USDT is a digital asset that is backed by a US dollar. It was the first stablecoin, which increased liquidity and convenience in the crypto space. Tether has become an essential tool that provides people to engage in crypto trading while eliminating the risks of high volatility. Today USDT is the most traded cryptocurrency with a daily volume of around $20 billion.

In this article, we will observe the USDT, its pros and cons, and talk about how to buy or store this cryptocurrency.

History of Tether (USDT)

Tether (USDT) is a cryptocurrency that was introduced to the community in 2014. It was created by Tether Limited, a corporation based in Hong Kong. The developers of USDT earn from investments made with funds held in dollar reserves, which ensure the stability of the coin. These reserves can be invested in various tools, generating additional income. Initially, the Tether was built on the Omni infrastructure, which was based on the Bitcoin blockchain. Over time, Tether expanded its ecosystem and started implementing other blockchains, like Ethereum, Tron, and others, to provide more options for buying or selling and improve transaction efficiency.

Here are some milestones in its history.

- In 2015, Tether Limited announced a partnership with Bitfinex to increase interaction between the project and the cryptocurrency ecosystem.

- In 2017, USDT faced auditing and transparency issues. But, the team continued to develop the project.

- In 2020, the issuance of USDT rapidly increased, reaching a billion dollars.

- In 2022, Tether reached a market capitalization of over $60 billion, becoming the most popular stablecoin.

Over time, USDT has become widely adopted on crypto platforms. Tether is a cryptocurrency that provides security and simplifies the exchange process.

What Backs the Tether (USDT)

Tether is a form of digital representation of the US dollar. For every issued coin, the creators must have an equivalent reserve in traditional dollars. This approach ensures the stability of USDT. Tether Limited claims to hold 100% reserves to guarantee the reliability of its cryptocurrency.

In the past, there were transparency and reliability issues regarding the reserves. For a while, the reserves were in the shadow, which raised concerns among investors. However, since 2019, the company has started publishing reports on the reserves that have been audited.

The backing of the coin to the US dollar is a key point in its stability and attractiveness to investors.

Today a total of 82 billion USDT has been issued and is in circulation.

How Tether (USDT) is Issued

Tether is a stablecoin that is issued based on market demand and needs. The issuance of new coins starts with Tether Limited. The company creates new tokens based on market demand and needs. When users want to exchange their fiat funds, the company releases a corresponding volume of new tokens and holds the reserve of fiat money.

- The role of the blockchain. To introduce USDT into circulation, corresponding entries must be made in the respective blockchains.

- Impact of issuance on price. The issuance of USDT is always accompanied by corresponding reserves, which maintain the stability of this stablecoin. The impact of issuance on its price is minimal since USDT is pegged to the dollar. However, an insufficient increase in demand during issuance may raise doubts about the backing of USDT with dollar reserves, which could ultimately affect its price and trust in the coin.

- Mining. A distinctive feature of USDT is that it cannot be mined like Bitcoin.

Blockchain Networks Supporting USDT

The stablecoin does not define its blockchain but operates on existing ones. Let’s consider the most common networks where USDT operates:

- ERC20. It is the blockchain network protocol of Ethereum and has support from most wallets and platforms. Additionally, USDT on this protocol can be used for participation in smart contracts and decentralized applications. However, it has the drawbacks of slow transfers and high fees.

- TRC20. This protocol offers fast and low-cost transactions within the TRON network and can be used in systems built on TRON. It also supports participation in decentralized applications and staking.

- Tether OMNI. It was the first version of the stablecoin and remains one of its variants. However, transaction fees are higher compared to their counterparts.

USDT cryptocurrency is often used for transfers. It’s important to note that when using non-custodial wallets for USDT transfers, gas fees may be required. Gas is a unit of measurement for transaction fees in the blockchain, and its amount can vary depending on the current network congestion.

Advantages and Disadvantages of Tether

Like any other crypto, USDT has its pros and cons.

Advantages:

- Stability. Tether (USDT) has low volatility, making it a sustainable instrument for storing and transferring digital money without significant price fluctuations.

- Liquidity. USDT is widely available on various platforms, and its popularity ensures high market liquidity. It can be easily exchanged for other cryptocurrencies or fiat currencies.

- Fast transactions. Tether can be transferred quickly, especially within the same network. This is beneficial for instant fund transfers or spot market trading.

- Convenience. USDT can be easily stored and transferred using wallets or payment systems. However, it is important to note that Tether is a centralized instrument, which means the company has full control over its issuance and reserves, raising concerns regarding transparency and reliability.

Disadvantages:

- Regulation. Tether has attracted regulatory attention in different jurisdictions, and its legal status and regulation remain uncertain, leading to potential uncertainties and issues within the community.

- Stability risk. Although Tether aims to maintain its peg to the US dollar, there is a possibility that the coin could lose its stability. This could happen due to financial difficulties faced by its creators or external factors such as changes in legislation, market shifts, or economic and political instability.

- Limited investment opportunities. Tether has limited potential for price growth as it is backed by the USD. Therefore, investing in Tether may not yield significant profits in the case of sharp price increases in other cryptocurrencies.

How to Use Tether (USDT)

Stable assets in a volatile market. Tether allows investors to maintain stability in their portfolios amidst high market volatility, serving as a hedge against risks.

Easy fund transfers between exchanges. Traders can make fast and efficient transactions between different services and platforms using Tether.

Trading on cryptocurrency-only platforms. Tether can be used for cryptocurrency trading without the need to involve fiat currencies.

Forex-style trading. Some cryptocurrency platforms offer trading opportunities where Tether serves as an exchange medium for various fiat currencies such as the euro, Japanese yen, or Chinese yuan. This allows traders to participate in international currency trading.

Wallet storage. Tether can be stored in dedicated cryptocurrency wallets, providing a means to hold digital funds in a stable form and have quick access for transactions or trading purposes.

Purchases. Tether can be used for making purchases on platforms that accept it as a payment method.

Exchange for fiat or other cryptocurrencies. Users can exchange their USDT for fiat currency through peer-to-peer platforms and exchanges. Additionally, it can be exchanged for other crypto assets, diversifying one’s investment portfolio.

Where can You Buy or Store USDT?

Storage. For Ethereum tokens, wallets such as MetaMask, MyEtherWallet, or Trust Wallet can be used. For TRC20 tokens, TronWallet or Trust Wallet can be used. Additionally, many centralized cryptocurrency exchanges also offer the option to store tokens in internal wallets on their platform. However, it is important to consider the risks of storing funds on an exchange and the potential threat of hacking or loss of account access.

Purchase. Users can register on a reliable exchange and purchase USDT with fiat currency using direct deposits or P2P services. There are also online services that allow the exchange of fiat money for cryptocurrency and vice versa. When using such services, it is important to be cautious and choose reputable and trusted platforms. Despite being pegged to the dollar, buying USDT at a 1:1 ratio can be difficult because Tether has several advantages compared to its fiat counterpart.

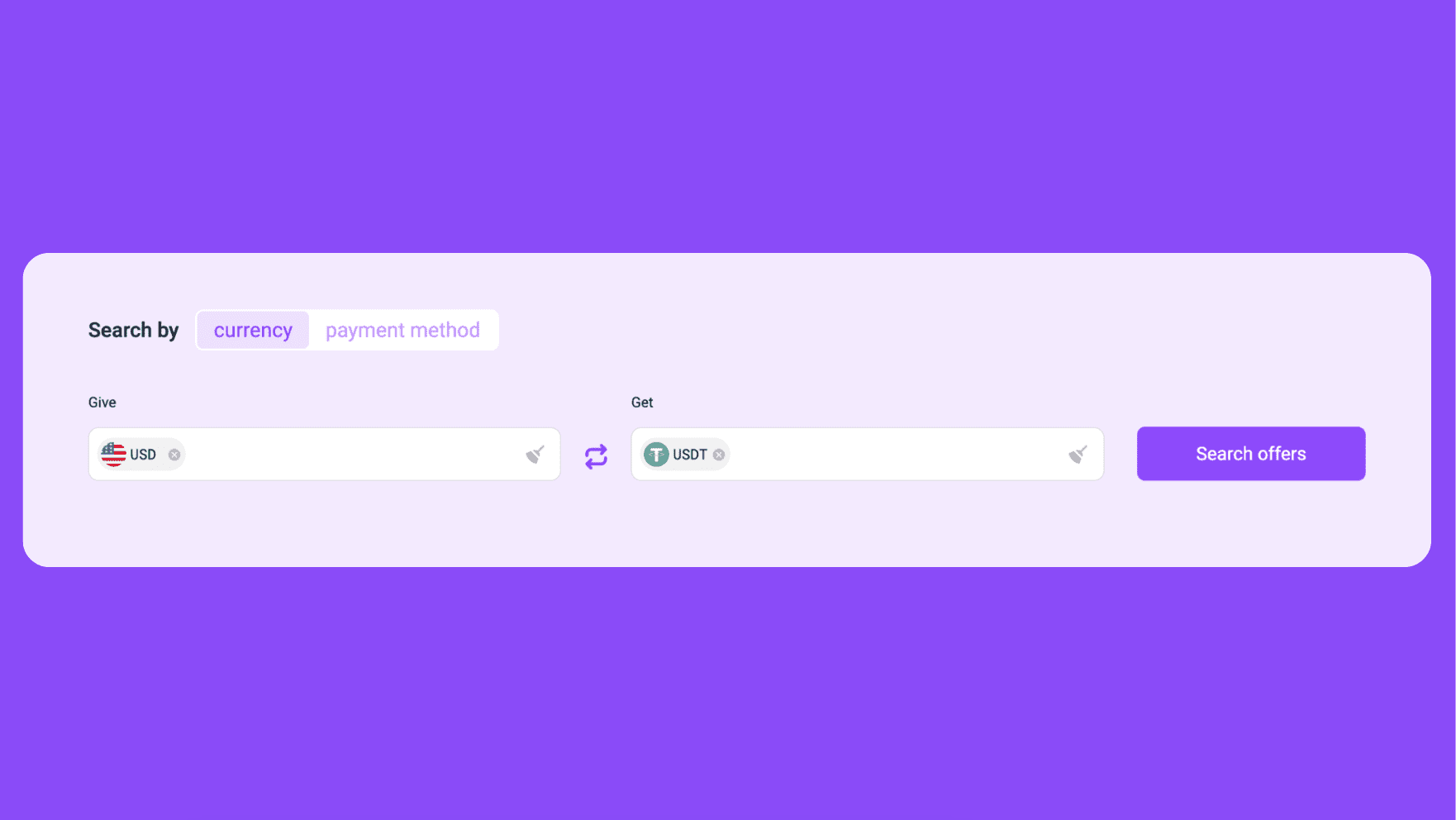

To track the best exchange rates, use Monetory. Monetory is an aggregator of P2P offers in the market, helping users find the most favorable rates across a wide range of P2P services and Exchangers. Here’s how to use it:

- Visit Monetory

- Choose searh mode: by currency or by payment method

- Choose USDT and, for example, USD and click “Search offers.”

USDT is a valuable tool that can be used as a protective asset. Check Monetory for purchasing USDT and efficiently managing your finances.