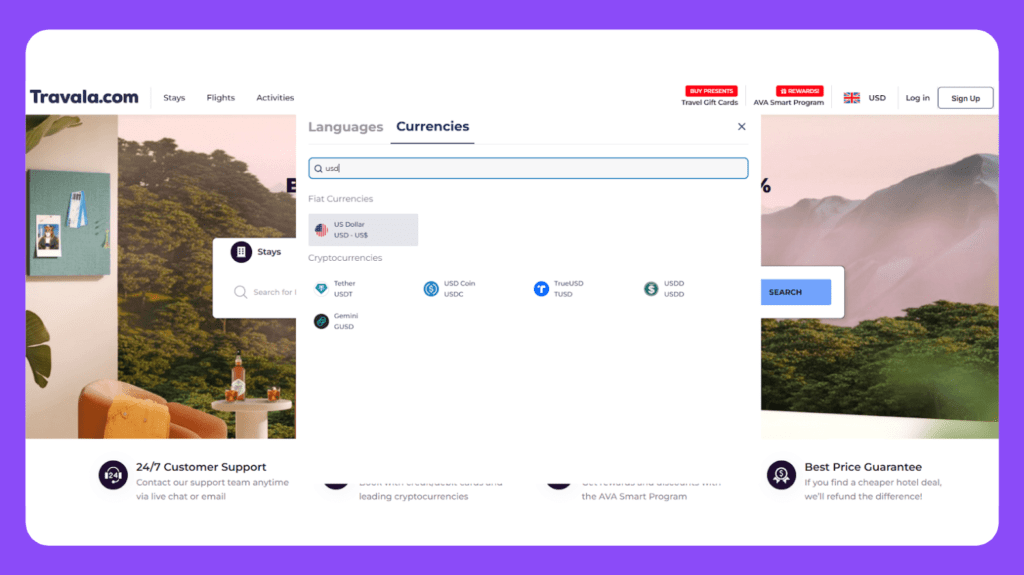

Using cryptocurrencies and stablecoins in the travel industry is becoming routine. Buy crypto, travel to another country, exchange it for local currency—it’s convenient. However, some companies are taking it further by integrating crypto payments directly into their booking services.

Travala.com is a prime example of this approach. The platform allows users to pay for flights, hotels, and even tours with cryptocurrencies, including five stablecoins:

- USDT

- USDC

- TUSD

- USDD

- GUSD

In total, over 120 different crypto assets are supported. The platform is integrated with Booking.com, offering the same wide selection of hotels but with far more convenient payment options.

Start Using Stablecoins Today

The world of stablecoins has long expanded beyond cryptocurrency exchanges. This isn’t just another “technology of the future”—it’s a practical tool that is already helping millions of people manage their finances more effectively. From instant international transfers to hosting payments, from investments to travel—stablecoins offer faster, simpler, and more cost-efficient solutions.

Monetory can help you take the first step. It provides the best offers for buying and selling USDT, USDC, and other stablecoins. Choose a convenient payment method, set appropriate limits, and start enjoying the benefits of digital dollars today.