P2P cryptocurrency trading in Russia has been and remains one of the most active in the world. The local market is distinguished by two factors: the popularity of mining, where mined coins need to be transferred to fiat, and the use of cryptocurrencies for cross-border transfers in the context of economic sanctions.

Binance, the flagship service in the crypto market, also made a significant contribution. A user-friendly interface, many trading tools, and active marketing attracted many Russian traders to the site.

However, at the beginning of 2024, the exchange stopped operating in the Russian Federation and left this market. How has this affected P2P trading volumes on Binance? Let us find out!

Binance is Still at the forefront of the crypto market

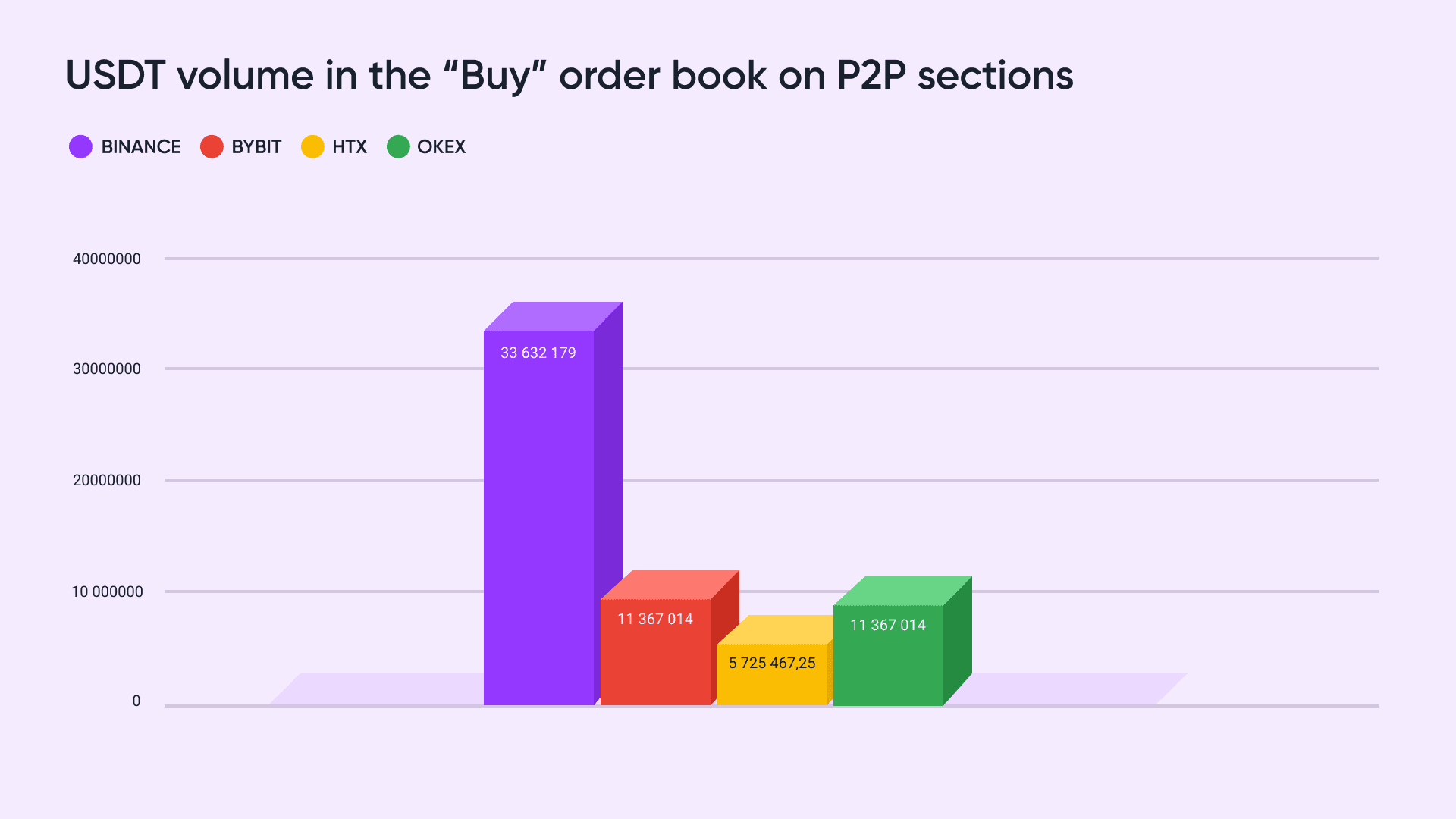

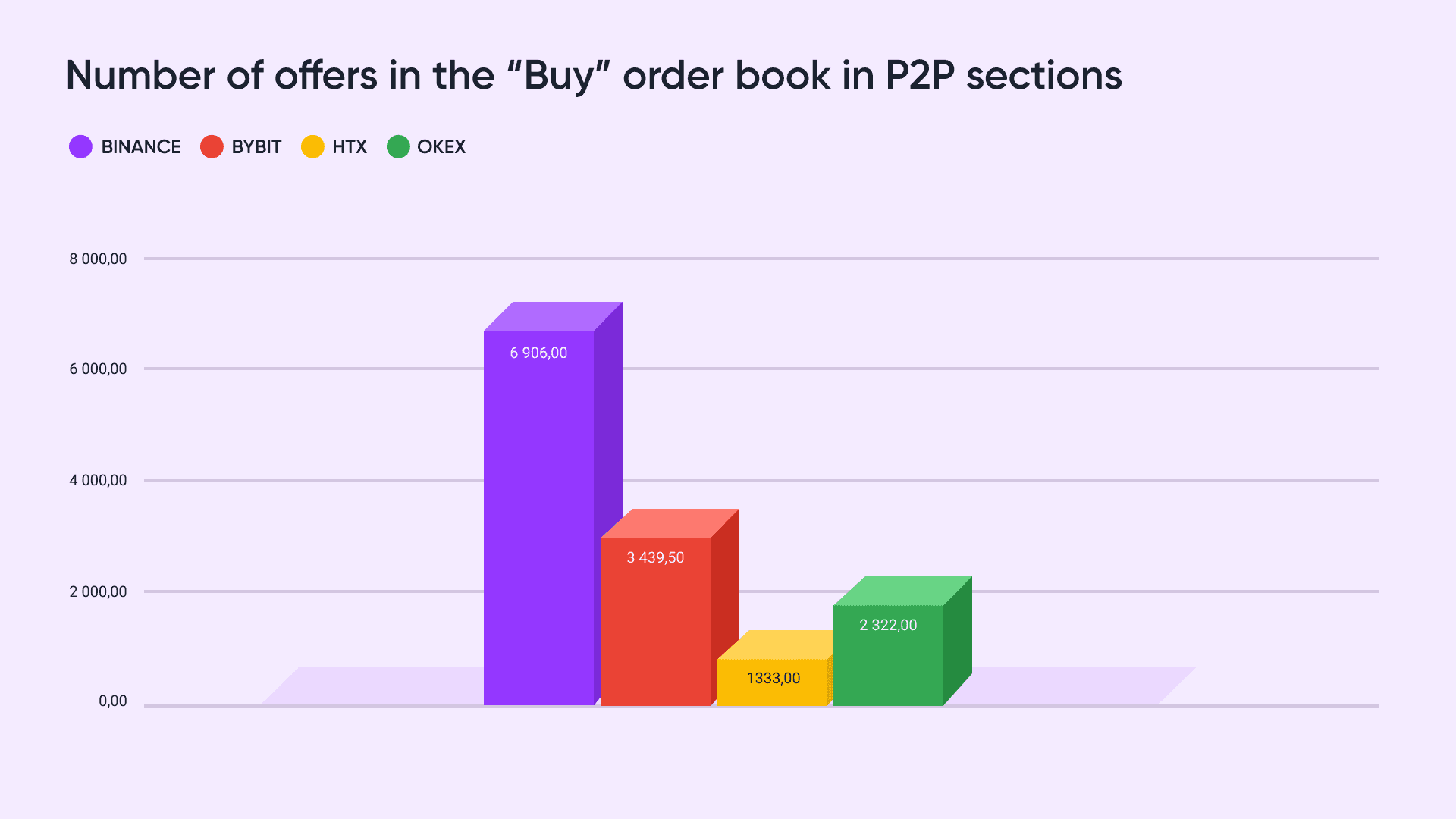

After Binance left the Russian market, the exchange maintained its leadership status. To check this, we analyzed the volume of offers in the buy order book, where you can’t post an offer without having a real deposit on your balance. Unlike offers to buy crypto in the sell order book, which can be placed without restrictions and collateral, there are much fewer offers that distort the trading volume.

As we can see, Binance is the leader by volume of funds:

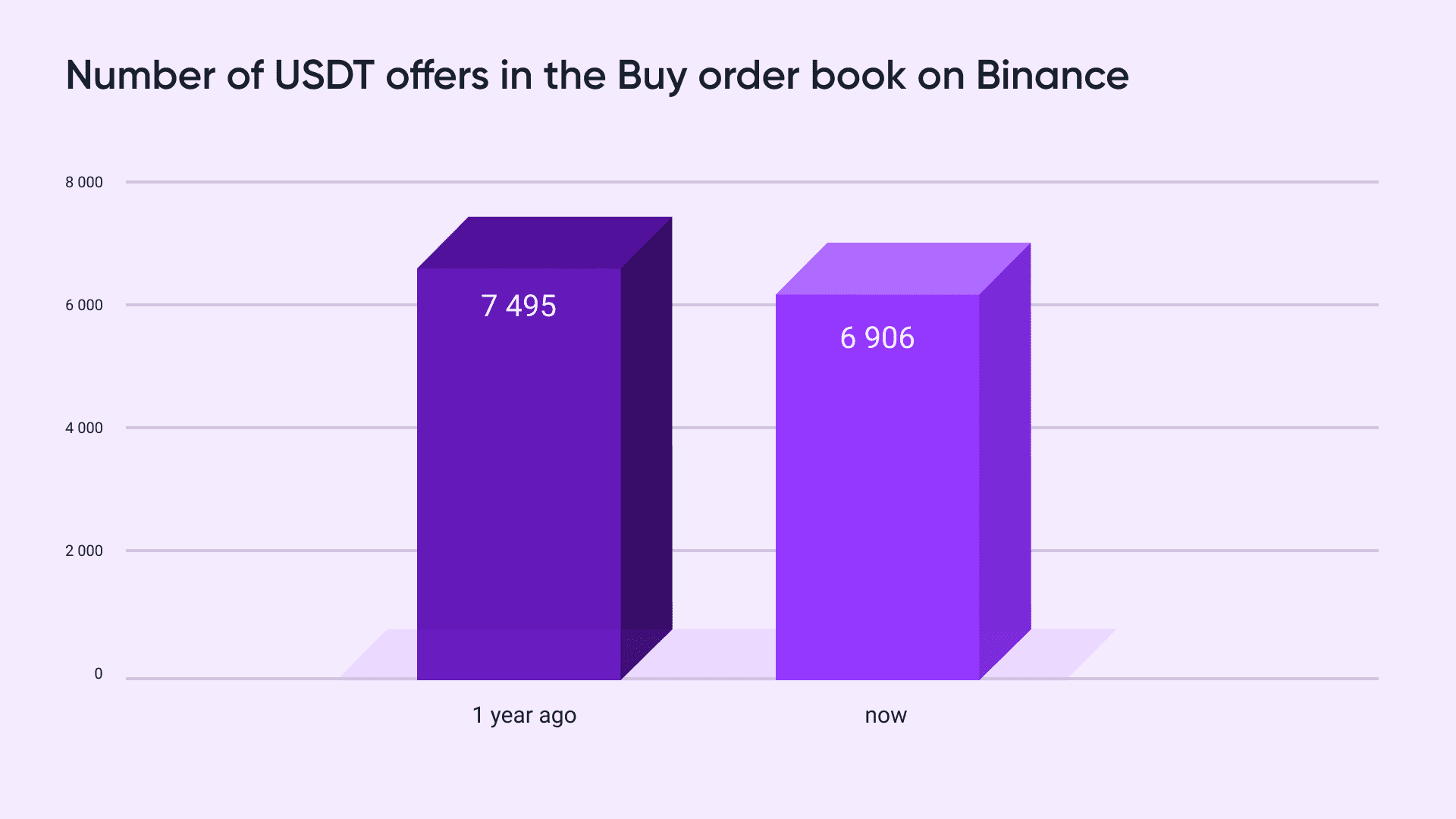

And by the number of posted offers:

The Binance P2P section has some of the most favorable rates for exchanging crypto for fiat, regardless of the region. This exchange provides the highest liquidity among all crypto platforms. And the higher the liquidity, the smaller the spread between purchase and sale prices. That is, the more favorable the conditions for ordinary traders. If you have the opportunity to trade on Binance, you can compare the rates of this exchange with others.

Comparative infographic on Buy order book on Binance

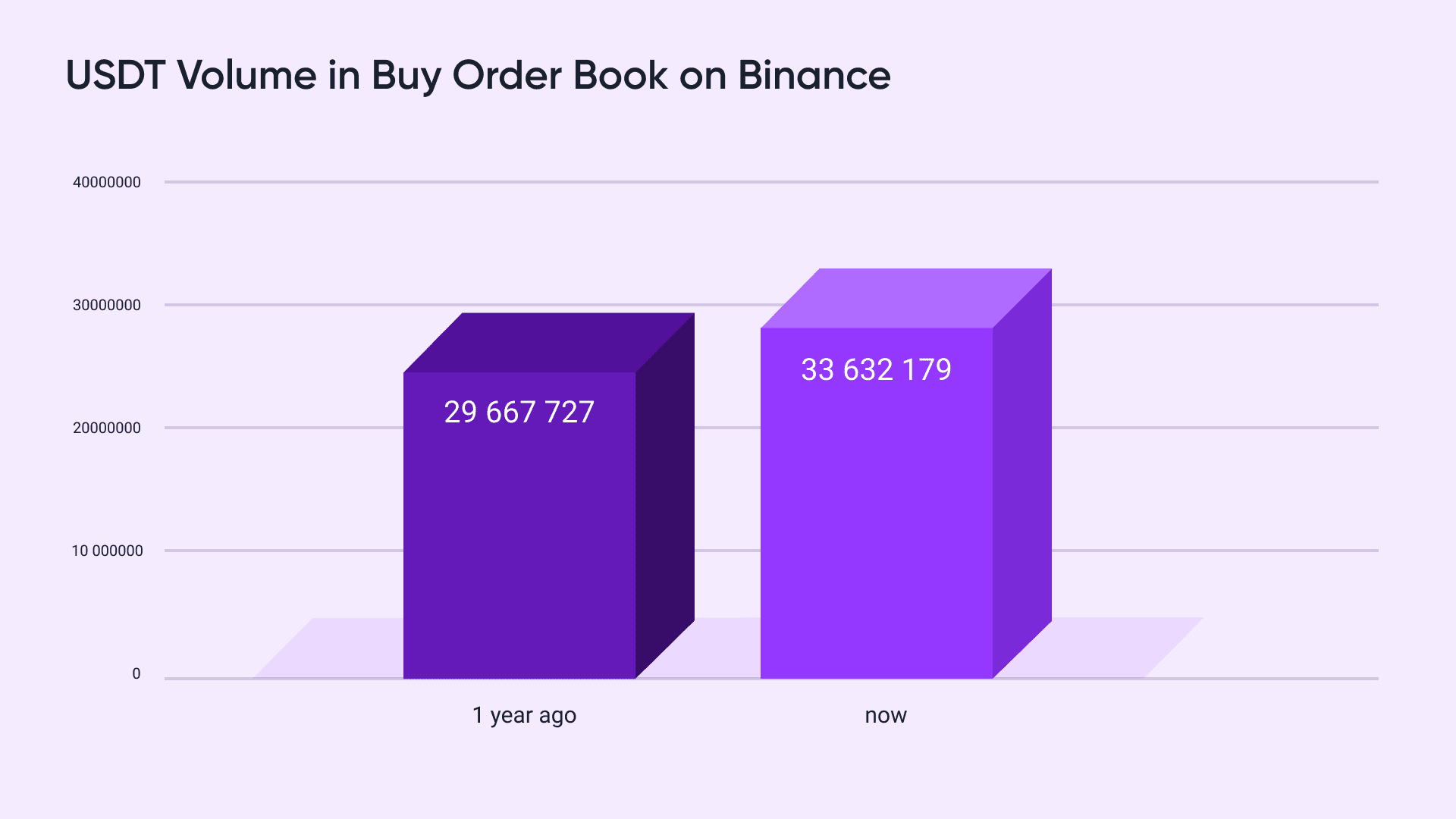

Now let’s see how the picture has changed compared to last year. To do this, we will take current data on Binance and compare it with the trade volume a year ago.

The amount of funds in offers has increased compared to last year. It is also clear that the number of offers has decreased, but not by much.

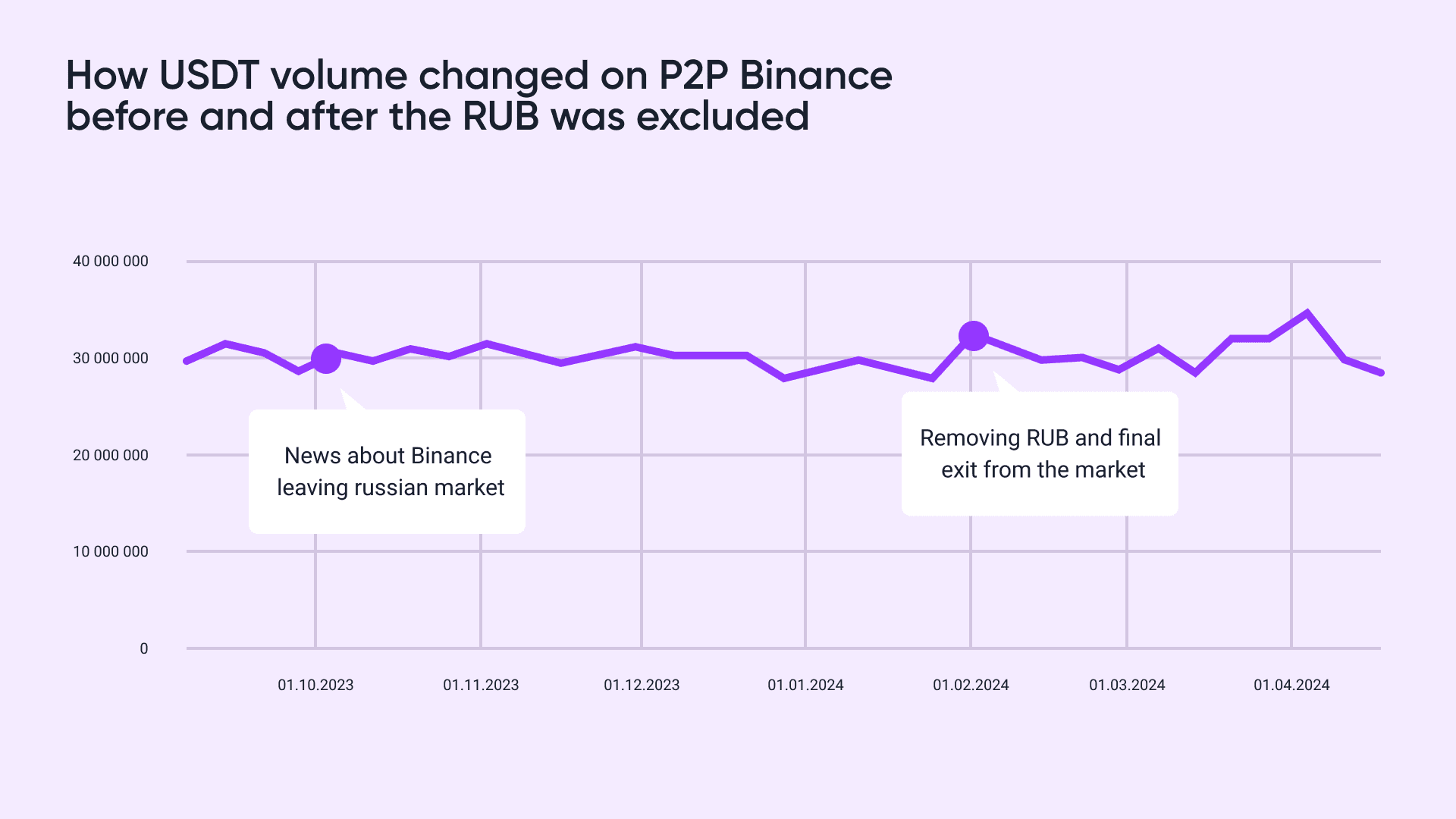

Overall, the situation on Binance has remained virtually unchanged over the past year. And there is a simple answer. At a certain point, a significant share of trading on the Binance P2P section was made up of ruble offers. But before being removed from the site, these offers accounted for only 4.4% of the total trading volume. And this is also a lot, especially considering that 119 fiat currencies are currently available on Binance. But on the scale of the entire market, the departure of the ruble had little effect.

It is confirmed by the graph of changes in the volume of funds on the platform:

Thus, we come to a rather unexpected conclusion: the removal of the ruble did not lead to a significant decrease in trading volume on P2P Binance.

How did Binance’s departure from Russia affect other sites?

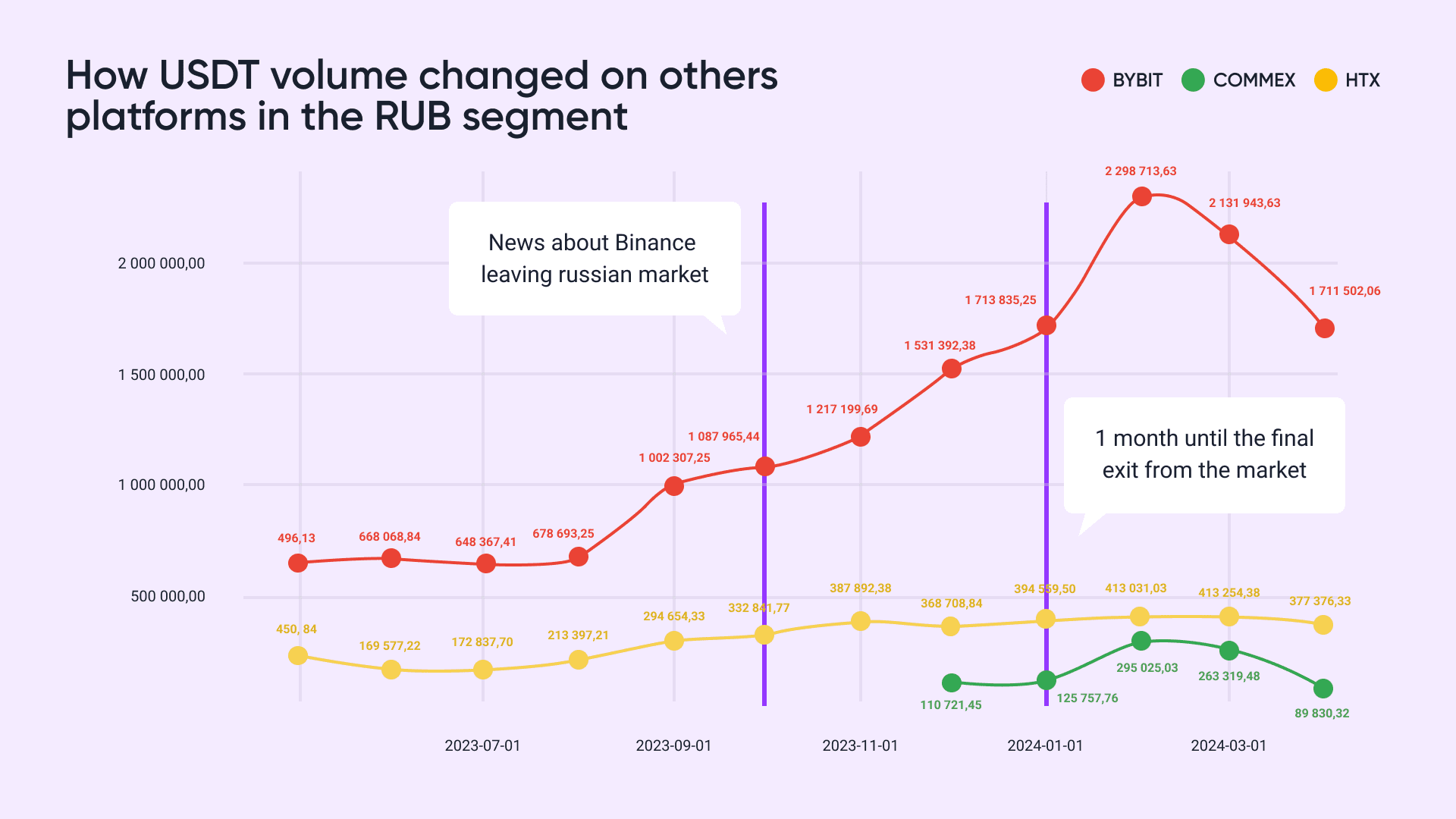

The ruble shutdown did not affect much Binance P2P volumes. However, for other P2P platforms, the distribution of ruble liquidity that left Binance was a notable event.

At the time of the publication of news about Binance’s departure from the Russian market, it was already possible to observe the beginning of an outflow of liquidity. Even taking into account the fact that the exchange had not left yet. The most dramatic increase on other platforms occurred a month before the final departure of Binance from Russia.

Bybit won the most. It became the new main P2P exchange for Russian traders. In addition, at the time of departure, Binance offered users to switch to CommEX, but the new exchange failed to capture enough market share and subsequently ceased operations. Less well-known sites certainly also saw an increase in traders and trading volumes, but this growth turned out to be insignificant and did not live up to their expectations.