Creating an optimal cryptocurrency portfolio is not an easy task for many investors. If you want maximum profit and minimum risks, you need to carefully select assets and determine their shares in the portfolio.

In this article, we explore effective portfolio-building strategies suitable for both beginners and experienced investors. In addition, we will look at several specific cryptocurrencies to help you build a diversified crypto portfolio.

Disclaimer: This article is not financial advice or a call to action. Any investment you make is at your own risk.

Key points when compiling a crypto portfolio

Diversification is the cornerstone of a crypto portfolio. One of the main advantages of this approach is to reduce risks because the cryptocurrency market is known for its unpredictability. While some coins may decline in price, others may rise, thus reducing the overall volatility of the portfolio.

In addition, when choosing crypto assets, it is significant to consider their capitalization. Coins like Bitcoin and Ethereum provide stability, while small and mid-cap altcoins can bring higher returns.

When diversifying, you should also pay attention to the date when crypto projects enter the market. Combining new coins and other assets will balance risk and return.

With the development of the crypto market and the emergence of new technologies, investors got the opportunity to diversify their investments not just by buying different cryptocurrencies but by investing in various niches, for example:

Decentralized Finance (DeFi):

- Uniswap – decentralized exchange

- Compound – crypto lending

- MakerDAO – DAI stablecoin

Platforms for smart contracts:

- Ethereum – the first platform for smart contracts

- Solana – fast blockchain with low fees

- Polygon – Ethereum Scaling Solution

Non-fungible tokens (NFTs):

- CryptoPunks is one of the first NFT projects

- Bored Ape Yacht Club – popular profile NFTs

- NBA Top Shot – Basketball video clips

Meme-tokens:

- Dogecoin is one of the first and most famous meme tokens

- Shiba Inu is a meme token inspired by Dogecoin

- PEPE – based on the popular internet meme Pepe the Frog

Games (P2E):

- Axie Infinity is one of the most popular GameFi projects.

- The Sandbox – a platform for creating games

- Gods Unchained – game similar to Hearthstone

Metaverses:

- Decentraland – a virtual world on the blockchain

- The Sandbox – a platform for creating virtual worlds

- Cryptovoxels – a virtual world in the style of pixel art

Investors can get the opportunity to use the growth potential of various crypto segments.

Moreover, diversification can be extended to different blockchains. Despite the dominance of Bitcoin and Ethereum, several other blockchain platforms will be better than their older competitors in some ways. For example, projects built on networks such as Solana, Cardano, Binance Smart Chain, and Polkadot offer faster transactions, lower fees, and greater scalability. This approach reduces risks because we are not solely dependent on the success of one blockchain.

In addition to diversification, it is significant to consider the liquidity of the assets in the portfolio. More liquid coins are easier to convert to fiat or stablecoins if necessary.

How to effectively build a crypto portfolio

- Define your goals based on risk level, investment horizon, and expected return.

- Choose a strategy, for example, high risk-high reward, HODL, investment in ICO/IDO/IEO.

- Carefully study potential cryptocurrencies. Conduct technical and fundamental analysis. Services such as CoinMarketCap, CoinGecko, DEXTools, and others will help you.

- Choose reliable and convenient crypto wallets and exchanges. It is better to keep funds in cold wallets like Trezor or Ledger.

- Based on the information received, allocate capital between different cryptocurrencies.

- Rebalance your portfolio regularly to adapt to new conditions.

- Take profit periodically.

Examples of a balanced distribution of cryptocurrencies in a portfolio

While there is no single correct option, there are several popular strategies. Investors choose them depending on their goals, opportunities, willingness to take risks, and personal preferences. Let’s see what options are available and how they differ.

Conservative approach: 60% BTC and 40% ETH

This portfolio offers the purchase of the two largest cryptocurrencies, Bitcoin and Ethereum, where there is a calculation for the stability and growth of the crypto market as a whole. This strategy is for conservative investors who do not believe in other altcoins.

Passive income: 50% stablecoins, 30% staking coins, 20% Bitcoin and Ethereum

Such a portfolio is for investors who want to receive regular income from their investments in cryptocurrency with minimal risk. Stablecoins provide risk management. Staking coins earn interest on deposits. And BTC and ETH are a reliable basis for the portfolio.

Moderate risk: 33% each for BTC, ETH, and high-risk cryptocurrencies

With this approach, investors are pairing Bitcoin and Ethereum with various more volatile cryptocurrencies. This distribution suits investors who seek a balanced approach but are willing to take risks for potentially higher returns.

Aggressive distribution – 40% BTC and ETH, 60% high-risk cryptocurrencies

With aggressive distribution, you focus on new cryptocurrencies with high risk. Investors who believe in their revolutionary potential and are ready for increased volatility may find this strategy attractive.

For short-term speculation – 80% high volatility altcoins, 20% BTC/ETH

This portfolio is focused on making momentary profits through highly volatile altcoins. The bulk of the funds are invested in fast-growing coins, which are then sold after growth to lock in profits. A small share of BTC and ETH is here for the stability of the portfolio. Such a strategy is risky and requires active management.

Is it worth investing in cryptocurrency?

The crypto market remains highly volatile. 95% of projects depreciate in the long term. There are regulatory risks of banning cryptocurrencies by individual countries. Technical failures on crypto exchanges and fraud are also possible. To reduce risks, it is important to competently diversify the crypto portfolio, use reliable platforms, regularly rebalance the portfolio, and fix profits.

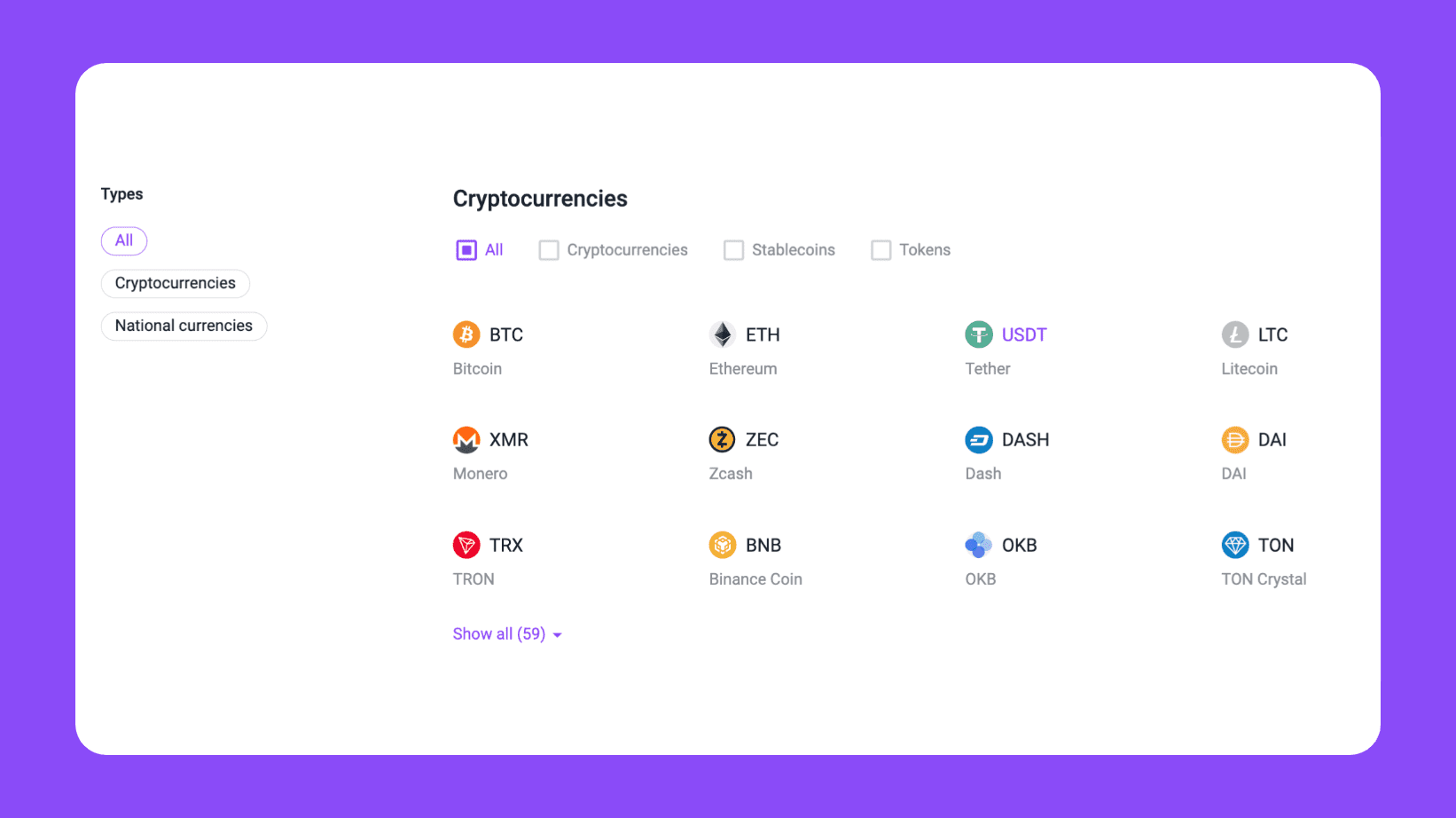

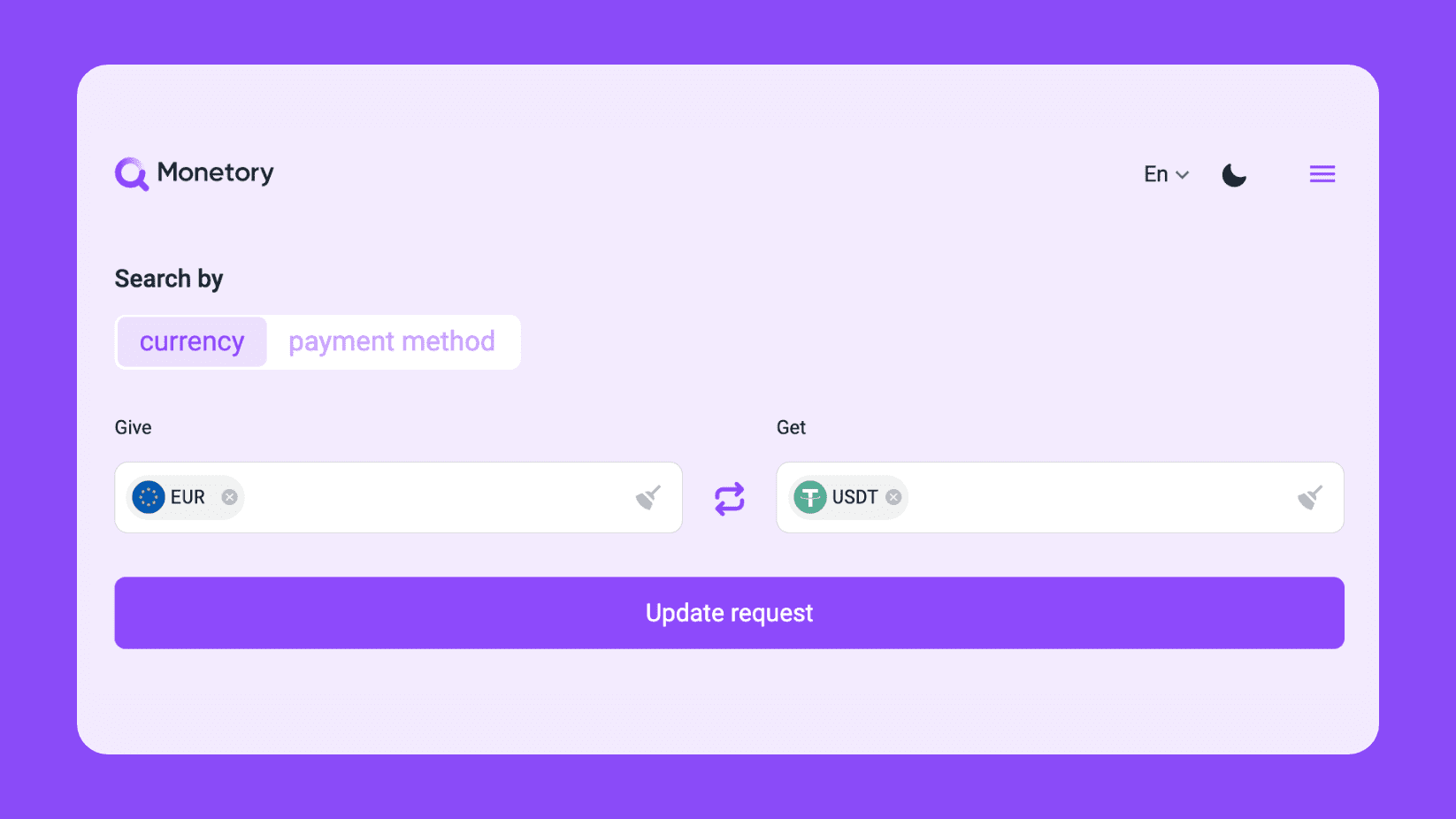

Among the advantages are potentially high profitability, the possibility of diversifying the investment portfolio, and access to new promising assets at an early stage. If you decide to build your portfolio and want to buy cryptocurrency, you can use the Monetory search.

Go to the main page and choose what you want to give and what to receive. In our example, we will buy USDT to further purchase various cryptocurrencies in the spot market.

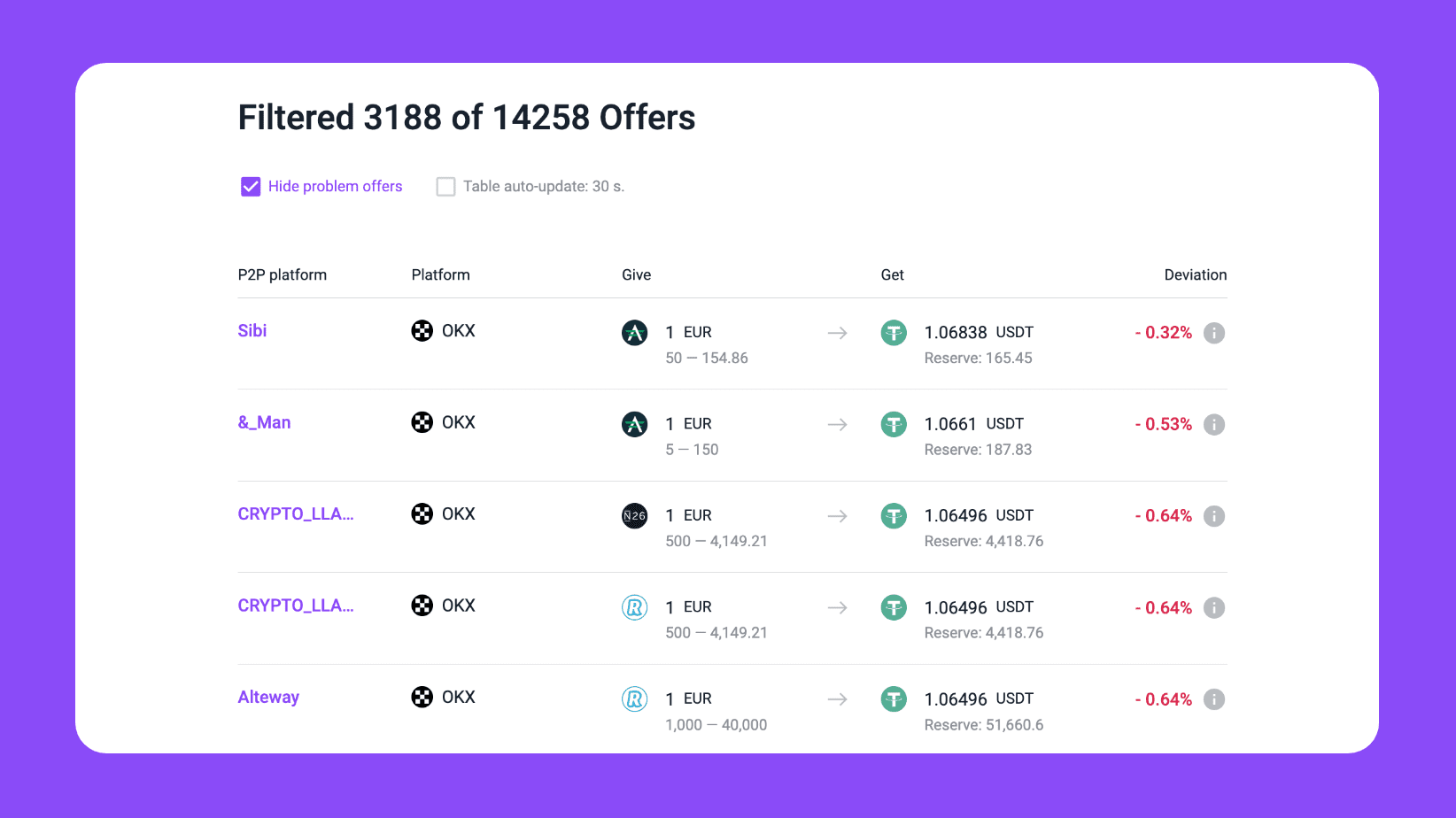

After receiving the search results, set up filters. You can choose the amount of the transaction you are interested in and the exchanges to which you have access. Or you can choose private exchangers. There, the exchange will be easier and faster, but the exchange rate will be worse.

Once you have filtered the desired offers, select the optimal one and click on it to go to the website of the exchange site.

You can search for offers not only with USDT but also with any other cryptocurrencies. Monetory allows you to find all the necessary offers on any site in a couple of clicks.