Stablecoins are a type of cryptocurrency that, unlike traditional coins such as Bitcoin or Ethereum, have a fixed value tied to common financial assets. The stability and predictability of their value make them an essential tool for storing and trading crypto assets. After all, using volatile coins for these purposes can lead to significant losses due to sharp fluctuations in their value.

We have already published materials on the two most popular stablecoins:

And now, let us compare them! We will explore the history of their emergence, principles of operation, and pros and cons to help you make an informed choice.

History of the Creation of USDT and USDC

Tether (USDT) was the first to emerge. It was issued by Tether Limited in 2014 on the Omni blockchain. The issuer is based in Hong Kong. This fact has faced criticism from regulators. Authorities in the US and EU expressed concerns about Tether’s activities, citing a potential lack of transparency.

USD Coin (USDC) came later, in 2018. It was created by the CENTRE consortium, which includes two major US cryptocurrency companies – Coinbase and Circle. The significant difference between USDC and USDT lies in the fact that CENTRE’s activities have been under the control and regulation of US authorities from the very beginning. It substantially increases trust in USDC among investors and financial regulators.

Definition and Basics of Stablecoins

Stablecoins are cryptocurrencies tied to the value of financial assets, such as the US dollar or the euro. Also, there are stablecoins connected to gold and other values and coins controlled by algorithms.

As for Tether and USD Coin specifically, each coin issued by these stablecoins is backed by an equivalent amount in US dollars held in reserve by the issuing companies. When someone buys USDT or USDC, companies exchange their dollars for their crypto equivalent.

That is why stablecoins maintain a stable exchange rate. They can be used for quick and inexpensive transactions within blockchains while preserving real purchasing power, unlike volatile cryptocurrencies.

USDT vs USDC

Disclaimer: Data is accurate as of November 14, 2023. Sources: CoinMarketCap and Monetory.

Tether

- MarketCap: $87.34B (TOP 3)

- ATH: $1.22

- ATL: $0.5683

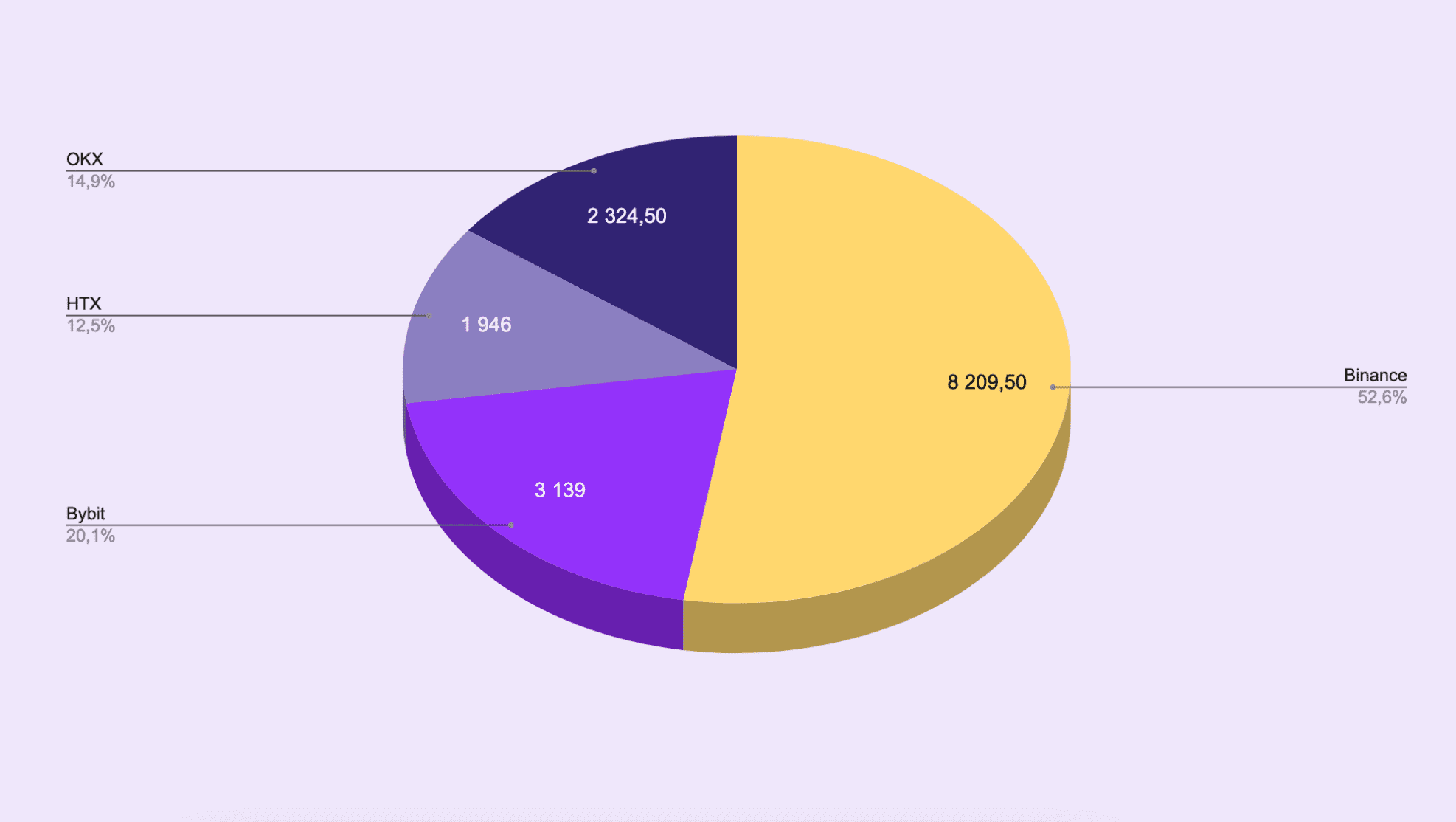

- The daily volume of cryptocurrency in the “Buy” order books on P2P is $65 750 273

- The average number of offers in the “Buy” order books on P2P is 15619

Currently, it holds the leading position among stablecoins in key metrics. The immense popularity of USDT is attributed to its high liquidity and convenience in use, both in arbitrage and for transferring funds through cryptocurrency.

USDT also impresses with volumes: the total daily volume on four popular platforms exceeds 50 million dollars.

USD Coin

- MarketCap: $23.86B (TOP 6)

- ATH: $2.35

- ATL: $0.8774

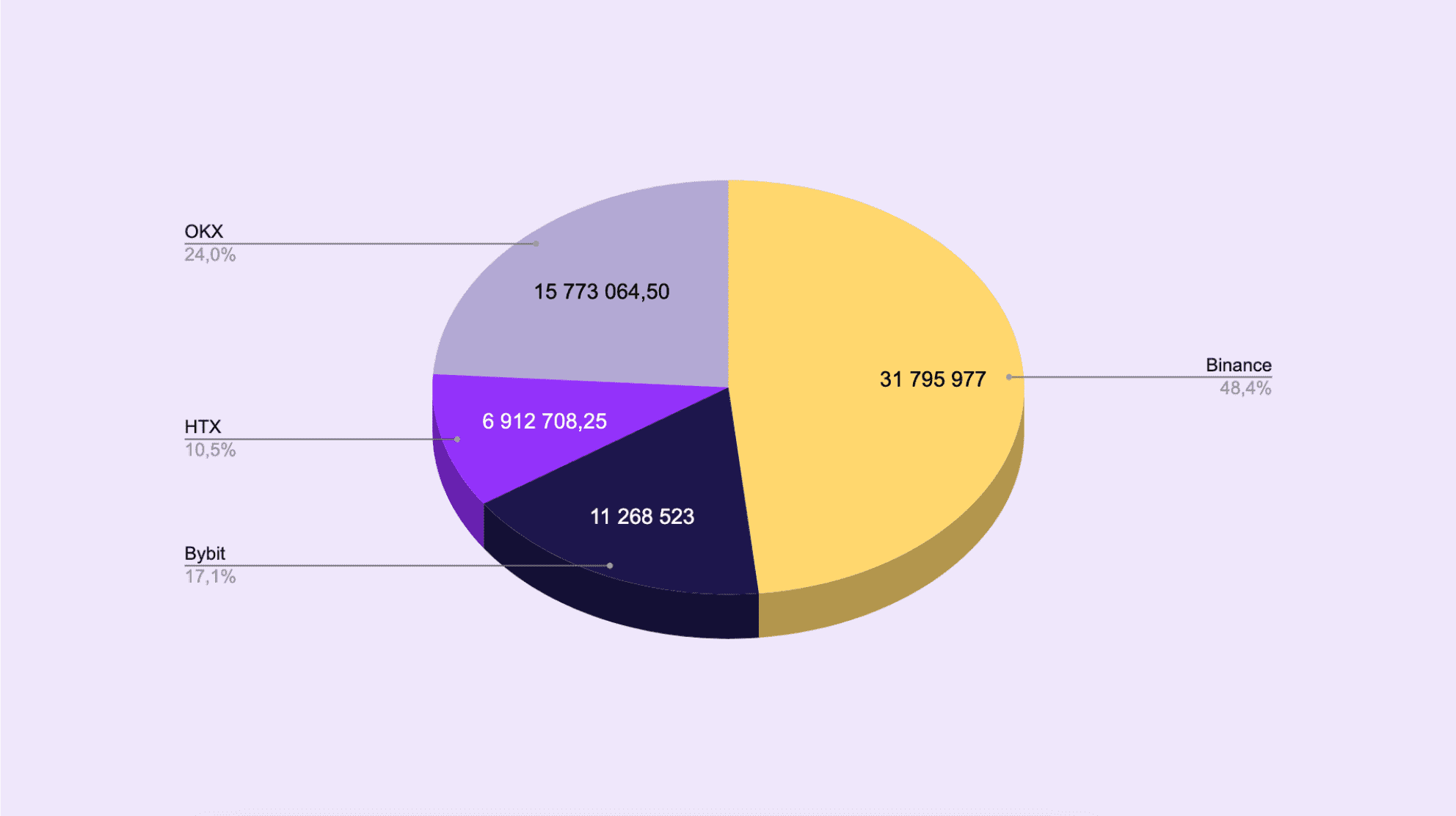

- The daily volume of cryptocurrency in the “Buy” order books on P2P is $228 808

- The average number of offers in the “Buy” order books on P2P is 152

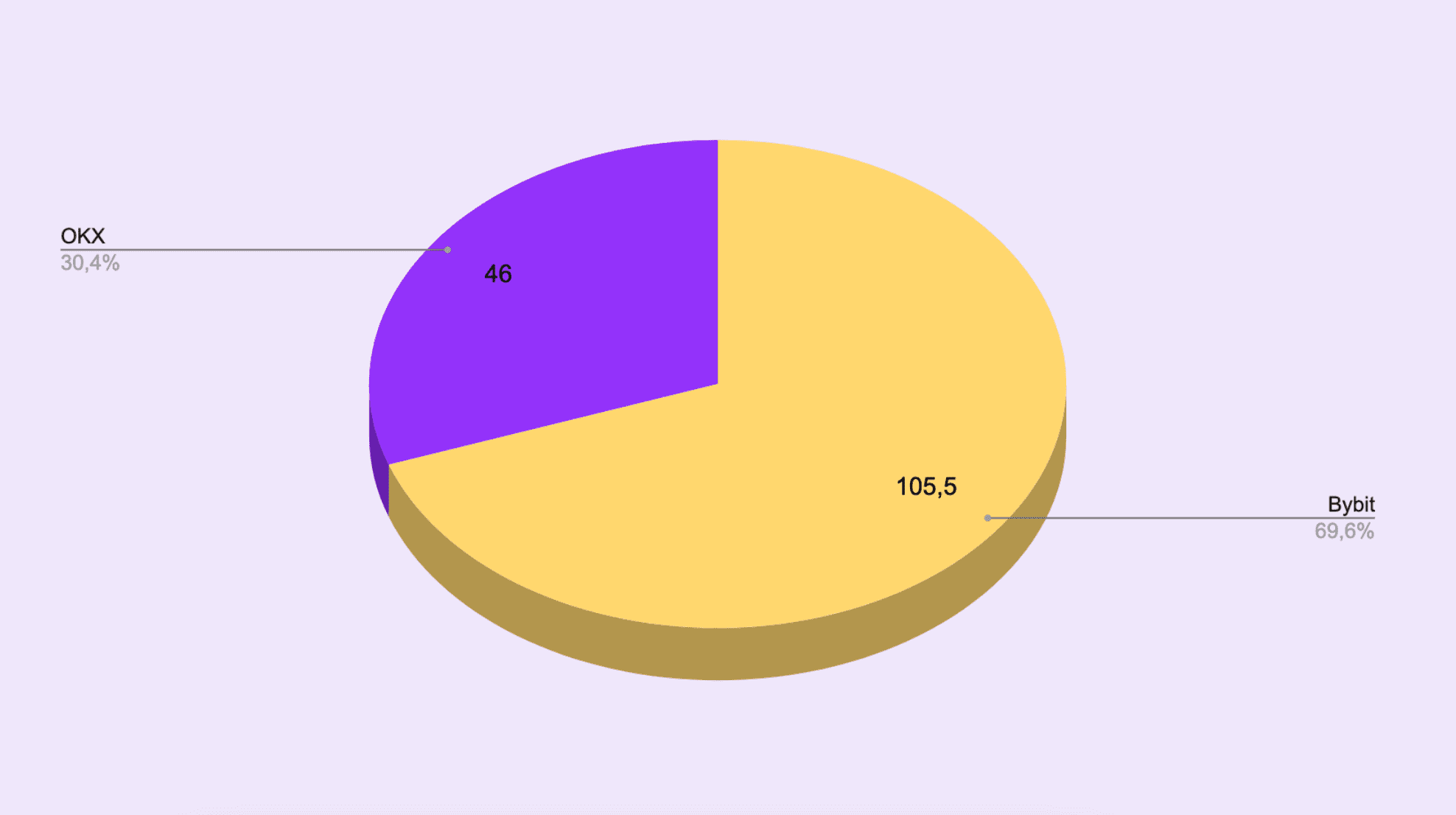

The stablecoin holds the second position in terms of market capitalization among stablecoins. Currently, there are significantly fewer USDC offerings both in terms of quantity and volume. You can find it on OKX and Bybit and there are fewer offers than with USDT.

USDT and USDC Technical Structure

Previously, Tether operated solely on the Omni blockchain, which utilizes the Bitcoin protocol. However, later on, USDT expanded its operations to other networks, primarily Tron, as well as Ethereum, Algorand, Solana, and others.

The issuance and control of USDT collateral are centralized and managed by Tether Limited. The company holds dollar reserves equivalent to the amount of USDT coins in circulation.

USD Coin was initially launched on the Ethereum and Stellar blockchains. Subsequently, it became available on other popular blockchains, including Solana, Algorand, and Polygon. In contrast to Tether, the issuance of USDC is partially decentralized using smart contracts. Reserves are distributed among members of the CENTRE consortium and undergo regular audit checks.

What Distinguishes USDT from USDC

Each coin has its own strengths and weaknesses.

| USDT | |

| Pros | Cons |

| High liquidity and prevalence on cryptocurrency exchanges and in DeFi. | Insufficient transparency of reserve structure, lack of regular audits by third parties. |

| Speed and low transaction costs. | Risks of centralization and dependence on the policy of one company, Tether Limited. |

| Convenience for trading and storage. | Potential risk of devaluation in case of reserve-related issues. |

| USDC | |

| Pros | Cons |

| Reliability of reserves, confirmed by regular audit checks. | Lower liquidity compared to USDT. |

| Support from regulated legal entities in the United States. | Less popularity among cryptocurrency users. |

| Relative decentralization through the CENTRE consortium. | Risks of regulatory pressure on consortium participants. |

Stablecoin Security

USDT and USDC use cryptographic transaction protection, ensuring the safety of transfers.

The primary risks are associated with keeping funds on exchanges. In the event of a hack or account freeze, funds may be irreversibly lost. Therefore, the most secure option is to use “cold” hardware wallets or offline storage.

Concerning the reliability of the assets backing them, USDT has faced occasional questions due to the lack of transparency in Tether’s reserve structure. Meanwhile, USDC publishes monthly reports from auditors, confirming the existence of full dollar coverage.

Overall, with the necessary security measures in place, both Tether and USD Coin can be considered sufficiently secure tools for use in the crypto sphere.

Choosing Between USDT and USDC

Tether and USD Coin hold leading positions among stablecoins and can serve as a reliable foundation for operations in the cryptocurrency world. USDT provides maximum liquidity and ease of use. However, transparency in its backing raises questions. While USDC demonstrates greater transparency and compliance with regulatory standards, it currently lags behind its competitors in popularity.

Therefore, the ideal approach is to diversify risks by using both stablecoins depending on tasks and preferences. You can acquire them and any other crypto easily, quickly, and profitably through Monetory’s search. It’s simple and convenient!