What’s the first thing that comes to mind when you hear “cryptocurrency”? Bitcoin, right? No surprise there – it was the first and most famous digital currency. However, there’s a coin that, upon closer inspection, outshines the first crypto in many ways. We’re talking about Ethereum (ETH). Recently, the U.S. Securities and Exchange Commission approved an Ethereum-based ETF. This will fuel the high interest in the cryptocurrency and attract new investors.

So today, we’ll look at Ethereum! We’ll explore its history, understand how it works, and discuss whether it’s worth investing in this digital asset.

ETH Today: Price, Trends, and Prospects

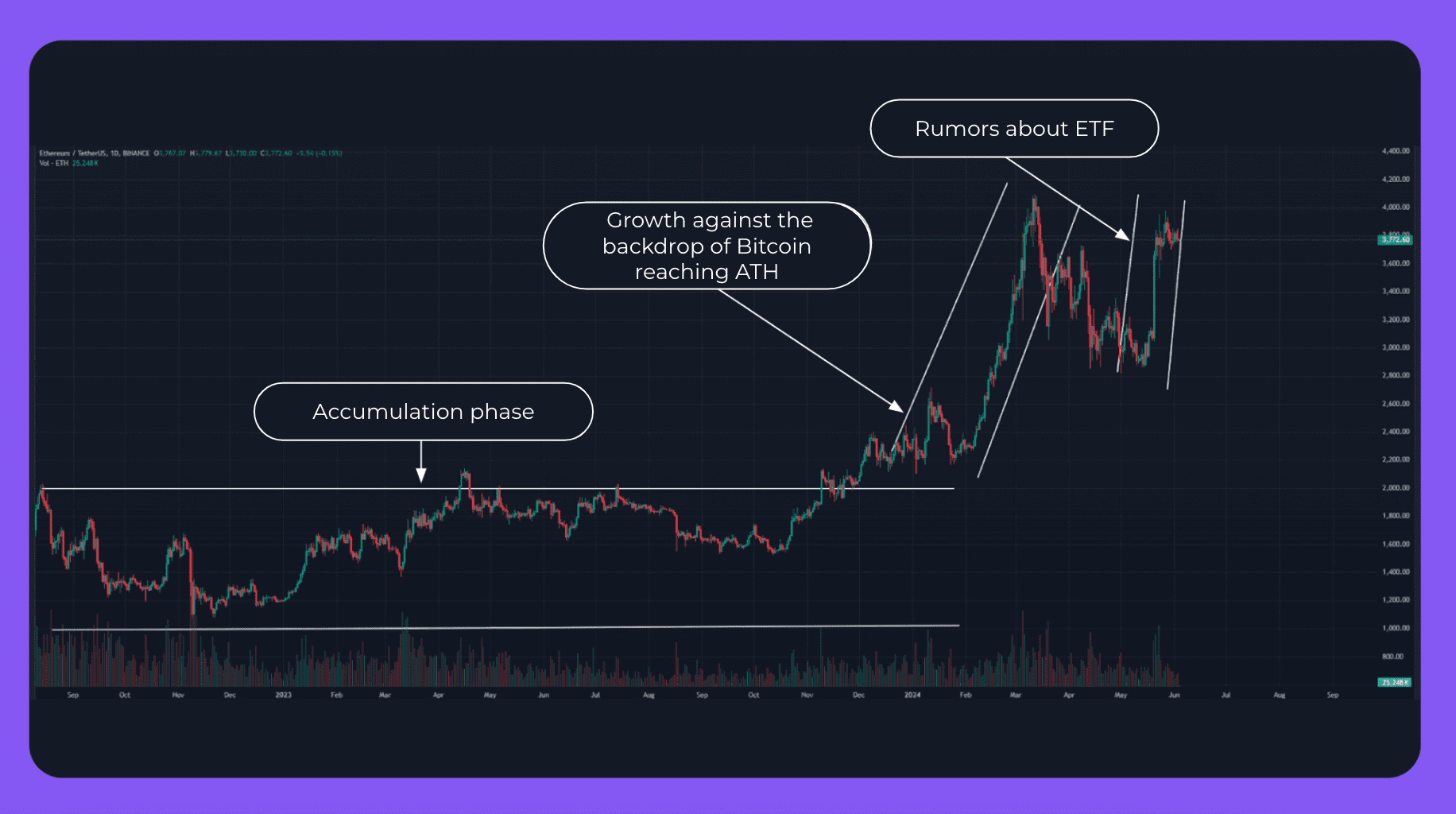

Ethereum, like Bitcoin, was stuck in a sideways market for a long time. We watched a prolonged correction, with the price unable to break the $2,000 barrier. However, 2024 changed everything. First, in February, as Bitcoin hit new all-time highs, Ethereum also surged. In March, we even saw it break the $4,000 mark, though it later pulled back to $3,000.

Second, rumors in late May about a possible approval of an Ethereum ETF immediately impacted the price. Overnight, ETH skyrocketed from $2,800 to $3,700 and has been hovering around that level since. Interestingly, while rumors boosted the price, the actual ETF approval hasn’t affected the value yet. Moreover, many investors are now withdrawing their ETH reserves from crypto exchanges – which increases Ether’s potential for continued growth above $4,000 in July.

So, you still have time to hop on this rocket and buy this promising coin. And the best way to do it is to use Monetory.

A Brief Journey Through History

How did Ethereum come into being, how did it evolve, and how did it become what it is today? Unlike Bitcoin with its mysterious creators, Ethereum’s history is more transparent.

The Birth of Ethereum

Vitalik Buterin introduced the concept of Ethereum to the world in 2013. In 2014, Buterin unveiled Ethereum at a Bitcoin conference, and later that year conducted an ICO, raising over $18 million in Bitcoin. The blockchain itself went live on July 30, 2015. The project was revolutionary – it was the first full-fledged platform for developing decentralized apps and smart contracts.

The DAO Hack and Hard Fork

In 2016, the DAO, which operated on the Ethereum network, fell victim to a hack resulting in the theft of over 3.6 million ETH. This event caused a rift in the Ethereum community – some wanted to alter the blockchain to undo the effects of the attack, while others insisted on the blockchain’s immutability. The majority sided with changing the blockchain. This led to a hard fork and the creation of two separate blockchains: the Ethereum we’re discussing here and Ethereum Classic – the original, unaltered version.

Ethereum’s Evolution

Since then, the blockchain has undergone numerous upgrades, such as Byzantium, Constantinople, and the Beacon Chain. Each of these introduced changes to various aspects of the network. For instance, the Beacon Chain initiated the transition from PoW to the more scalable Proof-of-Stake consensus algorithm.

The Future of Ethereum

Today, Ethereum is one of the leaders in the crypto space, as evidenced by its high market cap and the multitude of solutions built on this blockchain. Moreover, Vitalik Buterin has stated that after the Merge, Ethereum will undergo four more development stages: The Surge, The Verge, The Purge, and The Splurge. The question remains whether these upcoming updates will allow for more effective handling of the growing wave of digital asset regulation.

How Ethereum Works

Ethereum isn’t just another cryptocurrency – it’s a comprehensive platform for developing and running decentralized apps (dApps) and smart contracts on the blockchain. In essence, you can call Ethereum a “programming language” of the crypto world. At its core are smart contracts – self-executing programs that run when predetermined conditions are met. These contracts are the backbone of apps built on Ethereum.

With Ethereum, you can do more than just send and receive ETH tokens. It opens up a world of possibilities: launching apps, playing games, setting up trading platforms, and so much more. It’s also the birthplace of non-fungible tokens (NFTs), which have revolutionized how artists can sell their work directly to buyers through smart contracts, cutting out the middleman.

New ETH coins are minted by validators who confirm transactions. While Ethereum initially used a Proof-of-Work algorithm like Bitcoin, it has since evolved. The Merge update saw Ethereum transition to the more energy-efficient Proof-of-Stake method.

In the PoS system, ETH holders can stake their coins in a special wallet and earn rewards. There’s a cap on the annual emission of Ether – as of May 2024, about 120 million coins were in circulation.

Ethereum has become the go-to platform for developers to create new crypto projects and decentralized applications. It’s not just a cryptocurrency – it’s a full-fledged crypto ecosystem with massive potential.

Is it Worth Investing in ETH in 2024?

Absolutely! Ethereum remains the go-to platform for building dApps and continues to attract more developers. The total value of projects built on it exceeds $50 billion! It is five times more than its nearest competitor, Tron. Here are four more reasons why you should consider buying ETH today:

Reason #1: Superiority over Bitcoin. Ethereum has several significant advantages even over Bitcoin. Its blockchain supports smart contracts, transactions are faster, and the network itself is more energy-efficient and environmentally friendly after switching to Proof-of-Stake.

Reason #2: The asset is becoming deflationary. Following the 2021-2022 upgrades, Ethereum has become a deflationary asset – burning a portion of transaction fees gradually reduces the supply of ETH.

Reason #3: ETF approval. It will pave the way for billions in investments from economic giants like BlackRock and Fidelity.

Reason #4: Diversification. Unlike Bitcoin, which was conceived solely as a store of value, Ethereum opens up much broader prospects – from asset tokenization to creating custom crypto ecosystems.