The free Monetory.Toolkit extension is your assistant in the P2P world. It will protect against scammers by letting you know if you’re on a known scam site and making it even more accurate to find profitable exchange offers.

We developed Monetory.Toolkit with professional P2P traders, exchangers, and arbitrageurs. And we continue to add new features.

Here’s what the extension can do now:

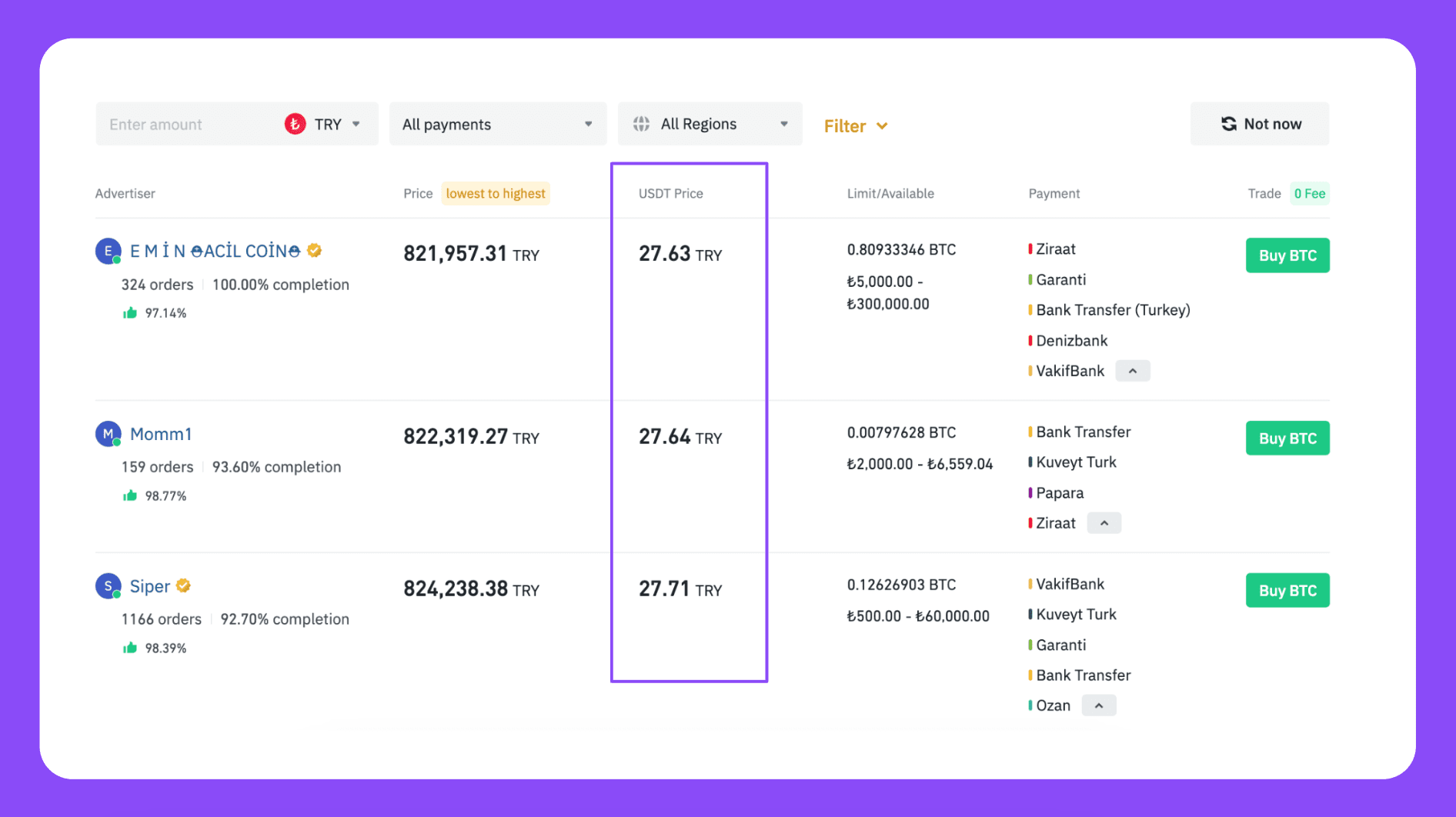

- Adds a column with the USDT Price parameter to the P2P order book. It displays the price of USDT calculated in terms of the currency of the offer.

- Notifies you when you are on suspicious sites and scam exchangers

- Adds the USDT Price parameter both in the merchant and regular user interfaces.

- Takes into account, according to your settings, commissions to obtain a net price when calculating USDT Price.

- Displays the amount of all offers on the page.

More than 800 people use the extension every day. How exactly? Let’s check three scenarios in which Monetory.Toolkit will come in handy.

Scenario 1: Buying Cheap USDT with Bitcoin and Altcoins

Buying USDT at a favorable rate is always good. And for many P2P strategies, this is a prerequisite. How to see the best price to buy USDT in the P2P order book:

- On the Buy page, the best buy price as a taker will be in the top offer.

- On the “Sell” page at the top, there will be an approximate best price at which you can get USDT if you put your offer as a maker.

But will these be the best USDT buying rates in the P2P market? Not always.

There is a strategy for buying USDT with Bitcoin via P2P and then exchanging it for USDT on the spot. Calculating the profitability of such an offer is problematic. You need to constantly monitor several parameters at once and every time recalculate the price of USDT. Not the best tactic, right?

Monetory.Toolkit calculates and updates the USDT price automatically. It will show up in the USDT Price column.

Buying USDT through other cryptocurrencies can be a standalone strategy or be included in any more complex bundle. Let’s look at a couple of examples.

Strategy 1: Buy and sell as a maker

| Buying USDT as a maker | Selling USDT as maker | Spread |

| 83,97 RUB | 84,07 RUB | ~0,12% |

🤷♂️ Spread 0.12% is OK. But you can do better! Let’s try to buy Bitcoin, convert to USDT on spot and sell.

| Buying BTC with conversion to USDT | Selling USDT as a maker | Spread |

| 82,72 RUB | 84,02 RUB | ~1,5% |

🤯 The spread of 1.5% is 13 times more than through the direct purchase of USDT.

We did not take into account commissions and limits. Commissions would reduce our income, but taking into account the limits in this example would increase profitability.

Strategy 2: Buy as a taker, sell as a maker

This strategy is suitable for those who do not have a merchant account. With the help of these bundles, you will gain the necessary volume of transactions to obtain the status. The scheme is simple:

- Buy USDT as a P2P taker.

- Convert USDT to the target cryptocurrency via spot.

- Sell cryptocurrency as a maker in the P2P section.

We will choose ETH as the target cryptocurrency:

| Buing USDT | Selling ETH as a maker | Spread |

| 84,10 RUB | 85,00 RUB | ~1% |

A spread of 1% can be called good, but this is a “dirty” percentage, it does not take into account the commission of the maker and the exchange for spot. Monetory.Toolkit can help with this too!

Scenario 2: accounting for commissions

In the extension settings, you can specify a coefficient for calculating USDT Price values. Coefficients can raise or lower these values. The need for this is determined by your trading strategy and order book.

You can specify a unique coefficient for each P2P platform, order book, and interface.

To account for the standard Binance maker fee of 0.1%, you need to:

- For the Buy order book, specify the coefficient 0.999 (since 0.1% of the cost is lost when the maker sells).

- For the Sell order book, indicate the coefficient 1.001 (since 0.1% of the cost is added when the maker buys).

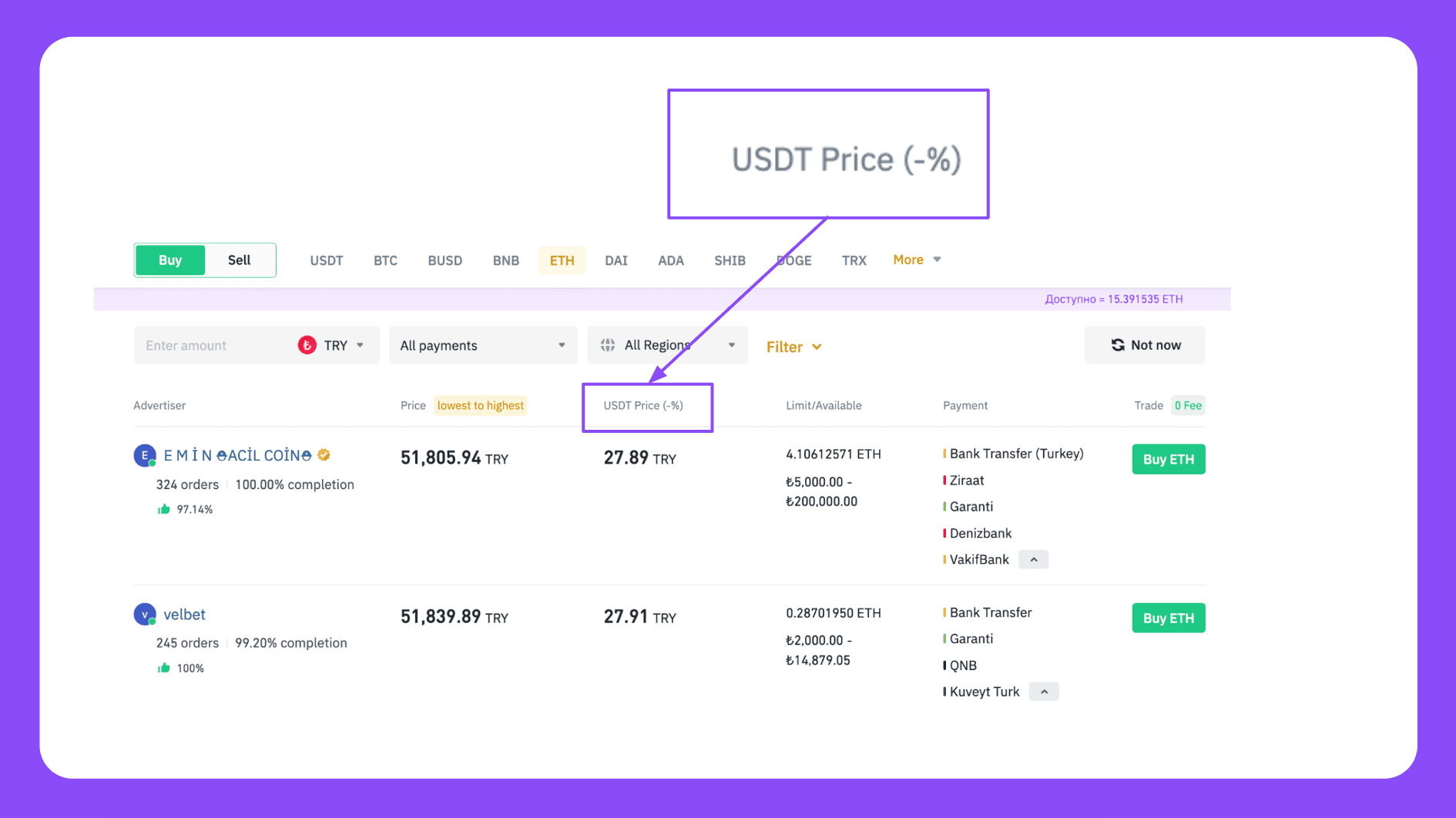

Let’s take into account the commissions for our bundle from Strategy 2.

- The maker fee for selling ETH is 0.01%.

- Exchange commission for a spot — 0.01%.

We are selling the asset as a maker in the Buy order book of ETH, so both commissions will reduce the value in the USDT Price column. We set the coefficient to 0.998 and once again look at the order book ETH:

The heading has a -% mark, which indicates a reduction factor. This mark appeared in the column header, and the USDT Price for the offer is now displayed with a commission.

So, the Monetory.Toolkit extension helped us quickly detect a bunch and automatically calculate the spread. But ETH is not the most liquid asset in the P2P market, so you need to check liquidity first. And with this, an extension can help us too.

Scenario 3: P2P Order Book Volume Estimation and Pricing

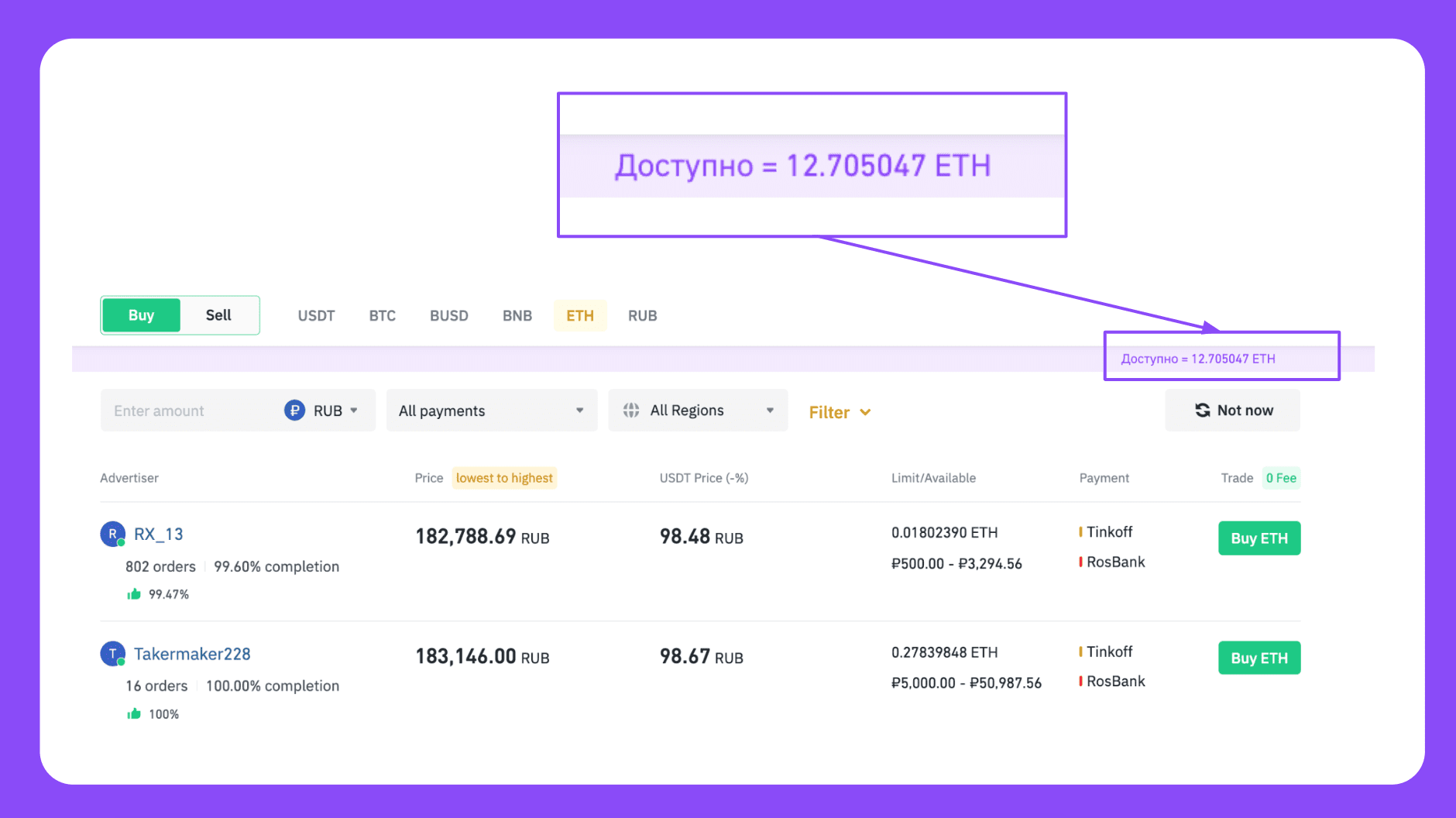

Monetory.Toolkit displays the volume of all placed offers on the page you are viewing on the P2P order book page. You can use this indicator for:

- assessment of liquidity

- deciding at what rate to place your ad

Using Monetory.Toolkit, you can quickly estimate the volume of ads in the order book and determine the position for your offer in order to implement it at the best price.

Rate it personally

This is just a small part of the scenarios for using Monetory.Toolkit. We regularly improve it by adding new features. Install the extension right now – it’s free!