All stories and screenshots are taken from open sources or directly from the authors. Some names have been changed.

Tourists and expats, especially from Russia, have increasingly started using P2P exchanges. It is one of the most convenient and cost-effective ways to transfer money to another country. Sometimes, it’s the only option, especially for those who receive their salary in crypto. Unfortunately, such exchanges may encounter some issues and problems.

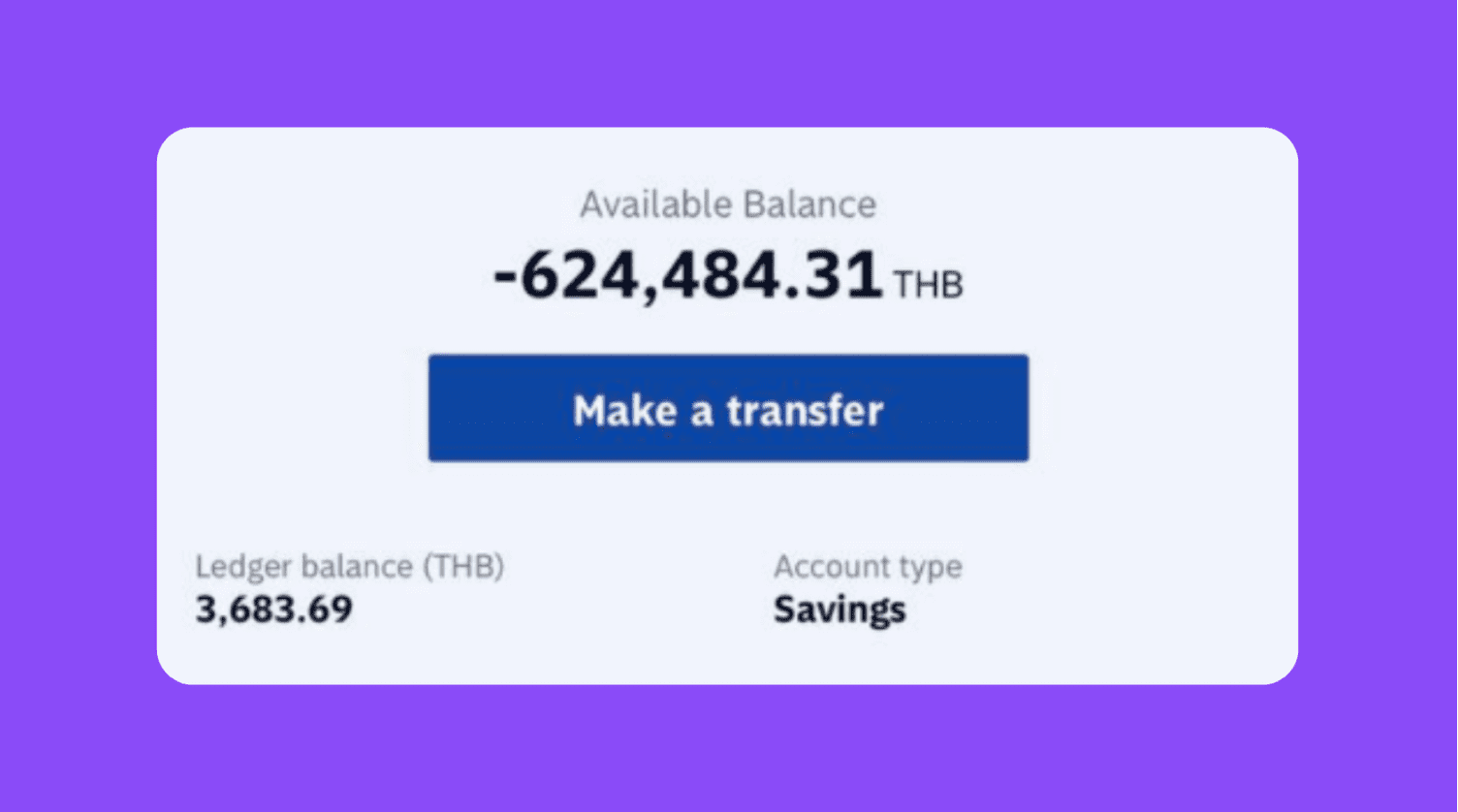

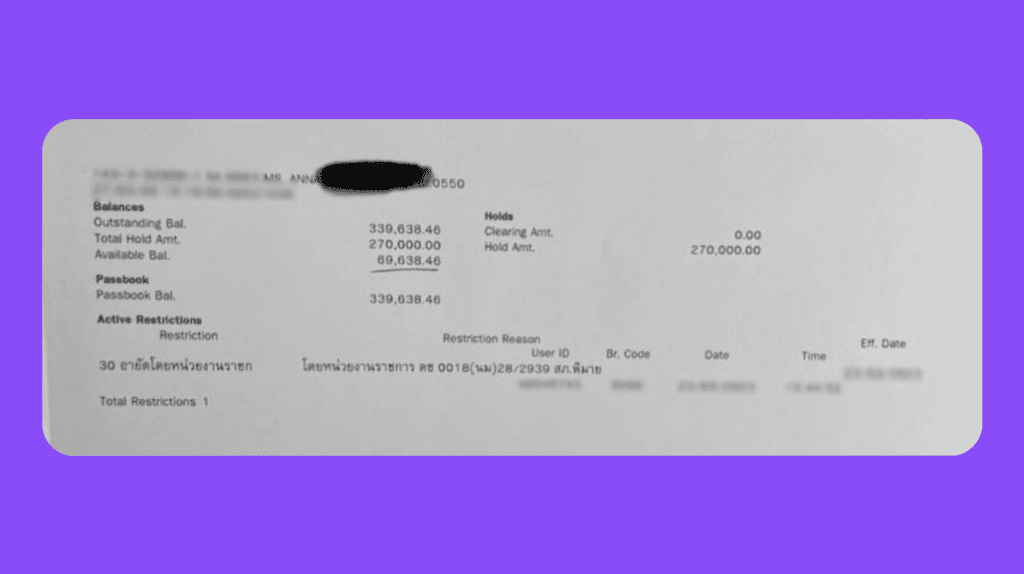

Let’s take a look at the example of Vasiliy, who lives in Thailand. He receives his salary in USDT and, as usual, exchanges stablecoins for THB at the beginning of each month. He uses his favorite P2P platform and makes exchanges with local traders. But, after some time, he discovers that his balance is in the negative:

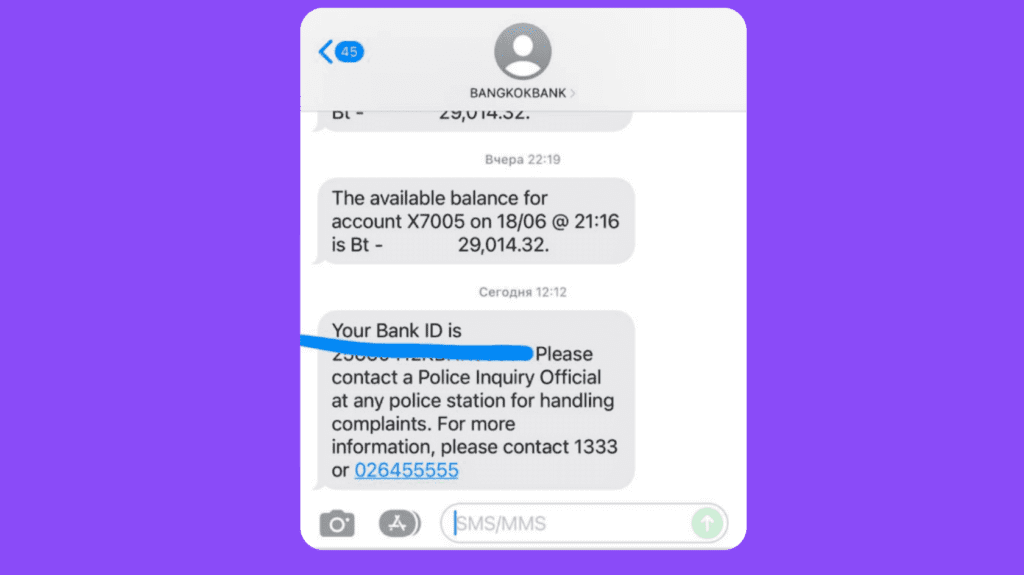

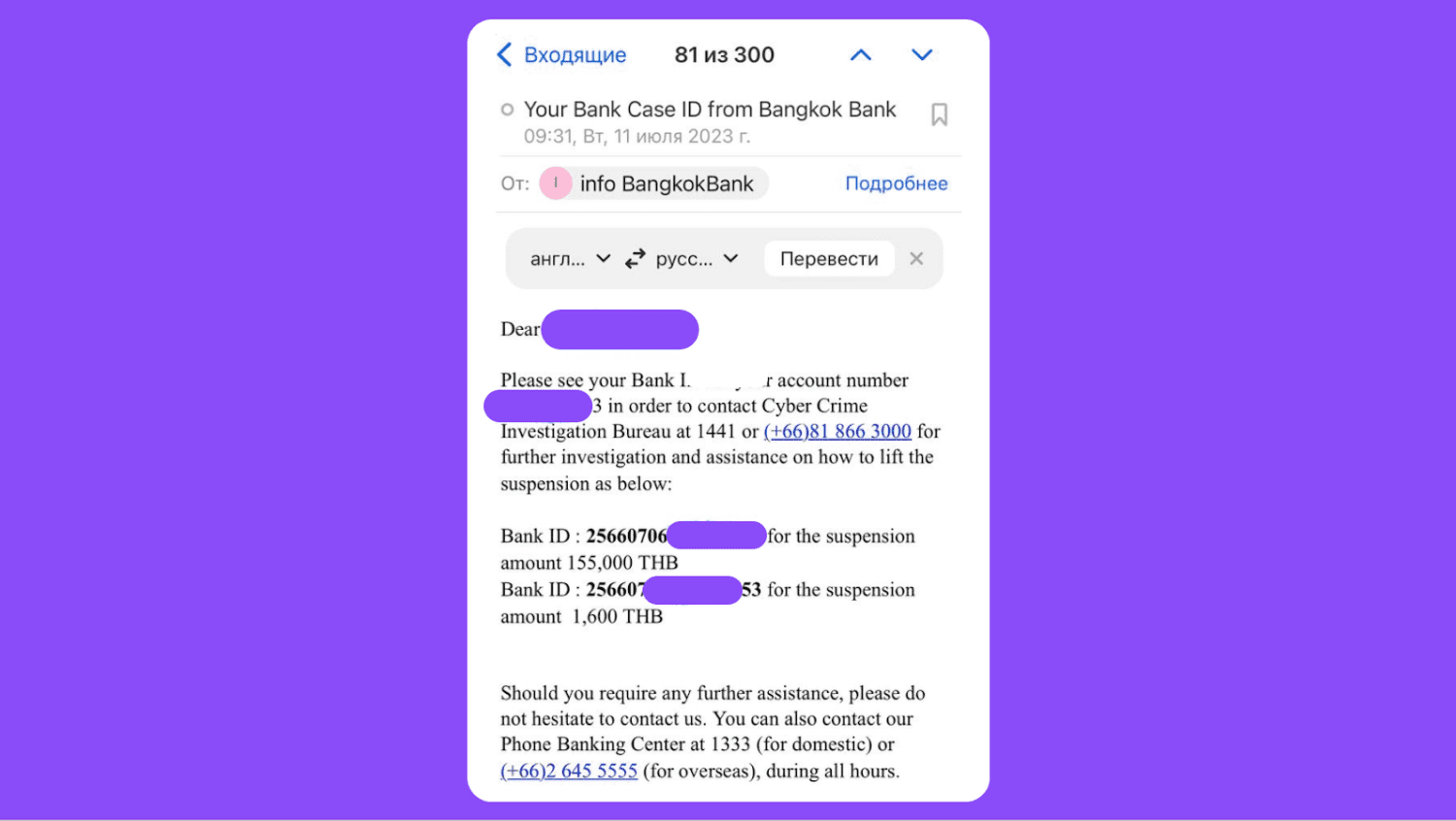

However, Vasiliy’s situation is not unique. Some people were even less fortunate, and after following the same steps for transferring via P2P, they ended up with a blocked account and received the following message from the bank:

What happened? And why did a harmless exchange result in such unpleasant consequences? It’s all due to a fraudulent scheme that is becoming more popular.

This fraudulent scheme can be implemented in any country, and its success depends on the local banking system, laws, and enforcement practices. However, in Thailand, it has gained traction and evolved from isolated incidents into a whole industry. We will share real-life cases of people who encountered such blocks. And, of course, we will provide detailed instructions on what to do in such situations.

What are the Possible Crypto Fraud Schemes

There are many schemes in the P2P industry. We will look at three main examples. The first two are widespread, while we will delve into the last one in more detail, as it specifically targets expats and tourists and served as the starting point for writing this article.

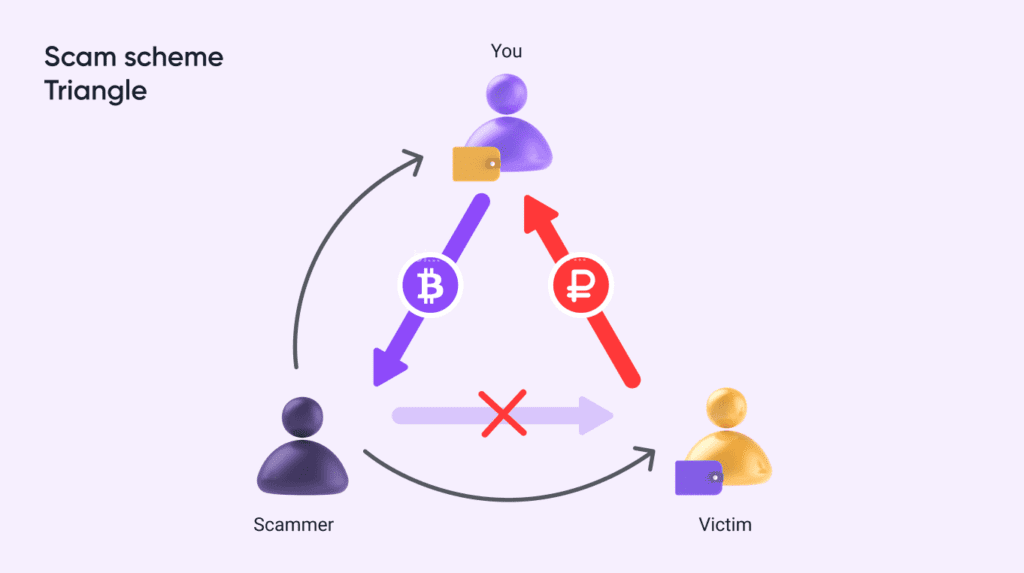

Scheme 1: “Triangle”

There are three parties involved: the P2P trader, the scammer, and the victim. The scammer offers the victim a non-existent product or service. At the same time, the scammer opens a P2P exchange deal with a P2P trader and sends the victim his information for payment. P2P trader receives the money, releasing the cryptocurrency to the scammer. Result: the scammer gets away with clean cryptocurrency, the victim is left with nothing, and the P2P trader ends up with money involved in illegal activities.

How to avoid: try not to make trades with third parties. Verify that the full name on the exchange and the bank account matches. If it’s not possible, request evidence, such as a photo of the bank card with the offer screen in the background.

Scheme 2: Using a Drop Account

A “drop” is a fake person used as a “link” to carry out certain activities, and besides, not always illegal.

Victims transfer money to these accounts, while scammers conduct transactions with P2P traders using freshly created drop accounts to make it appear as if there are no third parties involved in the scheme. If the account gets blocked, the scammer creates a new one and continues the same scheme.

As a result, the bank may block the account and transactions that interacted with illegal funds.

How to recognize a drop account:

- Fresh accounts — registered just a few days ago;

- Suspiciously fast transactions — an order is opened, and within seconds, money appears in the P2P trader’s account with a sent e-slip (transfer receipt in Thailand).;

- A mismatch between the number of counterparties and transactions — few counterparties with a big amount of transactions.;

- Amounts are rounded in fiat (THB) rather than in cryptocurrencies.

How to avoid deception: Set claims for counterparties. The available exchange offers may decrease, but you will reduce the risks.

Scheme 3: False Report to the Bank or Police

The P2P trader completed the exchange and confirmed that the funds were NOT from a third party. But the counterpart approached the bank or police and narrated a story, claiming that the funds were allegedly transferred to scammers. The calculation here is that the P2P trader has already left the country and cannot resolve the issue promptly.

In Thailand, this has evolved into a kind of business. Some have formed entire teams for such deception, involving corrupt representatives of authorities. Let’s check how it happens based on cases shared by real people.

Case 1: Boris, an Expat in Bangkok

Boris, an IT specialist, moved to Thailand a year ago. However, he still receives his salary in RUB on his Tinkoff card. Like many expats, he uses cryptocurrencies as a “buffer.” He buys USDT with RUB and then exchanges them for THB with his Bangkok Bank card.

Until some time, everything went well. Boris converted his salary to THB once a month without any worries. But one morning, he noticed a negative balance in his Thai bank account. Judging by the amount, one of the old transactions during a P2P exchange was blocked. He immediately called the bank, explaining that he was not engaged in anything illegal, just exchanging cryptocurrency for fiat. His complaint was accepted, and he was told to wait for 3-5 days. After 3 days, the block was lifted without any additional documents. Boris was fortunate; he didn’t have to go anywhere, even though he was in Thailand.

But not everyone is so lucky.

Case 2: The Great Thai Combinator

Remember when we mentioned that someone turned this scheme into a business? Well, one resident of Thailand made 19 exchanges with 11 counterparties. After 2 months, he reported to the police on all 19 orders, claiming that he did not make any transfers and that scammers stole his money. According to the police, the total damage amounted to 1.5 million THB.

We know the stories of three people involved in this case.

- Mikhail makes money on P2P-arbitrage. Thus, he is aware of all the risks and always sets restrictions for counterparties to protect himself. Despite this, his account at Kasikornbank got blocked in April. From that moment on, he called the bank daily for 25 days to resolve the situation. After endless promises of callbacks, the bank finally provided Mikhail with the officer’s name and the police department to contact.

- At the same time, Mikhail’s colleague, Alexey, had his account blocked, and it happened with two banks simultaneously.

- Dmitry was also involved in the case with 19 exchanges with the same resident of Thailand, just like Alexey and Mikhail. It was Dmitry who called the police to find out what should be done. The only response he received was, “Come to Koh Chang Island.” That is where the statements were filed.

Our heroes eventually made their way to Koh Chang Island. In advance, they prepared bank statements and transaction screenshots from Binance. However, the officer remained unconvinced. He sided with the Thai resident, branding our heroes as an “organized criminal group” and refused to accept any evidence. There are reasons to believe that the officer was hinting at a bribe. None of the participants in the story agreed to pay anything, which led to conflicts with the police.

To this day, all three heroes are still unable to resolve the issue. The official position is that the account block will not be lifted until all accounts involved in the case are thoroughly investigated.

Case 3: Anna vs. the Thai Banking System

Anna believes that the core issue is the Thai banking system. The problem is that anyone can call their bank, complain about their counterparty, and request the account to be blocked. No evidence is required — they take one’s word for it.

By law, an account is blocked for 72 hours. During this time, the account holder cannot perform transactions, although transfers can be made to the account, the funds will be inaccessible. After this period, the block should be lifted, but in practice, either the money or the account itself may remain inaccessible for several months. Anna recounts that even transactions for random amounts, such as 100 THB, were blocked, although she claims she had no exchanges for that amount.

Anna, like all our narrators, had a complaint filed against her to the police, accusing her of deception.

She sold USDT to a Thai resident. The order was for 50,000 THB, but the counterparty transferred 10 times more. Anna made a refund of 450,000 THB. After 3 months, her account was blocked. When she called the police, the officer demanded that she “return the 450,000 THB,” without providing any details.

They refused to resolve the issue remotely. Anna came to the police station in person — and once again faced demands to return the amount. The situation escalated to the point where the officer started demanding returns in installments. Our heroine did not give in to the persuasions and eventually left the police station with this document:

This document translation:

Urgent letter

BangKhunTian Police Station

Bangkhuntien, Jomthong

Bangkok 10150

30 June 2023

Title: Withdrawal notification of Ms. Anna’s bank account

Dear Kasikorn bank manager (Head office branch)

Refer to case ID ตช. 0015 on 10 June 2023

The BangKhunTian Police Station sent the letter to Kasikorn Bank for checking and blocking a total of 21 cases. Now we have already finished the investigation and found that this bank account is not concerned with any criminal in the system.

So please withdraw the notification of this bank account. If have any questions, please feel free to contact Mr. Potsawat ChanDung

Case 4: Thai Anti-Fraud System

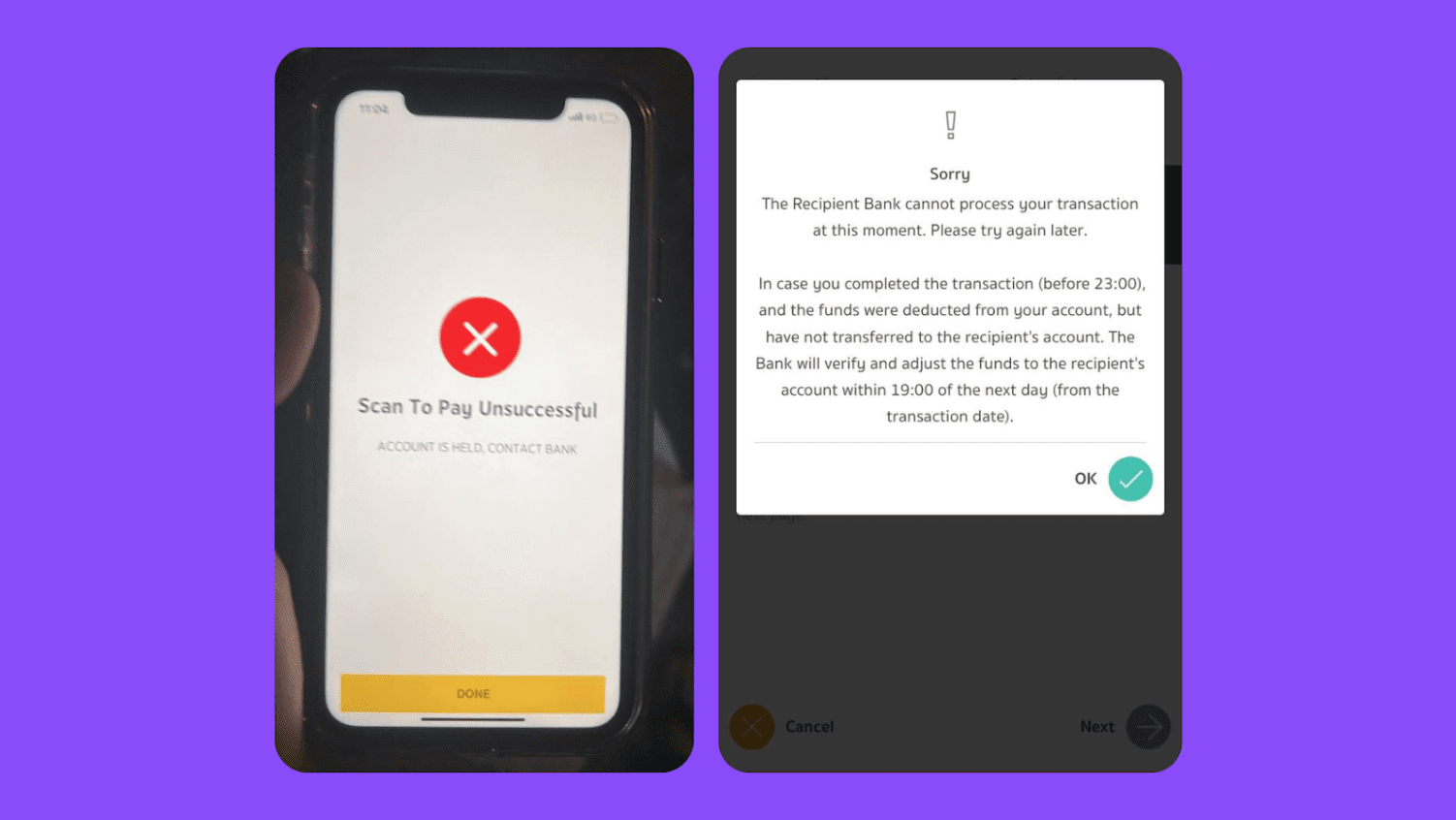

Yulia and Vladimir were actively trading on the P2P market. Their accounts were blocked at Krungsri (Bank of Ayudhya) and Kasikornbank. When attempting to transfer money or make QR payments, the message “account is held, contact bank” appeared.

Case 5: Thai Bureaucracy

Ivan’s funds were debited from his card, and the balance went negative. For two weeks, he was in continuous communication with the police and the bank. He visited two different police stations and the Bangkok Bank branch repeatedly. In an attempt to resolve the issue, he even provided his phone to the police, so they could directly contact the bank support. He also repeatedly explained his situation at the Bangkok Bank branch and filled out the provided form.

Ivan contacted the bank’s customer support and clarified that the police and the bank had communicated with each other several times regarding his case. He made multiple calls to both parties. A representative from the bank even contacted the cyber police, apparently realizing the complexity of the situation. She informed Ivan that they had held a meeting and promised to get back to him later.

After countless calls and visits to the police, cyber police, and the bank, Ivan received a request to check his balance. When Ivan logged into his banking application, he realized that all his troubles were finally over — the transactions were unlocked, and the funds were returned to his account.

Case 6: Binance vs. a tricky Thai resident

In this case, our narrator resolved the issue differently. Alexander exchanged his USDT for THB with a local trader. He made sure that the payment was not coming from a third party and confirmed the transaction. However, just after 3 minutes, his funds were frozen on his bank card.

He immediately contacted Binance customer support, explaining the entire situation. The platform was accommodating and froze the USDT of the counterparty, but they required evidence from the bank. The bank explained that a Thai resident had called immediately after the transfer and asked to cancel the transaction as he did not make it. They were now waiting for confirmation from the police, and Alexander was asked to come back in a week.

But, just after a day, Binance’s customer support contacted Alexander again. They informed him that this person had been involved in similar schemes on multiple occasions and received numerous complaints. As a result, the USDT was returned to Alexander’s account. Unfortunately, the received THB is still currently frozen.

Resolving the issue through a P2P exchange is an excellent option if, like Alexander, a P2P trader receives an immediate block after completing the transaction.

How to Prevent Blocks

There is no 100% way to protect from such blocks. However, by following our general advice, P2P-trader can significantly reduce the chances of losing or freezing the funds.

Blocks can come not only to P2P traders but also to all subsequent counterparts “in a chain.” A P2P trader (or the person he is trading with) may be in the middle of this chain. So try to find countrymates on the exchange and trade with the same people. Ideally, have contacts with 2-3 people who will help with exchanges at any time.

Ideal candidates must be like:

| The total amount of trades | > 1000 |

| Successful deals | > 98% |

| Transaction confirmation time | up to 5 minutes |

| Account age | from 6 month |

Also, check that the name on the exchange and the bank account matches. Additional quality measures will be the verification level and positive reviews.

If a P2P trader’s goal is not to earn from P2P exchanges, we recommend trade only as a taker (responding to other people’s ads) — this significantly reduces the risk of dealing with dishonest counterparts.

Another way to avoid scammers is to use any P2P alternatives. The exchange rate may be much worse, but the risks are significantly lower. You can use the following options:

- Local exchanges and withdrawals through the spot. For example, in Thailand, it’s Bitkub or Bitazza. The exchange rate will be approximately the same here. But the verification process for them is very complicated — they might even conduct interviews with you.

- Money transfer services. Wise, Revolut, etc.

- SWIFT transfers

- Offline and online crypto Exchangers (better rates).

Do not exceed transfer limits. If your card is blocked, do not use it until the issue is resolved. Warn buyers that if they file statements or complaints against you, you will personally contact the police.

How to Avoid Funds Blocks

There are two types of blocks: cyber police and regular police. Cyber police impose blocks in case of any suspicious card operations (many counterparts, similar transfers, large turnover of funds, etc.). The regular police block accounts if a statement has been filed against you. In the first scenario, blocks occur frequently but are easily lifted. Blocks of the second type rarely occur, but dealing with them is much more difficult.

In the case of the block by the regular police:

- Step 1: Call the bank. If it’s not a bank error or anti-fraud system issue, they should provide you with the case number, the police department, and the name of the investigator handling the case connected to your bank account.

- Step 2: Obtain a document from the bank regarding the blocks:

- Step 3: Immediately contact the specified police department and the officer, and using an interpreter, find out the exact reasons for the account or transaction block.

- Step 4: Visit the police department (which may be located far from your residence) and provide all available evidence of the legality of P2P transfers. You must have all exchange screenshots and e-slips saved.

- Step 5: Be persistent and don’t offer bribes. There have been cases when after lengthy negotiations with unscrupulous police officers, people were still granted documents for unlocking.

In case of blocks by the cyber police::

- Call the bank.

- Get the case number from the cyber police.

- Call the cyber police.

The account will be unlocked within 24 hours. If they didn’t provide the case number and suggested waiting for 3-10 days, the block will be automatically lifted within this period.

Follow these steps, and, in 99% of cases, the issue will be resolved.

Life Hacks to Simplify and Expedite the Problem-solving Process:

- It’s important to visit the police department with an official interpreter from the consulate; this increases the chances of being promptly received and heard. Sometimes the outcome of negotiations with the police solely depends on the charisma of the interpreter.

- Contact tourist police instead of regular police. The main task of this police department is to help foreigners, and they are always on the right side.

- Ask the counterparts to send e-slips.

Friends, share your experiences and thoughts on this matter with us in the @monetory_support_bot. We will read them for sure. In the future, we might create a similar story about other countries. Thank you for reading the article; share it with your fellow expats. We hope it will help you and your friends avoid unpleasant situations during P2P fund exchanges! And remember, you can always check the best exchange rate on our website!