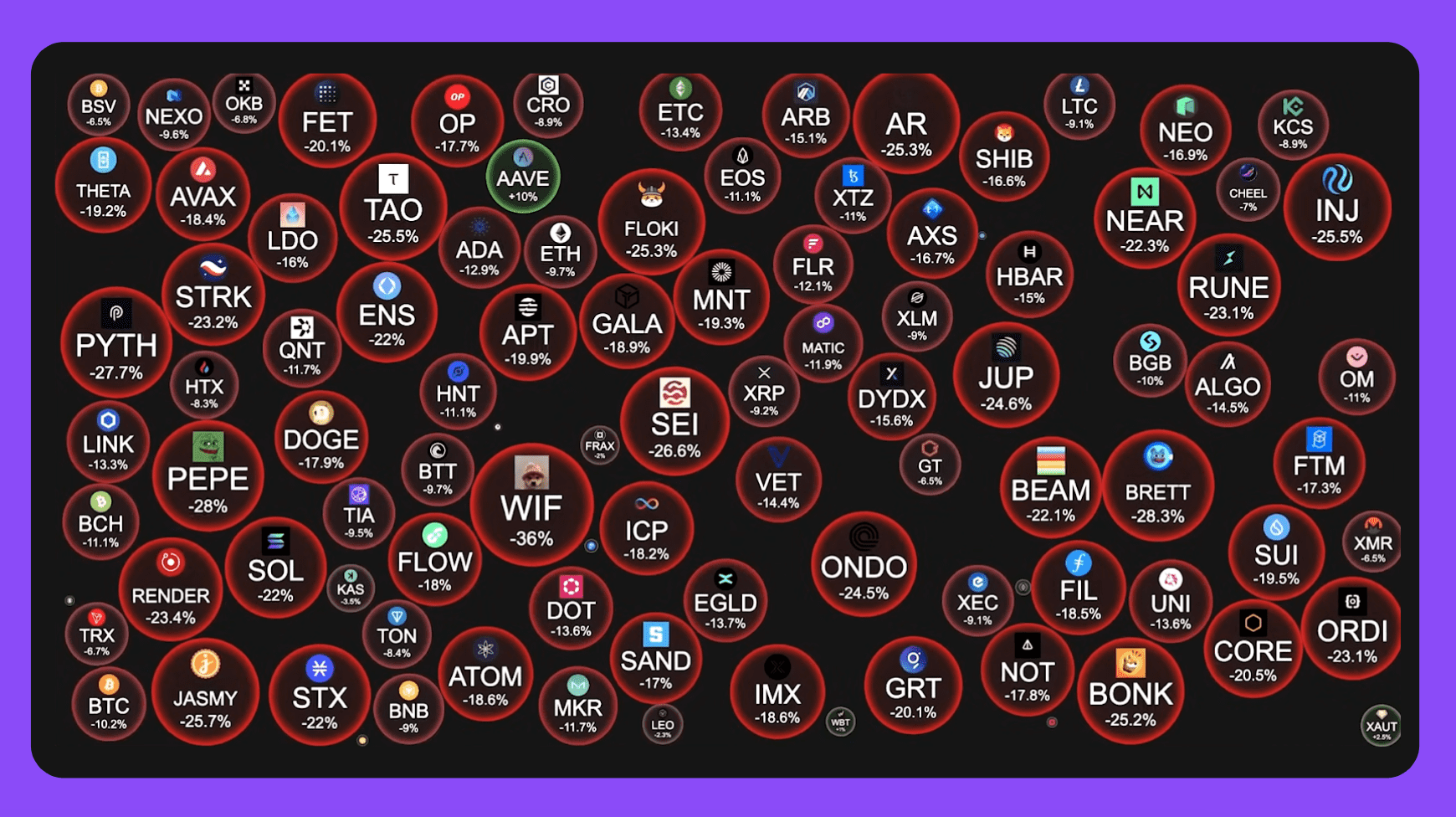

On August 5, 2024, the cryptocurrency market took a serious hit. In a single day, Bitcoin plummeted below $50,000 – a level not seen since the beginning of the year. Ethereum fared even worse, nearly breaking through the $2,000 mark. No one was spared – smaller cryptocurrencies also took a nosedive.

Two key events triggered this market meltdown: escalating tensions in the Middle East and disappointing unemployment figures in the US. But here’s the kicker – just a day later, prices rebounded, soon returning to their pre-crash levels. This incident demonstrates that cryptocurrencies no longer exist in their bubble. Now that digital currencies are increasingly woven into the fabric of our lives, they’re influenced by the same events that shape the traditional economy.

This raises some intriguing questions: How do global events impact cryptocurrency prices? Is it possible to predict when prices will surge or plummet? And how can one avoid losses – or even turn a profit – during such sharp fluctuations?

In this article, we’ll tackle these questions and offer advice on managing your cryptocurrencies in these tumultuous times. Our goal is to help you understand the connection between world news and cryptocurrency behavior, and learn to make smart decisions even when everything around you is changing at breakneck speed.

This article reflects the author’s opinion and is intended for informational purposes only. It is not financial advice or an investment recommendation. Please DYOR before making any financial decisions.

Similar Events in the Past and Could They Have Been Predicted

Let’s take a trip down memory lane and examine key news events that dramatically impacted the cryptocurrency market. Why bother? Well, while history may not repeat itself exactly, it often “rhymes.” By studying the past, we can’t predict the future with 100% accuracy, but we can better prepare ourselves for possible scenarios.

Event 1: The Onset of the COVID-19 Pandemic

In early 2020, few could have imagined the changes that would sweep the world in the coming years. The first reports of a new virus in Wuhan, China emerged in December 2019, but they seemed distant and insignificant at the time.

January and February 2020. The virus begins to spread beyond China’s borders. On January 30, the WHO declared a public health emergency of international concern. However, the cryptocurrency market remains calm. Bitcoin even rises, climbing from $7,200 in early January to $10,500 by mid-February.

Early March 2020. The situation begins to heat up. More and more countries report infection cases. On March 11, the WHO officially declared a pandemic. And that’s when the real storm begins.

“Black Thursday” March 12, 2020. Within 24 hours, Bitcoin crashes from $7,900 to $4,800, losing almost 40% of its value. It’s the largest single-day drop since 2013. Ethereum falls even harder – by 43%, from $195 to $111. The total cryptocurrency market cap shrinks by $93.5 billion in a day.

Reasons for this collapse:

- General panic in financial markets. Traditional stock exchanges are also crashing.

- Investors are selling off cryptocurrencies en masse to get cash in the face of uncertainty.

- Liquidity problems on cryptocurrency exchanges due to the flood of sell orders.

In the following weeks. The cryptocurrency market is in turmoil. Bitcoin fluctuates between $5,000 and $6,500. Many analysts predict further declines.

But then something unexpected happens. By mid-April, Bitcoin not only recovers to early March levels but continues to climb. By the end of the year, it reached a historic high of $29,000.

Why this happened:

- Governments and central banks start pumping trillions of dollars into the economy to combat the pandemic’s effects.

- Fear of inflation grows, and people begin looking for “safe haven” assets.

- Bitcoin starts to be viewed as “digital gold” and a hedge against inflation.

Could these events have been foreseen? Entirely? Probably not. But astute investors who closely followed news about the virus’s spread could have prepared for potential upheavals. Those who understood Bitcoin’s nature and its potential role in times of crisis were able to capitalize on the situation for long-term investments.

The main lesson from this event: cryptocurrencies, especially Bitcoin, can behave unpredictably in the short term, but in the long run, they can demonstrate resilience and even benefit from global crises.

Event 2: Elon Musk’s Tweets About Tesla and Bitcoin

So, what if we told you that sometimes just a couple of words from one person are enough to shake up the market? We’re talking about Elon Musk and his statements about Bitcoin in 2021.

February 8, 2021. Tesla announces a $1.5 billion Bitcoin purchase and plans to accept it as payment for cars. Bitcoin soars from $39,000 to $46,000 in 24 hours – an 18% increase.

March-April 2021. Musk continues to tweet about cryptocurrencies, including Dogecoin, causing market fluctuations.

May 12, 2021. Musk announces that Tesla is suspending Bitcoin acceptance due to environmental concerns. Bitcoin drops from $54,700 to $45,700 in 24 hours – a 16% decline.

July 21, 2021. Musk states that Tesla will resume accepting Bitcoin when mining becomes more environmentally friendly. Bitcoin jumps from $30,000 to $44,000 in a week.

Reasons for such influence:

- Musk’s reputation as an innovative entrepreneur.

- Musk’s massive social media following (over 60 million Twitter followers at the time).

- The perception of Tesla as a cutting-edge tech company.

- The overall volatility of the cryptocurrency market and its sensitivity to news.

Could these events have been foreseen? Predicting Musk’s specific tweets is impossible 🙂, but:

- Investors could have anticipated that Musk’s statements would influence the market, given his previous comments on cryptocurrencies.

- Questions about Bitcoin’s environmental impact had been raised before, so this aspect wasn’t a complete surprise.

The main lesson from this event: the influence of individuals on the cryptocurrency market can be enormous, especially if these individuals have a large audience and authority.

Event 3: China’s Cryptocurrency Ban

Let’s look at how decisions made by an entire nation can turn the situation upside down. We’re talking about the cryptocurrency ban in China – a country that has long been one of the key players in this market.

May 19, 2021. China has issued a ban on all cryptocurrency operations for financial institutions. Bitcoin drops from $42,000 to $36,000 in a matter of hours.

June 19, 2021. Authorities in Sichuan province ordered mining farms to be disconnected from the power grid. Bitcoin falls below $30,000.

September 24, 2021. The People’s Bank of China declares all cryptocurrency transactions illegal. Bitcoin drops below $40,000.

Reasons for such influence:

- China was the largest Bitcoin mining center (over 65% of the hash rate before the ban).

- Chinese traders made up a significant portion of the cryptocurrency market.

- Fears that other countries might follow China’s example.

Why this happened:

- The Chinese government was concerned about financial risks associated with cryptocurrencies.

- Chinese authorities sought to strengthen control over financial flows in the country.

- Preparation for launching their own central bank digital currency (CBDC).

Could these events have been foreseen?

- China had previously imposed restrictions on cryptocurrencies (ICO ban in 2017, closure of crypto exchanges).

- China’s official rhetoric towards cryptocurrencies was becoming increasingly negative.

- The most attentive observers could have noticed signs of policy tightening long before the full ban.

The main lesson from this event: the actions of major nations can have an enormous impact on the cryptocurrency market. However, despite short-term shocks, the market showed it can easily adapt. Mining operations moved to other countries, and Chinese traders found ways to circumvent the bans. Soon after, the Bitcoin price began to rise again and reached what was then an all-time high of $67,000.

Event 4: The Terra/LUNA Collapse

Sometimes, shocks come from within the crypto industry itself. The collapse of the Terra/LUNA ecosystem is a prime example, showing how fragile even seemingly successful projects can be.

May 7-8, 2022. The TerraUSD (UST) stablecoin begins to lose its dollar peg, falling to $0.985.

May 9, 2022. UST drops to $0.61, causing market panic. LUNA, Terra’s governance token, starts rapidly losing value.

May 11, 2022. UST crashes to $0.30, while LUNA’s price plummets from $62 to $1.

May 12, 2022. The Terra blockchain is officially halted.

June 19, 2022. LUNA fell to nearly zero ($0.00001675), losing over 99.99% of its value in just a few days.

Reasons for such impact:

- Terra was one of the largest ecosystems in the DeFi world, with a market cap of over $40 billion before the crash.

- Many investors and projects were tied to UST and LUNA.

- The collapse undermined confidence in algorithmic stablecoins as a whole.

Why this happened:

- UST’s algorithmic model proved unstable during large-scale sell-offs.

- High interest rates on UST deposits (up to 20% annually) attracted a lot of speculative capital.

- Possible targeted attacks on the ecosystem by large players.

Could these events have been foreseen?

- Critics have long pointed out the risks of algorithmic stablecoins.

- Some experts warned that Terra’s model was “too good to be true.”

- Signs of UST instability were noticeable even before the complete collapse.

The main lesson from this event: even the most popular and seemingly successful projects in the crypto world can collapse. The Terra/LUNA crash also showed the danger of excessive enthusiasm for high-yield but risky DeFi products. “If something looks too good to be true, it probably is” – this rule proved particularly apt in this situation.

Event 5: The FTX Bankruptcy

After the Terra/LUNA collapse, many thought the worst was over. But the crypto world taught another bitter lesson, showing that even industry giants can crumble in a matter of days. This time, it was the fall of one of the largest cryptocurrency exchanges – FTX.

November 2, 2022. CoinDesk publishes a report raising doubts about the balance sheet of Alameda Research, a trading firm closely tied to FTX.

November 6, 2022. Binance announces the sale of its FTT tokens amid growing concerns.

November 7-8, 2022. Users begin mass withdrawals from FTX. The exchange halts withdrawals.

November 9, 2022. Binance announces its intention to buy FTX but then backs out of the deal.

November 11, 2022. FTX files for bankruptcy. CEO Sam Bankman-Fried resigns.

Why this happened:

- Misuse of client funds. FTX used user deposits for risky investments and operations, violating basic principles of financial ethics.

- Lack of transparency and manipulations. The exchange was accused of distorting data on trading volumes and revenues, undermining investor confidence.

- Risky financial products. FTX offered high-risk trading instruments, often with inaccurate valuations, leading to significant losses for traders.

- Management issues. Ineffective leadership and a lack of a clear governance structure exacerbated the crisis of confidence in the exchange.

- Vulnerability to cyber attacks. FTX became a target for hackers, further undermining user confidence in the safety of their funds.

Consequences:

- Crypto market crash. In the week following FTX’s collapse, Bitcoin fell 25% from $21,300 to $15,900. Ethereum lost about 30%, dropping from $1,600 to $1,100.

- Mass exodus from CEXs. Users withdrew over $3 billion from Binance, Crypto.com, and other major exchanges within a week of FTX’s collapse.

- FTT token price crash. FTX’s native token (FTT) plummeted 91% in three days, from $22 to less than $2.

- A wave of bankruptcies. FTX’s collapse triggered a chain reaction in the industry. Several major companies, including crypto lender BlockFi and exchange Genesis, filed for bankruptcy in the following months.

Could these events have been foreseen?

- Some experts had long expressed doubts about FTX’s business model and its ties to Alameda Research.

- FTX’s rapid growth and aggressive marketing strategy raised questions among skeptics.

- However, the full scale of the problems came as a surprise even to many industry insiders.

The main lesson from this event: “Not your keys, not your coins.” FTX’s collapse underscored the risks of storing large sums on centralized exchanges and the importance of using cold wallets for long-term storage.

This event also highlighted the need for greater transparency and regulation in the crypto industry. Investors realized that even the most respected figures and companies in the cryptocurrency world can prove unreliable.

Event 6: Launch of the $1.9 Trillion US Economic Stimulus Program

We’ve looked at several cases where various events led to a decline in the cryptocurrency market. But for the sake of fairness, let’s remember the bright moments. After all, there are news events that don’t crash the market but rather send it soaring in a good way. One such event was Joe Biden’s decision in spring 2021.

March 11, 2021. US President Joe Biden signs the $1.9 trillion economic stimulus bill into law.

March 13-14, 2021. Distribution of $1,400 checks to American citizens begins.

March 17, 2021. The US Federal Reserve announces it will maintain low interest rates.

Market impact:

- Bitcoin rose from $40,000 to $61,000 in 2 weeks.

- A week later, Ethereum climbed from $1,500 to $2,500.

- The total crypto market cap increased by more than $150 billion.

Reasons for such influence:

- Inflation fears due to the massive injection of money into the US economy.

- Perception of Bitcoin as “digital gold” and a hedge against inflation.

- Part of the received stimulus payments was invested in cryptocurrencies.

- Low interest rates make traditional investments less attractive.

Could this event have been foreseen?

- Plans to stimulate the economy were known in advance, but the exact amount and date were uncertain.

- Analysts suggested it could affect the crypto market, but the scale of the impact was difficult to predict.

The main lesson from this event: this event showed that during periods of economic uncertainty and inflationary concerns, cryptocurrencies, especially Bitcoin, can be perceived as a “safe-haven asset.”

Key Patterns in the Crypto Market

After analyzing a series of significant events in the cryptocurrency world, we can identify several key patterns and principles.

Price Often “Predicts” News

It’s not uncommon to see a cryptocurrency’s price start moving even before official news is announced. This phenomenon is known as “buy the rumor, sell the news.” For instance, with Elon Musk’s tweets about Tesla and Bitcoin, the market often reacted to hints and unofficial statements before any official announcements. This underscores the importance of keeping tabs not just on official news, but also on community sentiment, rumors, and unofficial information sources.

Market Sentiment Influences News Perception

Interestingly, during periods of general optimism (bull market), negative news is often ignored or quickly priced in, while in a bear market, even positive news might not have a significant impact. For example, China’s cryptocurrency ban in 2021 occurred against the backdrop of an overall bullish trend, and although it caused a short-term dip, the market quickly recovered and continued to grow.

The Crypto Market is Manipulative and Unfriendly to Newcomers

Early investors, large funds, token unlock periods (vestings), and market maker actions can significantly influence prices. Pump-and-dump schemes, fake trading volumes, and order book manipulations are par for the course here.

It’s crucial to understand that the market’s goal is to redistribute capital, often from inexperienced participants to more seasoned ones. The collapse of FTX demonstrates just how unpredictable the market can be. Recognizing this unfriendly nature is critical for survival in crypto trading and requires constant learning and development of critical thinking.

Macroeconomic Factors and Central Bank Actions Have a Big Impact

The cryptocurrency market is highly sensitive to macroeconomic indicators and decisions by central banks, especially the US Federal Reserve. Key factors include interest rate decisions, unemployment reports, inflation data, and geopolitical events. For example, interest rate cuts in 2021 led to significant growth in the crypto market, while the Fed’s tightening policy in 2022 contributed to its decline.

Long-term Trends Often Prevail Over Short-term News

Despite strong reactions to individual news items, long-term trends often prove stronger. For instance, despite the initial shock from the start of the COVID-19 pandemic, the cryptocurrency market not only recovered but reached new heights over the following year.

Regulatory Decisions Have a Significant Impact

Actions by regulators, especially in major economies, can have a substantial influence on the market. China’s cryptocurrency ban is a prime example of this. This highlights the importance of monitoring regulatory trends in key jurisdictions.

Internal Problems in Projects Can Have Systemic Consequences

The collapse of Terra/LUNA and the bankruptcy of FTX showed that problems in individual projects can cause a domino effect and impact the entire market. This underscores the importance of diversification and thorough analysis of the projects you invest in.

When to Buy and When to Sell

We’ve examined numerous events and their impact on the crypto market. Now, let’s try to systematize this information by highlighting key signals that can hint at when it might be time to consider buying cryptocurrencies, and when it might be better to prepare for selling.

| Red Flags | Green Flags |

| Fed raising interest rates | Fed lowering interest rates |

| Tightening cryptocurrency regulations | Adoption of favorable cryptocurrency laws |

| Major exchange hacks | Cryptocurrency adoption by large companies |

| Bankruptcy of major market players | Launch of cryptocurrency ETFs |

| Negative statements from influential figures | Positive statements from influential figures |

| High inflation in major economies | Economic stability |

| Geopolitical tensions | Technological breakthroughs in the blockchain industry |

| Mass sell-offs in stock markets | Growth of institutional investments in cryptocurrencies |

| Stablecoin issues | Successful updates of major blockchain protocols |

| Mining bans in large countries | Development of environmentally friendly mining |

Now that we know how to interpret news and events, the question arises: how can we buy and sell cryptocurrencies at the most favorable rates? This is where Monetory comes in – we’re always here to help you find the best conditions for your trades. Remember, in the world of cryptocurrencies, you shouldn’t fear events – you should look for opportunities in them. Every piece of news, whether positive or negative, can open doors for potential profit if you’re armed with knowledge and the right tools.