If you look at the TOP-10 cryptocurrencies by market capitalization, the names are familiar even to those new to the world of digital assets. Bitcoin, Ethereum, and Tether are household names at the moment. However, there’s one cryptocurrency that, despite its high ranking, remains somewhat of a mystery. We’re talking about XRP — a digital asset developed by Ripple, currently holding the 7th spot in market capitalization among all cryptocurrencies.

XRP isn’t just another cryptocurrency. Unlike many other digital assets, XRP doesn’t aim to replace traditional currencies. Instead, it seeks to integrate with the existing financial system, making it faster, cheaper, and more efficient.

In this article, we’ll explore what XRP is all about, what it has to offer, and why this cryptocurrency is worth your attention.

3 Key Reasons to Take a Closer Look at XRP

XRP didn’t earn its 7th place in cryptocurrency market capitalization by chance. This digital asset stands out both in terms of practical use and as an investment vehicle. Everyday users appreciate the convenience and speed of transactions on the XRP network, while investors see potential in its value growth.

Reason #1: A Stellar Payment System

XRP Ledger is a decentralized, open-source payment system. Think of it as a faster, cheaper version of SWIFT — that’s essentially what XRP Ledger is.

Transaction Speed

XRP processes between 15 and 30 transactions per second. Each transaction takes only 3 seconds to complete. It’s not the fastest blockchain

Reliability

For 12 years, the XRP blockchain has never experienced a single outage, hack, or major technical issue. For comparison, Ethereum, the second-largest cryptocurrency by market cap, has been hacked, leading to a split into two versions. XRP, on the other hand, has remained rock-solid — reliable and unwavering.

Low Fees

XRP boasts some of the lowest transaction fees in the crypto world. Most importantly, it has a fixed «gas» fee of 0.00001 XRP. No spikes during network congestion, no unexpected costs — everything is transparent and predictable.

Versatility and Multi-Currency Support

XRP Ledger can handle any cryptocurrency as a token. What’s more, the system acts as a bridge between cryptocurrencies and fiat currencies. You can send Bitcoin, and the recipient can receive USD — XRP handles the conversion automatically.

XRP isn’t just competing with traditional international payment systems like SWIFT or SEPA — it outperforms them in every key metric. And it remains competitive even against the most technologically advanced cryptocurrencies.

Reason #2: Deflationary Tokenomics

XRP is a transparent cryptocurrency. 100% of the coins are already in circulation, and no new ones will ever be created. But that’s not all — the total supply of XRP is shrinking!

The reason is a burn mechanism, where a small portion of each transaction fee (the same 0.00001 XRP) is permanently destroyed. To date, nearly 13 million coins have already been burned. This creates a deflationary effect, potentially increasing the value of the remaining coins over time.

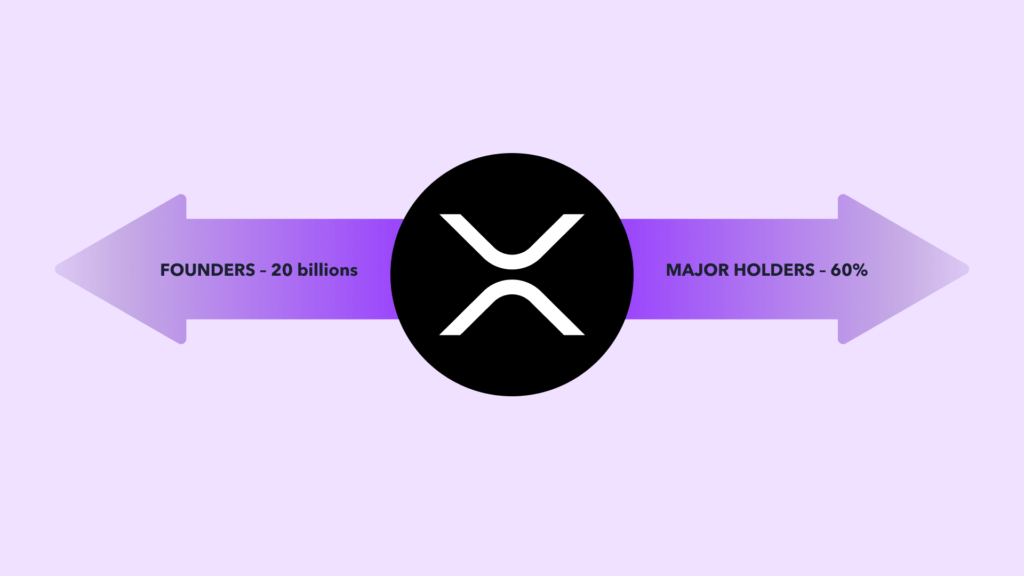

However, to be objective, it’s important to acknowledge the downsides:

- 20% of the total supply (20 billion XRP) is held by the founders. That’s quite a lot for a project that positions itself as decentralized.

- Over 60% of all XRP is concentrated in the hands of the top 100 holders, raising concerns about the true decentralization of the network.

Reason #3: Victory in Court Against the SEC

Imagine this: the U.S. Securities and Exchange Commission (SEC) files a lawsuit against you. For 99% of crypto projects, that would be a death sentence — most would shut down and fade into oblivion. But not Ripple.

Not only did the company survive the legal battle, but it came out on top. Yes, they had to pay a $125 million fine, but immediately after the court’s decision, the price of XRP shot up 20%! You could say the market more than compensated for Ripple’s losses, sending a clear signal of confidence in the project.

This speaks volumes. XRP is not a flash-in-the-pan project. It has serious, long-term ambitions, and the team, led by CEO Brad Garlinghouse, is ready to fight for its vision to the very end. Such resilience and confidence command respect and strengthen investor trust.

XRP is a project that solves real-world problems, has a well-thought-out economic model, and has proven its staying power. All of this adds up to a cryptocurrency that rightfully holds its 7th-place market cap ranking and continues to thrive.

A Price Evolution of XRP

XRP is one of the oldest cryptocurrencies on the market, created by Ripple way back in 2012. Since then, XRP’s price and popularity have experienced many highs and lows. So, what has happened with XRP over the years?

2012–2017: The Early Years

In its early years, XRP flew under the radar. At the time, cryptocurrencies were seen as a niche curiosity for tech geeks. The price of XRP was extremely low — around $0.0025 per coin.

It’s important to understand the context of that time:

- Bitcoin was just starting to gain traction. Only the most hardcore tech enthusiasts were familiar with it.

- Altcoins weren’t taken seriously by anyone.

- The entire crypto market was worth a fraction of what it is today.

Back then, the crypto world resembled the Wild West: no rules, high risks, and very few people knew what was going on. XRP was no exception. But Ripple’s team didn’t sit idle. They kept improving the technology, making deals with banks, and preparing for future growth.

2017: The First Major Surge

In 2017, the first true crypto boom occurred. At the start of the year, one XRP coin was worth about $0.006, but by the end of the year, the price skyrocketed to a record $3.22 — a staggering increase of over 60,000%! XRP was leading the charge in growth among all cryptocurrencies.

Why did this happen?

- The crypto market was exploding. Bitcoin hit $20,000, and suddenly, everyone was talking about cryptocurrencies.

- Ripple signed many new partnerships with banks, boosting trust in XRP.

- People began to realize that blockchain wasn’t just a buzzword but a genuinely useful technology.

- Many who missed out on buying Bitcoin were searching for the «next Bitcoin» among other cryptocurrencies.

Of course, such rapid growth couldn’t last forever, and after reaching its peak, the decline began.

2018–2020: The First Real Crypto Winter

In 2018, the crypto market entered its first truly harsh «bear» phase. Many refer to this period as the first Crypto Winter. What did this mean for XRP? After hitting its record high of $3.22 (a level XRP has yet to reach again), the price fell back to around $0.30. The decline continued, and by 2020, XRP hit rock bottom, dropping to $0.25.

Why did this happen?

- General disappointment in cryptocurrencies after the insane growth of 2017.

- Stricter cryptocurrency regulations in many countries.

- Speculative money exiting the market.

However, not all was doom and gloom. Ripple’s team kept working on their technology, securing new partnerships, and preparing for future growth.

2020–2021: A Rebound, But Not to Previous Heights

By the end of 2020, the crypto market began to recover. A new bull cycle started, and the prices of many cryptocurrencies climbed. But here’s the interesting part: with each bull cycle, Bitcoin not only returned to previous highs but also set new records. Altcoins, however, faced a more complicated situation.

What happened with XRP:

- The price did rise, reaching $1.80 in April 2021.

- This was a solid increase compared to $0.25 at the start of 2020.

- However, XRP didn’t quite make it back to its all-time high of $3.22.

XRP wasn’t alone in this struggle. Around 90% of altcoins failed to come close to their 2017–2018 records. Despite this, the growth of 2020–2021 showed that interest in XRP was still alive.

2021 to the Present: Waiting for a New Altcoin Season?

After the 2021 surge, XRP, like many other altcoins, found itself in a prolonged sideways movement. With the end of the 2021 bull market, XRP’s price fell back to around $0.50. For more than three years now, XRP has been stuck in this range. There was one bright moment: when Ripple won its court case against the SEC, the price briefly spiked to $0.80. But over time, it slid back to $0.50.

This isn’t just XRP’s problem — many altcoins are in a similar situation. That’s just their nature; with rare exceptions, most coins struggle to return to their historical highs.

So, what can XRP holders look forward to? Many are eyeing 2025. Why? Because 2025 could bring the next altcoin season. What might this mean for XRP?

- Pessimistic forecast: XRP fails to break the $1 barrier.

- Realistic forecast: A return to prices of $2–$3 per coin.

- Optimistic forecast: A new all-time high, with XRP peaking around $5.

But let’s be realistic: no one can guarantee that altcoin season will actually happen. However, there are signs that some liquidity from Bitcoin could flow into altcoins, including Ripple.

Advantages of XRP

- Deflationary model: The total supply of XRP is fixed, which theoretically helps support its value over time.

- Practical application: XRP addresses real-world challenges in cross-border payments, giving it an edge over many other cryptocurrencies.

- Reliability: XRP has withstood a major test by winning its lawsuit against the SEC. Additionally, it has never faced any serious hacks or technical issues.

- Eco-friendly: XRP doesn’t require mining. All the coins have already been issued, making it a more environmentally friendly option.

- Smart validation: XRP’s supply is controlled through smart contracts, ensuring a transparent and predictable issuance process. Ripple’s system uses a unique consensus algorithm, enabling fast transactions with minimal energy consumption.

However, alongside these advantages, XRP does have a few drawbacks:

- Decentralization concerns: One-fifth of all coins are held by developers, and 60% of the circulating supply is concentrated in the hands of large market players. This raises concerns about potential price manipulation.

- Limited functionality: XRP lacks the capabilities of platforms like Ethereum or Solana. It doesn’t have a rich ecosystem of decentralized applications (dApps), complex smart contracts, or a developed DeFi sector. There’s also no support for NFTs.

- Potential ceiling: XRP has held the 7th spot in crypto market capitalization for a long time, and the chances of overtaking coins like BNB seem slim. While there’s still potential for price growth, it’s possible that XRP has reached its peak in terms of market position.

XRP is a highly unique project, unlike other cryptocurrencies. It doesn’t try to be «everything to everyone» but focuses on solving specific problems in the financial sector.

Where to Buy XRP

XRP is available not only on major exchanges but also in peer-to-peer (P2P) markets. For buying XRP with USD or any of your local currency, there are other options. On Monetory, you can find over a thousand offers from private exchangers, compare rates, and choose the best deal.