We are continuing to review crypto platforms. Today we are going to check out OKX. This project has established itself as one of the most liquid and popular cryptocurrency exchanges. Billions of dollars in trades across hundreds of trading pairs, including «blue chips» like Bitcoin and Ethereum, as well as altcoins, take place here. If you do not have an account yet, keep reading our review!

We discover the crypto trading instruments available on OKX, the account registration, and the verification procedure. We will also look at peer-to-peer trading.

OKX: A Brief History of the Project

This cryptocurrency exchange was founded in 2017 and registered in the Seychelles. It is a subsidiary of the OK Group, headquartered in Hong Kong. The exchange actively collaborates with well-known brands: the Manchester City football club, the McLaren Formula 1 team, famous golfer Ian Poulter, and other athletes.

The OKX platform is available everywhere except the USA, Belgium, Cuba, France, Iran, Japan, North Korea, Crimea, Malaysia, Syria, the Bahamas, Canada, the Netherlands, Ireland, Bangladesh, Bolivia, Donetsk, Lugansk, and Malta.

After rebranding from OKEx to OKX, the exchange is actively implementing advanced decentralized (DeFi) solutions and Web 3.0 products. Today it is not just an exchange, but an ecosystem with various tools and services.

Registering and Verifying on OKX

To use the exchange, you need to go through a simple registration process with your email address or phone number. However, this will not give you access to deposit or withdraw cryptocurrency, which completely precludes working with the exchange. To start using the platform, you need to pass a verification process. It will require an ID document and a selfie.

Security

OKX is one of the most secure exchanges on the market. For example, CoinGecko gives the platform the highest score on this metric — 10/10. You can also increase the security of your account and funds using:

- Biometrics on your devices

- Two-factor authentication

- Anti-phishing code

- White-list for devices

- Trading limits (like setting a maximum leverage)

If you need to freeze or even delete your account, OKX also supports.

Tools and Sections on OKX

There is probably everything here that you could imagine in the field of digital assets and blockchain. This variety is almost dizzying! But now we will go through all the main OKX options in detail.

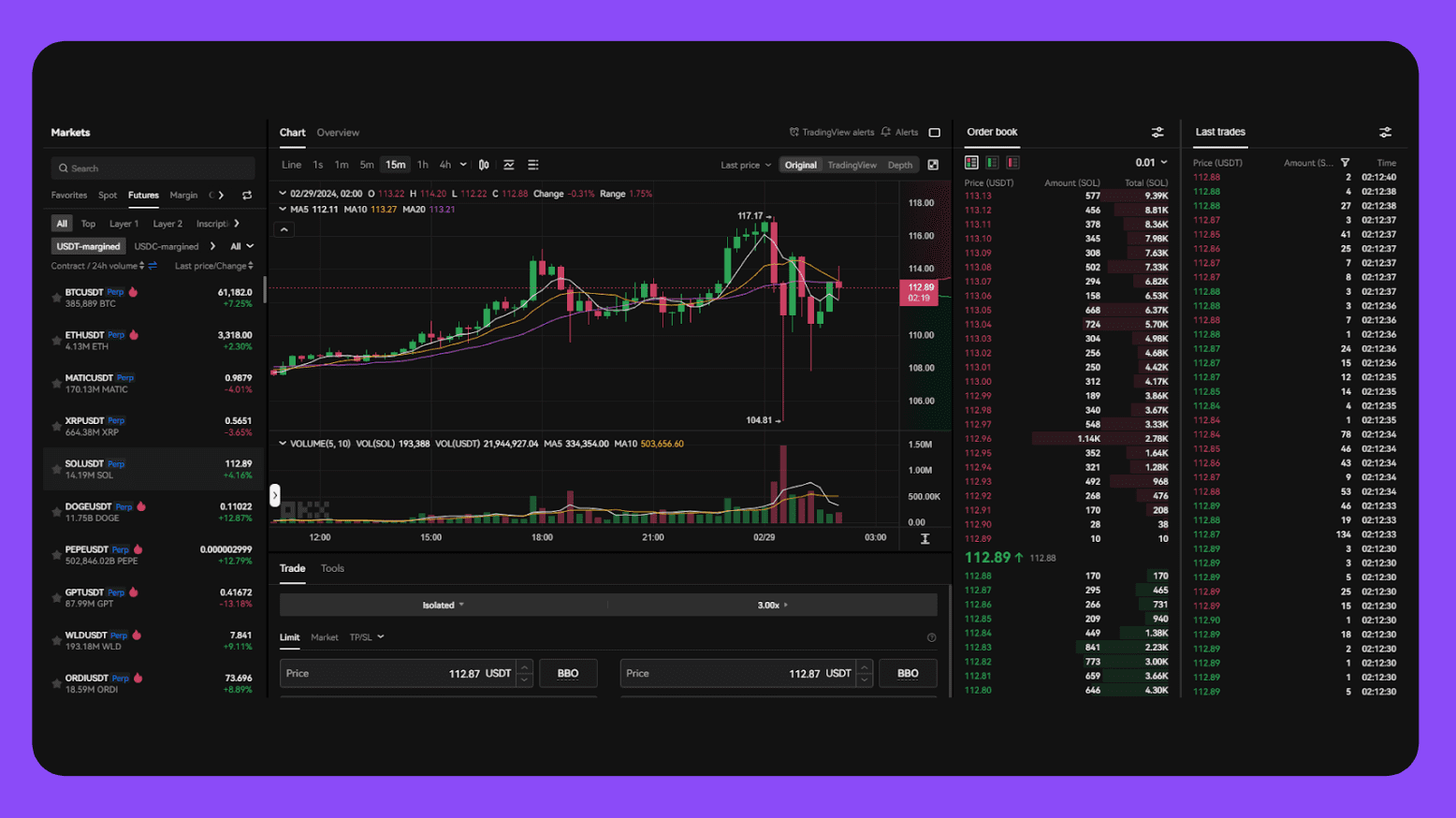

Cryptocurrency Trading

The interface is user-friendly and quite similar to spot exchanges on other platforms. As of March 2024, 316 coins are available. You can sort them by categories: memes, DeFi, GameFi, POW, and others. In addition to limit and market orders, there are tools for professional traders like bots, take profit, stop loss, OCO, trailing stop, and iceberg orders. There is copy trading and margin trading with up to 10x leverage. For beginners, there is a simplified quick swap form to exchange one coin for another.

Spot trading fees: Maker — 0.08%, Taker — 0.1%

There are internal market analytics infographics for different cryptocurrencies:

There are lots of futures and options in the OKX crypto derivatives market.

Futures fees on OKX: Maker — 0.02%, Taker — 0.05%

For futures, maximum leverage depends on the trading pair. For example, BTCUSDT has 125x, and SOLUSDT has 50x leverage. Both isolated and cross-margin modes are available. Options trading has simple and professional modes.

Options fees on OKX: Maker — 0.02%, Taker — 0.03%

Earn, Loan and Jumpstart

Earn allows earning crypto simply by holding it in a staking pool. The returns are high, better than many competitors. For example, USDT has an APR of 2.75-10.99%, depending on flexible or fixed terms. Getting almost 11% yields on the most stable currency in the world is decent, right?

Loan allows borrowing one crypto by collateralizing another without having to sell. It can be useful when you urgently need cash but do not want to sell an asset like BTC since its price may significantly rise later.

Jumpstart is a launchpad where you can invest in early-stage projects. You can also apply to raise funds for your project to gain investor attention worldwide. All operations use the OKX exchange token OKB. Holding this token allows you to save up to 40% on fees.

Solutions for Corporations

OKX will be useful for companies. The exchange offers conditions for institutional investors, including increased liquidity. There are API tools, VIP loans, and a market database for analytics.

DeFi and Web 3.0

OKX’s largest decentralized product is its non-custodial wallet. It supports over 70 networks, NFTs, and earning tools: staking, farming, liquidity pools, etc. It is available on 4 OS: iOS, Android, macOS, and Windows, as well as a Google Chrome extension. In addition to the wallet, other services are also available:

- NFT Marketplace — supports 17 networks, including the most popular ones like Ethereum and Solana

- OKX Build — a set of tools for developing Web 3.0 solutions

- OKLink — a blockchain explorer. It allows viewing up to 40 blockchains in one place, which distinguishes it from network-specific explorers like Etherscan.

Learn

The «Learn» section helps you to understand crypto. Here, you can find answers to frequently asked questions, trading guides, and articles on popular topics. The guides are divided into «Beginner» — for those just taking their first steps, and «Intermediate» for those already familiar with crypto technologies and want to learn more about working with digital assets.

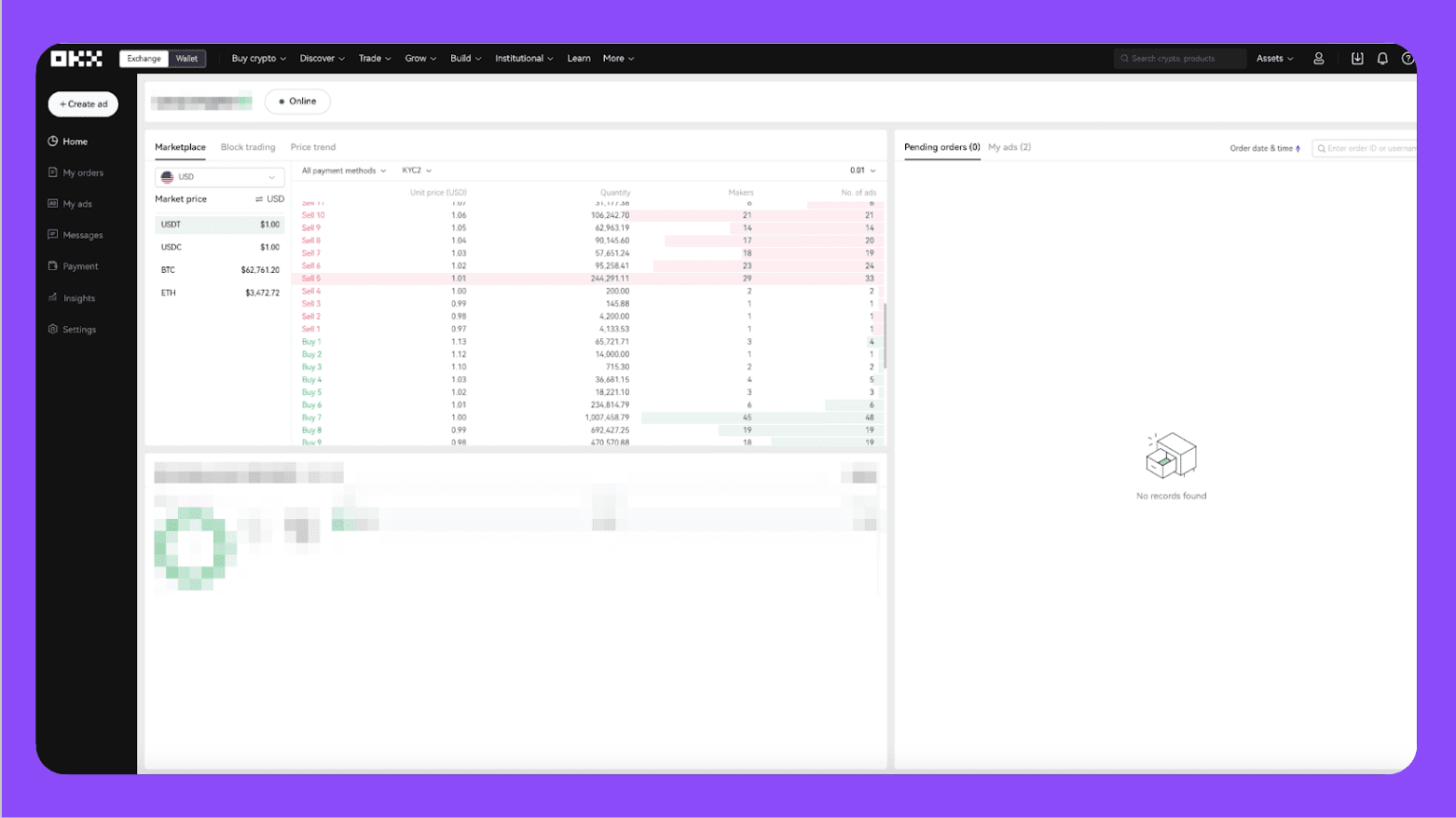

P2P section of OKX

Now let us talk about one of the main advantages of the platform P2P trading with high liquidity and zero fees.

There is an express buy option where you fill out the currency and cryptocurrency fields, and the system automatically selects an offer. However, we recommend using the full P2P trading interface.

Everything here is familiar and straightforward. We fill in the required fields and get a list of all offers matching our request. Maker trading also differs little from other platforms.

There are a few things to note about using the P2P platform:

If getting the best exchange rate is not critical, you can sort listings by seller reliability based on the number and success of transactions. However, if you want the best rates, use the «Verified Merchants only» filter and choose sellers with the highest number of deals.

When posting your ad, you can make it «Public» or «Private.» Public ads show up in the order book for all to see. Private ones require you to share a link for buyers to see and respond to your offer. It can be useful if you want to trade with someone but need an intermediary to ensure safety.

There are also two merchant account levels — «Super» and «Diamond» to increase order limits and get priority. Your orders stand out and get matched first at the same price. By default you can post two listings per currency, increased to 5 with a Diamond account. Useful for high-volume traders or arbitrage. Merchant accounts also get priority support and dispute processing. Eligibility requires meeting certain criteria.

Some other merchant tools:

- KYC Filter. You can sort listings by verification requirements. For example, only show offers that can be responded to by users with Level 2 KYC. This is useful because it allows you to evaluate who you are competing with on rates, and who you are not.

- Order Book. Allows displaying P2P order books like spot order books. Useful for professional traders doing market analysis.

- Quick Access. A more convenient interface for all your orders, listings and payment methods. You can conduct analytics on how much crypto you bought and sold over a certain time period.

However, such accounts also have a downside. For example, in Thailand, many counterparties may not want to trade with you if you are a merchant. It is because they don’t want to interact with high-volume accounts. This is due to the higher risk of receiving «dirty money.» So, for casual traders, we recommend not getting merchant status.

The platform only supports four cryptocurrencies: USDT, USDC, BTC, and ETH. Popular fiat currencies are CNY, GBP, THB, and USD. There is a review system that helps filter out potentially dishonest counterparties.

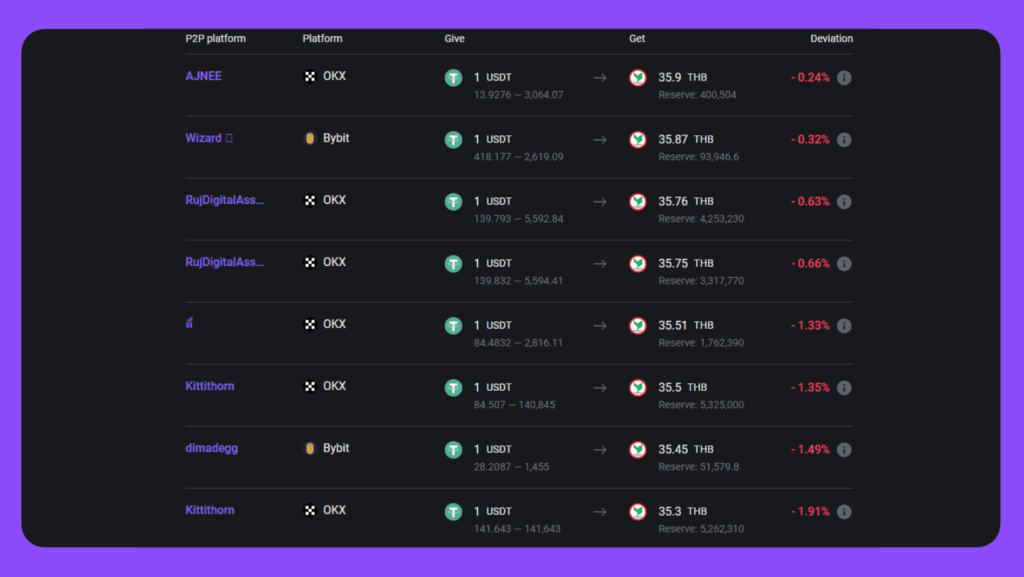

The P2P section on OKX is simple and convenient. It has all the most necessary features and tools. In terms of liquidity, the platform easily competes with the largest P2P exchanges — finding an offer with the desired volume, currency, and payment method will be no problem at all.

Verdict on OKX

| OKX | |

| Pros | Cons |

| Full-stack ecosystem | Not available in the USA |

| High security level | Not Beginner-Friendly |

| Mobile applications | |

| Fast registration | |

| Zero fees on P2P | |

| There are training materials for beginners | |

OKX deserves a spot as a top cryptocurrency exchange. All of its services and tools are convenient and offer competitive conditions, as evidenced by the 11% APR on USDT staking. Trading on P2P is a pleasure — it has all the functions, high liquidity, and zero fees. The platform does not have many downsides, but we will highlight two main ones — OKX is not available to users from the USA, and the exchange may seem too complex for beginners.

How to Find Exchange Offers on OKX

The most convenient way to do this is through Monetory. You can find the best deals on OKX and compare them to offers on other platforms. For example, if you want to sell USDT and receive Thai Baht on your Kasikorn Bank card, it is most profitable to do so right on OKX.

Of course, this was accurate at the time this article was written. In your case, the most advantageous offer could already be on another platform. But with Monetory, you can always be sure you are trading with maximum benefit!